Bubble Brewing?

The US market has defied all expectations by surging to new highs in spite of war in the Middle East, tariff frictions, and geopolitical uncertainty.

Firstly, let me apologize to my readers for having been offline for six weeks.

I have just added 90 days free credit to every paying subscription.

I am not one to make excuses for not being there for you, but it has been me time these past six weeks with my health issues hitting a psychological wall.

I am through it now, but it was not easy.

In trying to understand why I was in a mental slump; I did a cancer count.

One prostate cancer removed

One bladder cancer removed

One skin cancer removed

Then there were the polyps that turned out not to be cancers.

Whew!

For anybody who has had health issues, or is dealing with such, I get it now.

This stuff creeps up on you. You feel fine and you are coping. Then you are not.

This is normal, which is why I am sharing, and I can share because I licked it.

I did a day count: 53 of the last 266 days I spent in hospital.

This is not terrible, some folks have it a lot worse.

The good news is that I am now clear of cancers. I did not have to have the really tough stuff like chemotherapy, or radiotherapy, just robotic surgery.

I have a great surgeon to thank for a “cancer undetectable” outcome.

I also have a splendid hospital staff who saw me through a six-week 24x7 IV drip to cure a blood infection, the one that kicked this whole show into action.

Reflecting on the past eight months makes me really appreciate, friends, family, the medical professionals who got me back on track, the rehabilitation experts, and the pharmacological geniuses who concocted whatever killed my blood bug.

It also made me appreciate this connection to the real world.

You, my readers!

Thanks for being great subscribers and not giving me grief for being AWOL.

I hope to make it up to you with what is left of this year.

What a year in the financial market!

I think I remember when Trump was elected.

I was in a hospital bed then, but I cannot blame the President for that.

It is just odd, and noteworthy, how many ups and downs this financial market has delivered since that day back in early November 2024.

Our track record since then has been mixed. We got gold right, Asian stocks right, and the April 9th US markets dip wrong. We did call a Bear market prior to that, but it was very brief, as bear markets go. The acceleration out has been with us since.

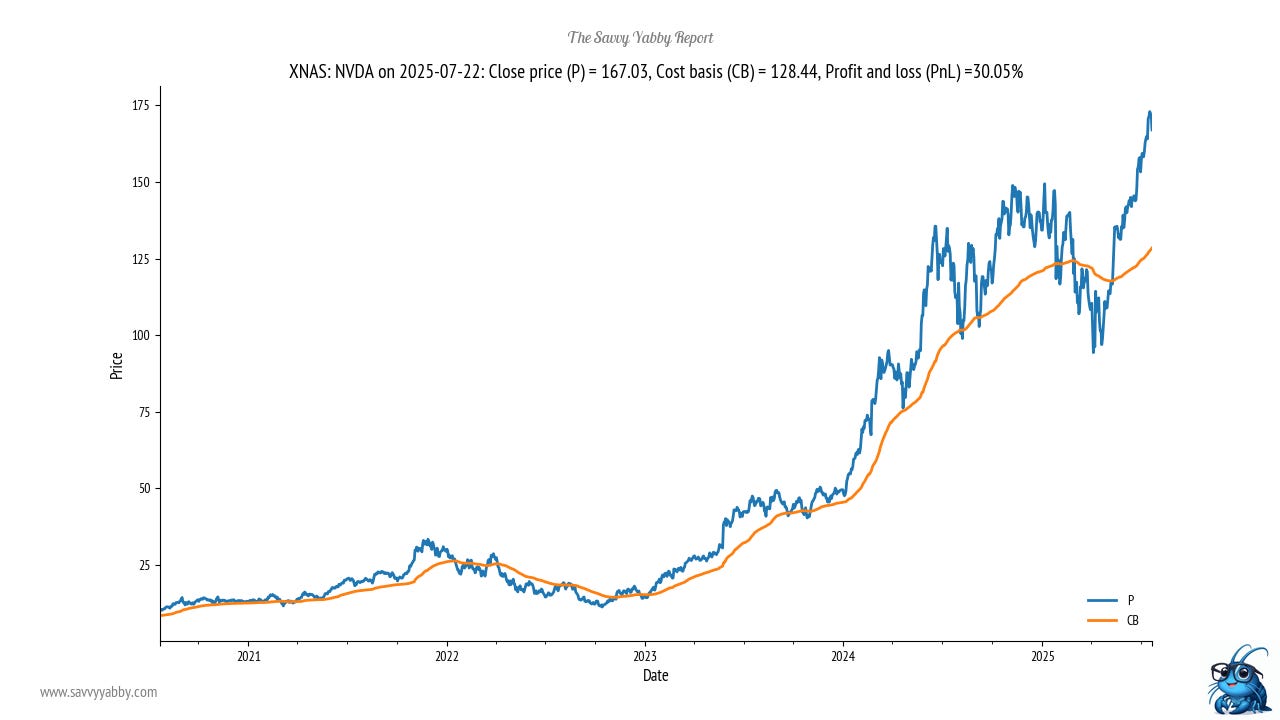

Let me note that with the poster child for AI, namely Nvidia XNAS: NVDA.

Does this mean we are out of the woods?

For now, yes, and we face the opposite risk.

Sentiment is extremely positive across the board.

If we look at a broad index, like the S&P1500 over 2/3rd of stocks are in profit.

The same ratio applies to the large-cap sub-index of the S&P500.

The top three positive sentiment names are all large-caps.

First out of 1500 with a 44.3% unrealized PnL is chip maker Broadcom XNAS: AVGO.

Next comes cloud infrastructure and ERP software play Oracle XNAS: ORCL.

The mega-bank JP Morgan XNYS: JPM rounds out the top three in the S&P 1500.

Rounding out the usual suspects, in the Magnificent Seven, it has been a mixed story.

Microsoft XNAS: MSFT made a modest recovery from a pretty shallow slump.

Meta XNAS: META has been buoyed by AI enthusiasm but is now stalled.

Amazon XNAS: AMZN is still below former highs.

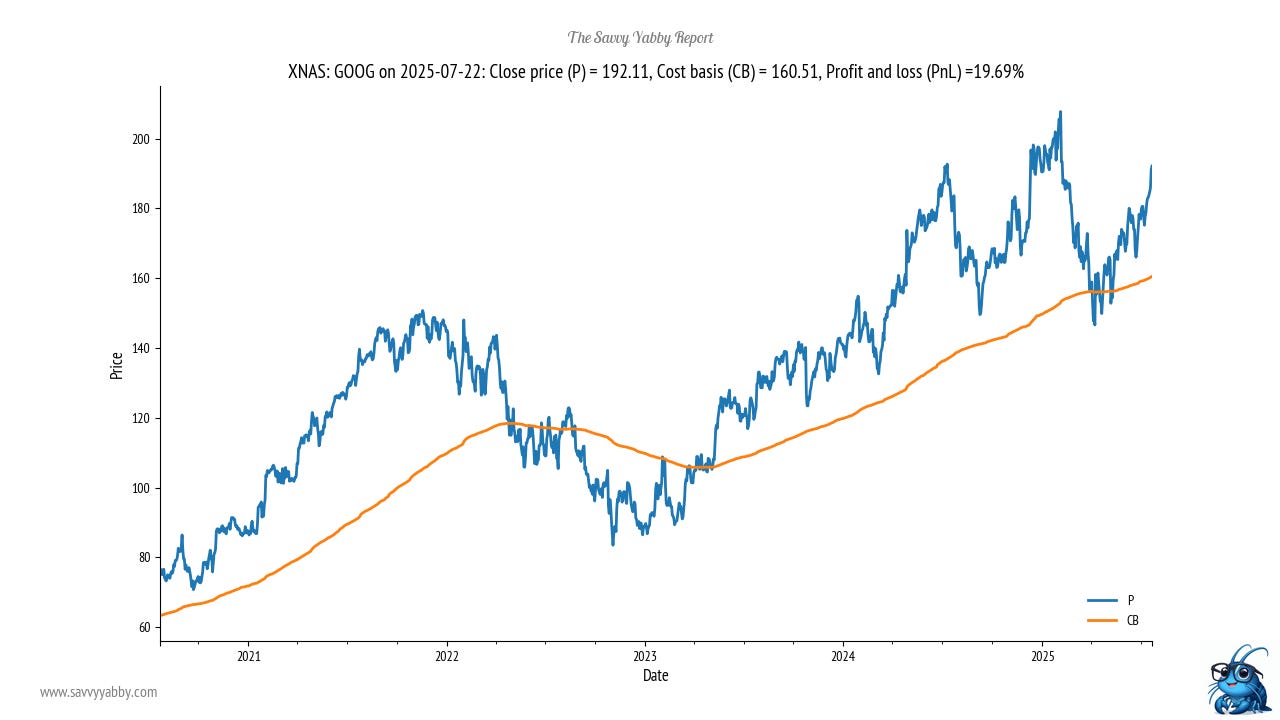

Alphabet XNAS: GOOG is not looking very convincing at this stage.

Apple XNAS: AAPL is struggling to keep up with the indices.

Tesla XNAS: TSLA is as volatile as ever and well below former highs.

These markets are defying the constant stream of this-way that-way announcements from President Trump on what happens next to who, where, and when.

The tariff measures are settled, sort of, until they possibly change again tomorrow.

The Chairman of the Federal Reserve might be Jerome Powell, for a while yet.

Then again, it could be Treasury Secretary Scott Bessent, or whomever.

If Donald Duck had a good publicist, or some handy Trump dirt, he might be a shoe-in.

I jest, of course, because what else can I do?

US Sentiment is very positive again and interest rates may fall.

The markets that looked dangerous to the downside on Liberation Day now look dangerous to the upside. We could be headed into a bubble phase.

These markets are very driven by narrative, and the AI narrative, plus a resurgence of US manufacturing, with all carried higher on a protectionist tariff wave is the story.

I am skeptical that this will end well.

However, it could be a time where day traders do well, just like 1999, before the blow off top to the NASDAQ Internet Bubble in April 2000.

For my money, the safest course now is to stick with steadier names, like Microsoft, which is promising to spend money, but less than Oracle. With sentiment being so positive, the outliers are the depressed names being trashed.

I will do more work on this, but clearly healthcare is unloved.

United Health XNYS: UNH has been a magnet for controversy since the CEO was gunned down in cold blood. That stock is in a deep Bear market.

So too is drug-maker Merck XNYS: MRK.

This may be a reaction to the threatened Trump tariffs on imported pharmaceuticals.

Negative sentiment has also affected reagent suppliers like Thermo-Fisher XNYS: TMO.

That is before we get into apparel firms like Lululemon XNAS: LULU.

With the present appetite for armed conflict, you would think that US Defense giants would be in great shape. Not so for the leader Lockheed Martin XNYS: LMT.

The world of software is also marked by glum spots. Adobe XNAS: ADBE is in a slump.

To make matters more confusing, small parcel delivery firm UPS XNYS: UPS in is a steadily worsening Bear trend. Transports are not doing that great.

The bottom line is that the laggards in this Bull Market have a story to tell.

Conclusion

This has been superficial first look at the state of the US market.

The top-level index view looks fine, and the sentiment is broadly positive, but I fear that the stocks not participating in this rally have some story to tell.

I want to dig further into this aspect of the market.

Sectors like healthcare seem to be under a cloud, the transports are wobbly, and there are some industrials, like Lockheed Martin, that are under pressure.

The easy thing to do is to buy this market in the belief that American Patriotism will carry us to new heights, and yet higher valuations among the majors.

Not holding some US stocks right now would be a mistake.

However, there does appear to be a story building among the wreckage, that may be pointing towards some policy fallout from the Trump Administration.

I think this is the right place to put in some research effort.

I am back on the horse now, and that looks like the right place to go.

Stay well and happy investing!

Photo by Lanju Fotografie on Unsplash

Glad you are back on that horse. We missed you!

Cheers, Jeff

Been where you have been, it’s confronting to say the least. Welcome back. I bought a few of your Kowloon Dragons back in early May, they have done well, especially CATL. Thx!