Beware the Ides of May

The middle of May, next month, say three weeks away, is when we should know what will happen to the US economy. The effects on the global economy show up later.

Since the Fall of Rome is our current classical fascination, it will help to recall why the middle of the month matters in finance. It also mattered in Ancient Rome.

The term Ides derives from the Latin word iduare (Latin: “to divide”), with the full moon serving as the division point in the middle of each month. In the ancient Roman calendar, months were divided according to the lunar cycle into three groups of days. - Encyclopedia Britannica

We know that the USA is a divided nation, so there is one hit right there :-)

However, in the old Roman calendar the “Ides” marked the middle of the month. This is the 15th of each month, in both the Roman Julian Calendar, and the Gregorian.

The Roman emperor responsible for the Julian Calendar, namely Julius Caeser, was assassinated on March 15th in 44BC, having been stabbed by a crowd of Senators.

William Shakespeare immortalized this event with the following turn of phrase:

“Beware the Ides of March.” - William Shakespeare, Julius Caesar, Act 1, Scene 2.

Since I am fan of classics, I recall this piece of soothsaying during the GFC:

“Beware the Ides of September.” - Kingsley Jones, Wanker, GFC 2008

I said this because the “Ides” of any month has deep significance in the bond market. Just as the mythology surrounding the England standard rail gauge maintains, there are carry overs from past tradition in many modern practices.

The Ides, when the calendar was lunar, coincided with the full moon. Lunar calendars are good in that every month has 28 days, but they are bad for cropping.

Solar calendars have variable numbers of days, but the 15th is in the middle, sort of. This can be handy when constructing financial contracts. Rather than have debts fall due at the start of the month, or a variable end date, the middle is good.

It sounds stupid, but that is how much of the bond market operates.

Some, by no means all, bonds will fall due for repayment on the 15th of the month.

This led to my remark on a trading floor at the start of September 2008. The US bank Lehmann Brothers was in visible trouble, and its bonds matured on the 15th.

I made an educated guess.

Lehmann Brothers died on the 15th of September 2008, when bonds fell due.

I did not feel too great about this forecast. The portfolio I was managing got torched.

These were special circumstances, so I doubt this educated guess will work again.

However, there is some calendar math we can do which marks May 15th, 2025, and the surrounding weeks as a high-risk period for US financial markets.

The two factors at work are data release dates and supply chain lags.

The supply chain logjam in progress

The US Secretary of the Treasury has described US tariffs on China as unsustainable.

It puzzles me why the USA imposed unsustainable tariffs on China, which have made most all imports from China uneconomic to US importers.

Why did you impose unsustainable tariffs which put the USA under blockade?

This is a mystery for the ages which will be properly answered by historians.

You could ask the same question of China, when it responded, but for these facts:

US importers pay the tariff port-side for anything they import from China

China exports to the USA account for around 3% of GDP

It used to be, before China entered the World Trade Organization (WTO) that the share of Chinese exports that went to the USA was around 42%.

Contrary to the rhetoric from the White House, the Chinese reliance on the USA for exports has steadily fallen after they entered the WTO and now sits around 10%.

China has become less reliant on the USA for exports since it entered the WTO.

When you consider that exports to the USA are 3% of Chinese GDP, and the share of overall Chinese exports is around 10%, the tariffs seem survivable for China.

Let us look at it rationally.

Many items that the USA imports from China have no easy substitutes. This is why the very high level of tariffs, at 145% to 245%, is effectively a blockade. The USA decided that it would unilaterally stop receiving imports from China.

Logically, China will suffer from this, but how much?

The have imposed their own reciprocal tariffs on the USA, but they can fool with those for anything they need. Alternatively, for US Agricultural Imports, which are a big part of what the US exports to China, they can second-source from Brazil.

On the factory side, it all sounds terrible, but 10% of exports are affected on average. The use of averages is dangerous, but if you idled factories for one day in five, you most likely will keep folks employed, and keep cashflow positive.

The cost of building the factory is a sunk cost.

Rather than shut it down, idle the factory for one day a week, until you are able to locate alternative buyers inside or outside of China. This is a different challenge.

The USA has to source product from elsewhere or build it from scratch.

China just needs to take the capacity is has and manage it for cash.

There is really no comparison here.

China is in the box seat.

Leads and lags in an economy

Recessions happen when demand backs off and supply needs to shrink.

However, the same effect can happen if supply just disappears and price rations the demand for an ever-shrinking supply of goods.

Lena Petrova did a good piece on this impending supply chain shock.

I cannot fault her analysis.

Why waste time repeating it when she nailed it?

The other key analytical point is the lead time to have goods appear on a shelf from the initial order to when it has been shipped, cleared customs, trucked, and picked.

The first date to note is the Liberation Day date of April 2nd, 2025.

The lead time, as a rule of thumb, is around six weeks from the China factory gate. There is another factor to consider on time to manufacture, but let’s leave that.

If you count forward six weeks from the start of April, you get mid-May. This will not be a single point in time, but the leading edge of a distribution of shortage in time.

Imagine a pig going through a python. If you saw the pig, go down the gullet of the python on April 2nd, and you knew it took six weeks to digest, you need not turn up for the show finale until May 14th, as long as your python is regular.

You get the idea.

The pig has been clocked entering the python, as documented here.

Properly, there is normally a warehouse of pigs clocked entering pythons, way over the waves in China, about six weeks before showing up on US shelves as pork.

What is happening now is a curtailment of shipping, from China, which bakes in the fact that there will be less stuff landing in the Port of LA, and less to truck.

This is so elementary you would have to be a billionaire to not understand it.

Unfortunately, the USA is run by billionaires, and they do not understand it.

One person who does get it is Torsten Slok, the Chief Economist of Apollo Global.

As reported by Axios, in their piece How Trump tariffs can cause a recession, there is no essential reason why the USA would enter a recession, unless you made it do so.

If you were president of the United States and wanted to engineer a recession by summer, at least one economist says a very effective way of doing that would be to announce sweeping "Liberation Day" tariffs in April. - AXIOS

That article lays it all out in black and white and helpfully links to a slide deck.

This is a comprehensive look, by Torsten Slok and team, at a range of indicators that speak to recession risk in the USA. They are none of them, conclusive, yet.

However, this one slide lays out the timetable for the recession thesis.

This is a very admirable piece of research, in my opinion. It is not a definitive analysis that there will be a recession, but it does lay out the “why” of a possible recession.

Note that the real tell is likely to appear around the Ides of May, or mid-May.

Hence my warning dear readers.

“Beware the Ides of May!”

This is cute, but the analysis of Slok is better than cute.

It gives you a gameplan.

Conclusion

We have a proximate cause for a US recession, a timetable, and a set of data streams to watch. These are all nuts-and-bolts things in logistics.

Container bookings

Port loading and unloading

Trucking activity

Prices

This is (thankfully) not rocket science.

Mortals can understand this.

Billionaires who have not shopped for groceries in thirty years will not understand it.

You have the advantage now. Watch data releases closely.

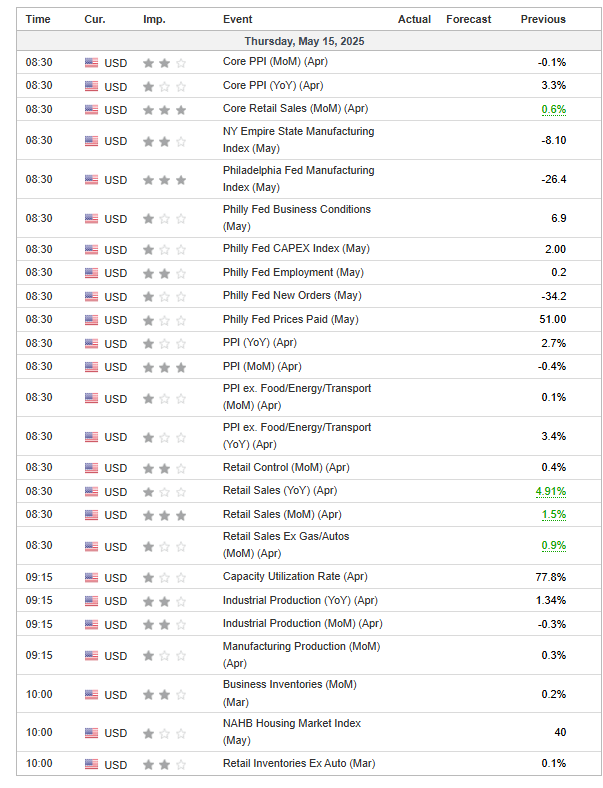

There is a free Economic Calendar over at Investing.com

I took a snapshot of the schedule morning releases on May 15th, 2025.

It is not only this day that matters, but the weeks either side.

I do not think a recession will show up until June, but there will be data releases like the Philadelphia Fed reports, Manufacturing Survey, Industrial Production and the other key items Retail Sales, and Consumer Price surveys that matter.

Stay tuned.