Australian Twenty Stock Portfolio

This year our paid service offering expands to include full model portfolios updated on a monthly basis. These are all run on the Jevons Global institutional grade process.

The Savvy Yabby Report is pleased to announce that our institutional grade model portfolios are now to be distributed to paying subscribers on a monthly basis.

There is no change to our fee or service terms.

You will get more for the same price, and that will not change.

The service level and range will expand to include:

Australian 20 Stock Model Portfolio

USA 20 Stock Model Portfolio

International (non-USA) 20 Stock Model Portfolio

Global Best Ideas 25 Stock Model Portfolio

The existing research notes and newsletter offer remains, but you will see some tighter integration between what we write there and the model portfolios.

These portfolios follow the Jevons Global investment process.

This service is owned and operated by Jevons Global Pty Ltd.

The licensing and complaints procedure is outlined in our Financial Services Guide.

For legal reasons, I need to include this informational disclosure.

They are now included in the service and will be updated monthly.

These models impound our ongoing research ideas and investment themes.

They represent how I build portfolios to reflect thinking.

They are not designed to change a lot, and we will continue to supplement these with regular thematic research, educational pieces, and focused best ideas.

For instance, our piece on precious metals will lead to a focused best ideas list.

The process is designed to be both informative and versatile.

To kick things off, this note launches the 20-Stock Australian Portfolio.

This is the strategy with the longest track record at Jevons Global.

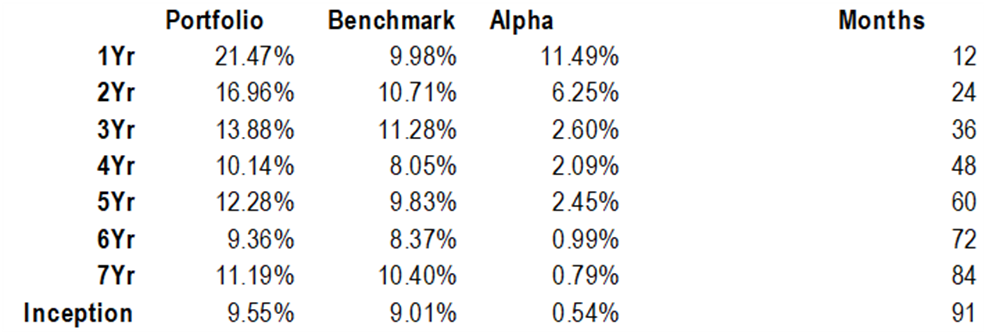

The above show the annualized total returns by period since Jun-2018.

This strategy is coming off a great year in 2025.

The main reason for this latest outperformance is our thematic investment style.

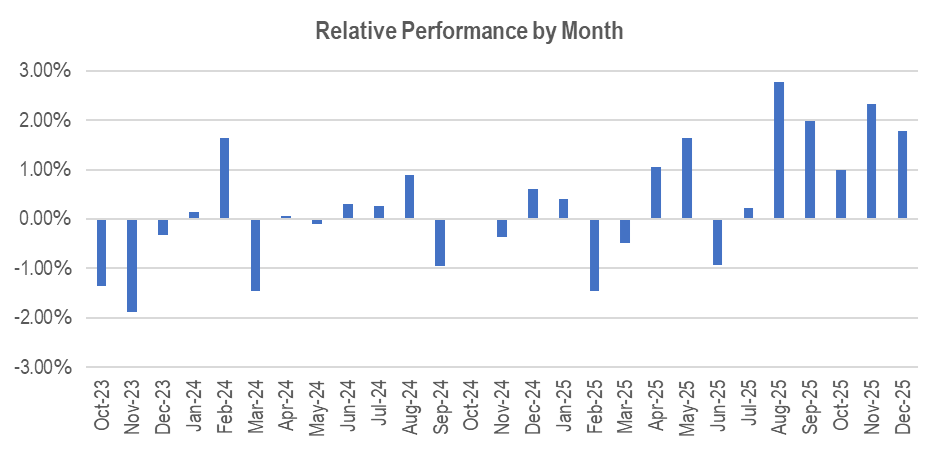

Our process adjusts relatively slowly over time and generally owns some stocks in all sectors but adjusts the sector weight to reflect the outlook. For some years we held battery mineral stocks at lower weights during the bear market. Once it started to improve, we upweighted the same stocks to larger positions.

The philosophy at work is to keep track of ideas we think have a good chance of working well but to change stock weights to reflect our level of conviction.

For instance, around July of last year we started selling long term winners which we judged had gotten overvalued, stocks like TechnologyOne XASX: TNE, and put the proceeds into other stocks which were good value and starting to turn.

Nobody will get this right every time.

Last year was a good year for us because there was a big turn and we caught it.

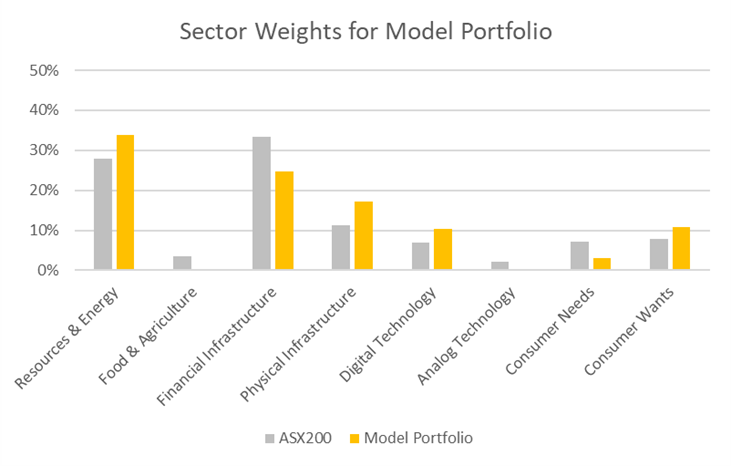

The strategy tries to keep sector weights relatively balanced.

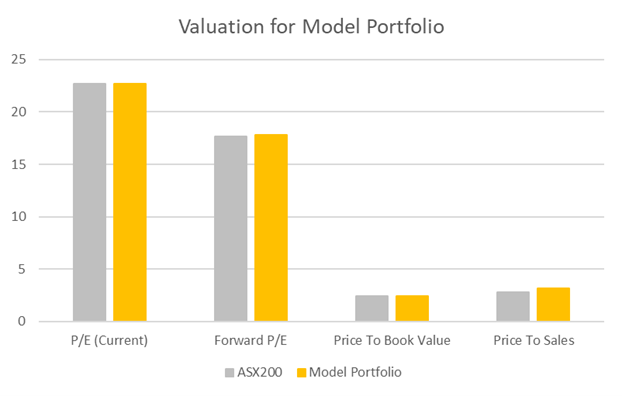

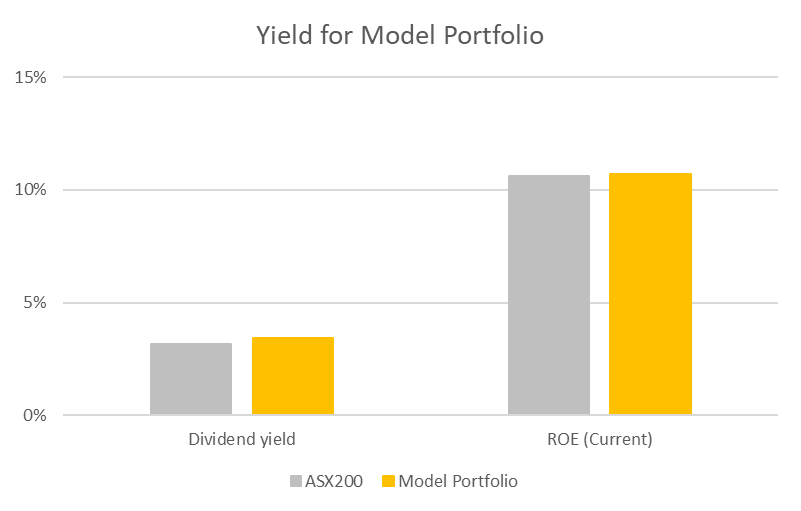

The valuations aim to be in line with the market or better.

The same is true of dividend yield.

In short, this is a concentrated equity strategy with similar top-level metrics to the market which aims to outperform over time by adjusting to conditions.

No strategy is perfect, but this is our way to run stock portfolios.

The full model portfolio and performance reports are below.