EOFY Tax-Loss Selling Season

We are into the first week of the annual sell-off in loss making stocks as investors harvest losses to minimize capital gains tax. Expect some bargains.

The original application of the Savvy Yabby indicator was for tax-loss selling.

You can read my original research note here.

To summarize the findings of that study, the general rule of thumb is that stocks with a current average unrealized tax loss, as measured by cost-basis, are more likely to fall versus the market in the month of June, with unrealized tax gains the opposite.

This is about a 60/40 split.

Those with tax losses are likely to have a 60% likelihood of falling.

Those with tax gains are likely to have a 60% likelihood of rising.

These numbers will vary from year to year as it is statistical rule, not a certainty.

The post June period is more negative for tax loss stocks; they can stay down in the three months afterwards. Conversely, positive trend tax gainers are likely to remain trending upwards following the end of the tax year.

These are subtle effects, but the rule of thumb is that tax losers are at risk of selling pressure in the month of June and may remain weak in the following three months.

Screening for unrealized gains and losses is helpful to flag those of your holdings which are at greater risk of coming under selling pressure at financial year end.

The Big Picture

Last Friday, I screened the entire ASX for tax-loss screening purposes.

There are often marked company size effects for unrealized gains and losses, and this seems to be a larger effect in recent years. Australia has compulsory superannuation, as you know, and the constant inflow of money is channeled to larger stocks.

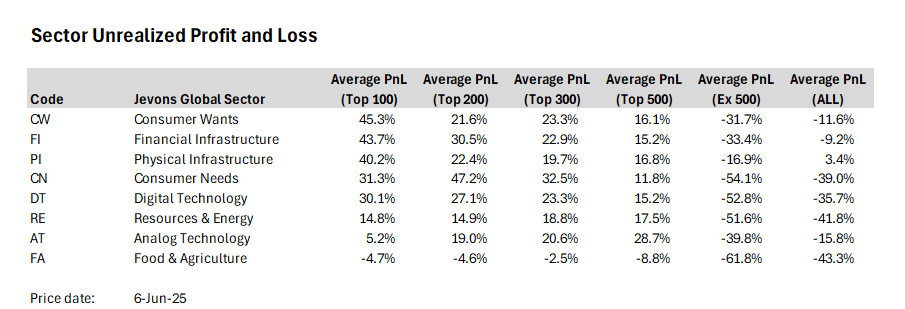

You can see this effect in detail when shown in tabular format.

There are around 1840 stocks in this study, and you can see that the smallest stocks, those outside the top 500, are universally in loss across all sectors.

Note that consumer sectors, finance and real estate are more positive.

This effect is clear if you look at the largest stock, Commonwealth Bank XASX: CBA.

The CBA is the most expensive bank in the world, but fund inflows are sending it ever higher, with a 65% unrealized gain for the average investor.

Notice how the unrealized profit buffer just keeps expanding.

These are very positive sentiment conditions for most large cap companies.

The top twenty largest companies highlight the pattern.

Looking at this through the glass half full lens, there may be good buying after the EOFY when the selling pressure has abated. Let us have a look.

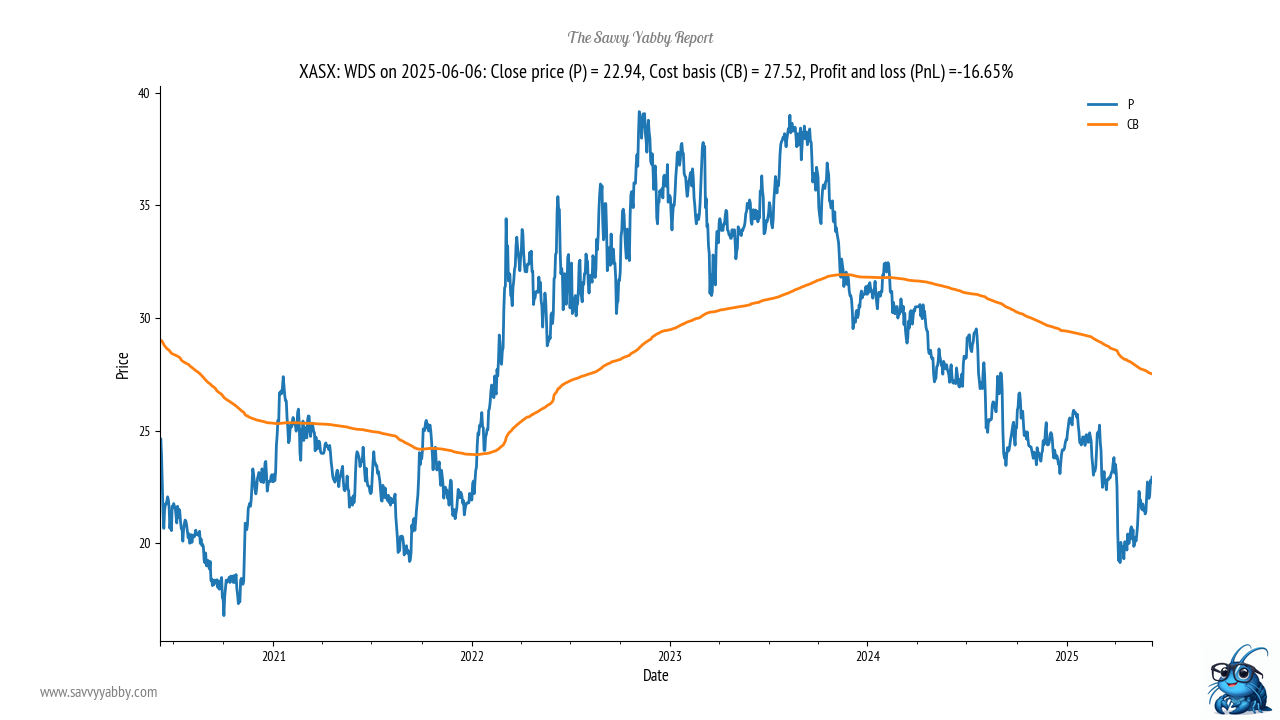

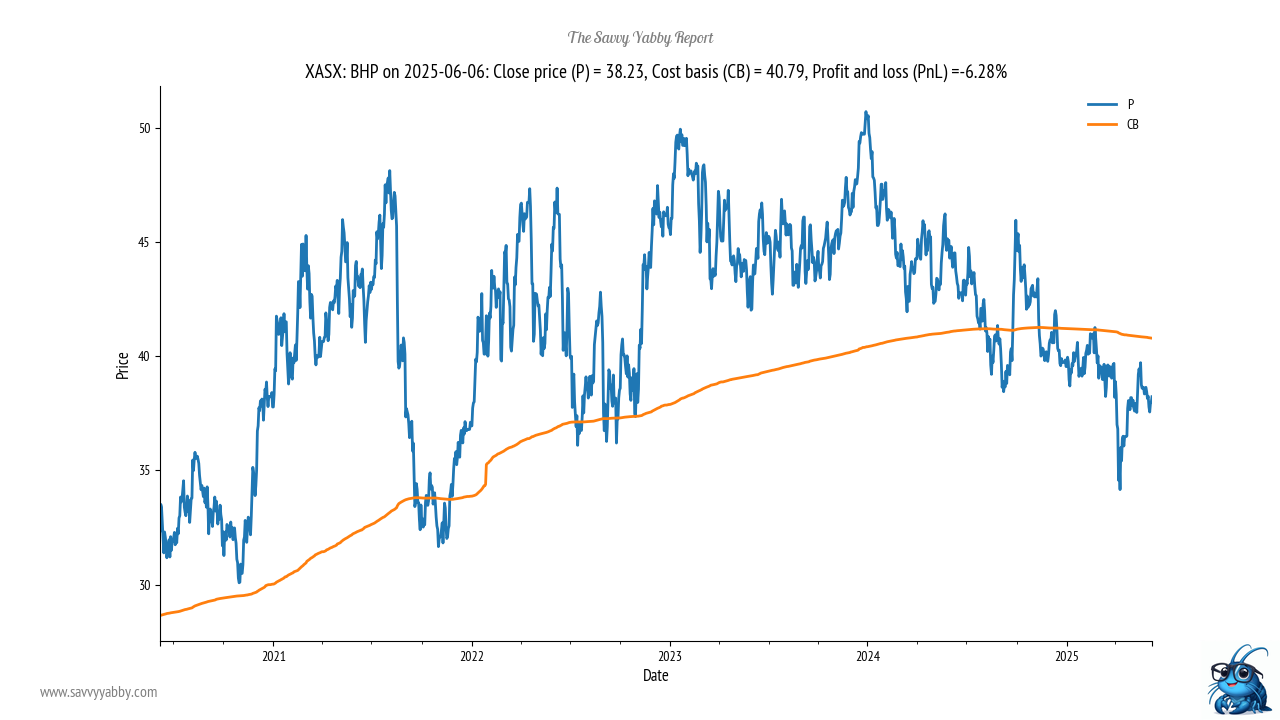

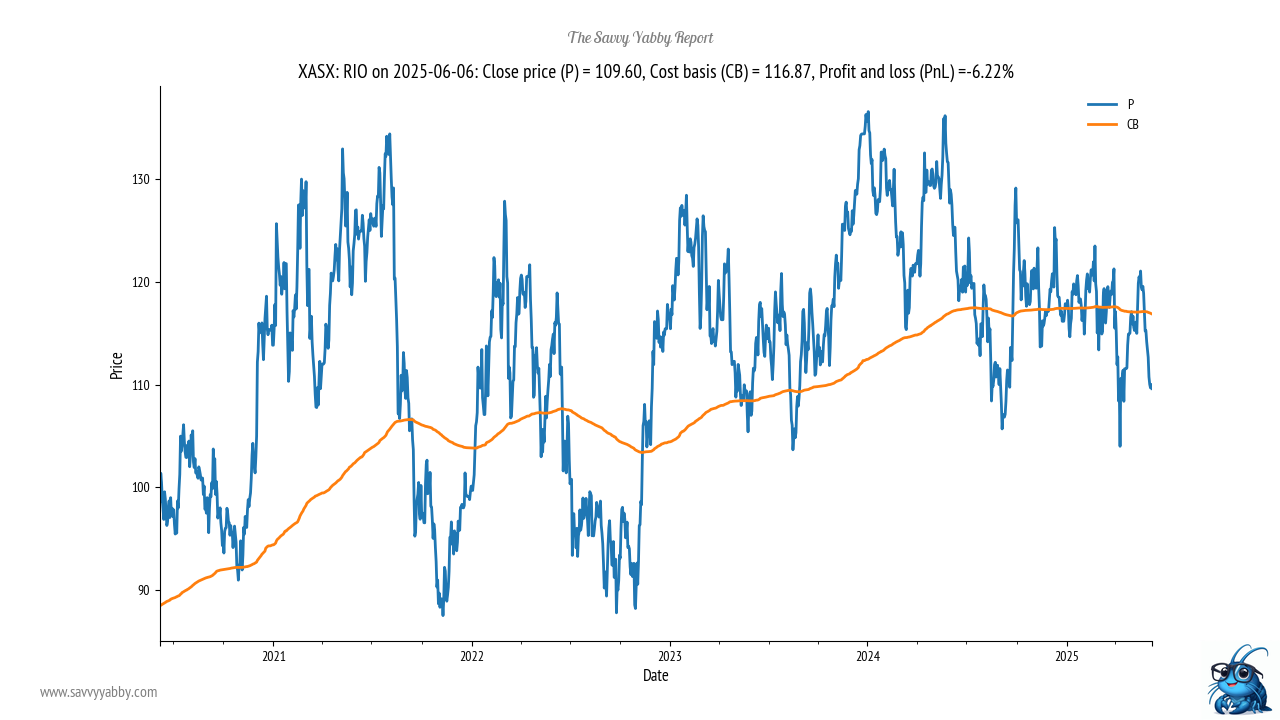

The biggest losers in large cap companies.

The worst of the top 20 is Block ASX: XYZ. Stocks with a large overhang that has persisted for some time may well be value traps. We would avoid this one.

Fortescue XASX: FMG is also in a sustained bear market.

Woolworths XASX: WOW is interesting and in need of good news.

Of the above, I think BHP and RIO likely present good long-term buying in the aftermath of what is likely to be only minimal tax-loss selling.

Woolworths is a good one to put on the watchlist pending a clear improvement in the fundamentals. A break above cost basis, currently at $33.43, would attract my interest. Stocks with a good long-term history, that have come under recent negative pressure, can be good turnaround candidates. However, I think it is still too early.

What about strong improvers?

This does not seem to be a season where betting on a tax loss rebound is a good idea.

We can turn this around and look for recent improvers as buy targets.

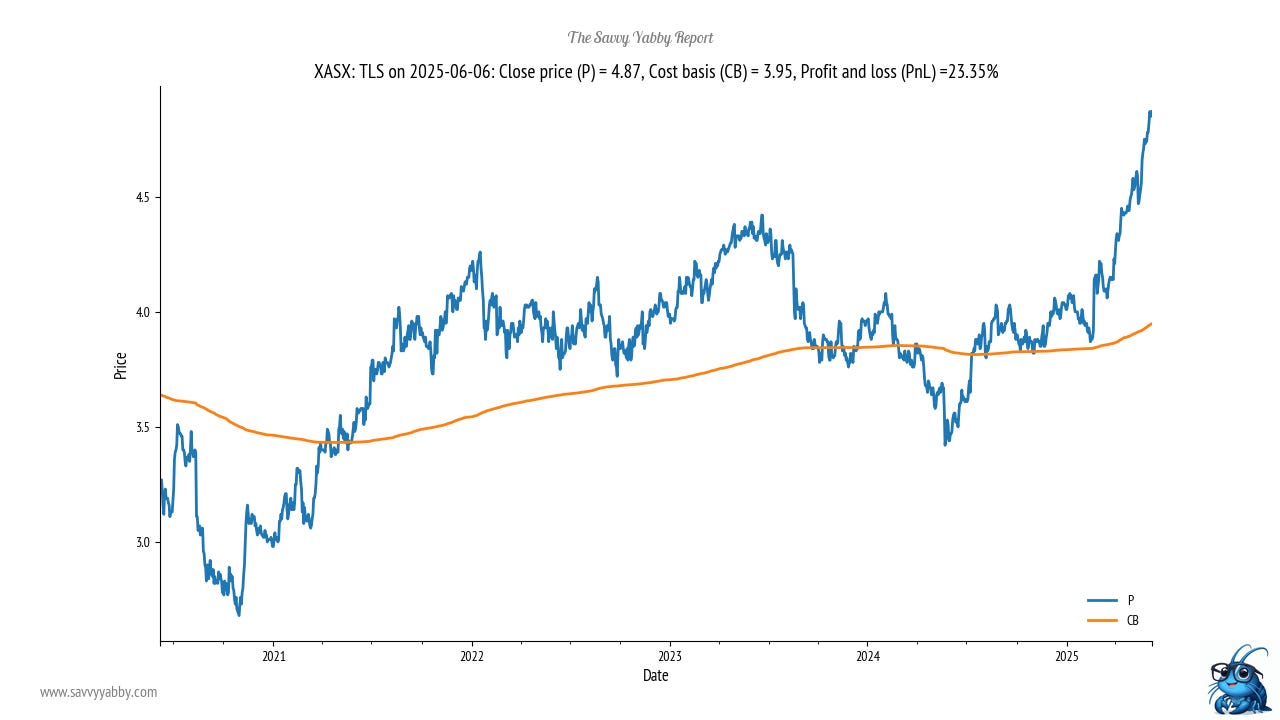

Among the top twenty, the standout from this screen is Telstra XASX: TLS.

The change happened around the beginning of this year.

I do not presently own Telstra, but this is the kind of signal that will make me go have a really good look at the company outlook, and the reason for the change.

Other companies in the middle of the pack are also of interest.

Gold mining major, Newmont XASX: NEM is picking up. I prefer the local mid-tier gold miners, Northern Star XASX: NST, Evolution XASX: EVN, Perseus XASX: PRU, and West African XAS: WAF. Newmont has a higher All-In Sustaining Cost (AISC), and so will likely show significant operating leverage at higher gold prices.

For now, I am sticking to my prior picks as discussed here.

Goodman Group XASX: GMG had a big test of confidence in the Liberation Day rout. The underlying data center trend remains firm. This looks like a fair entry.

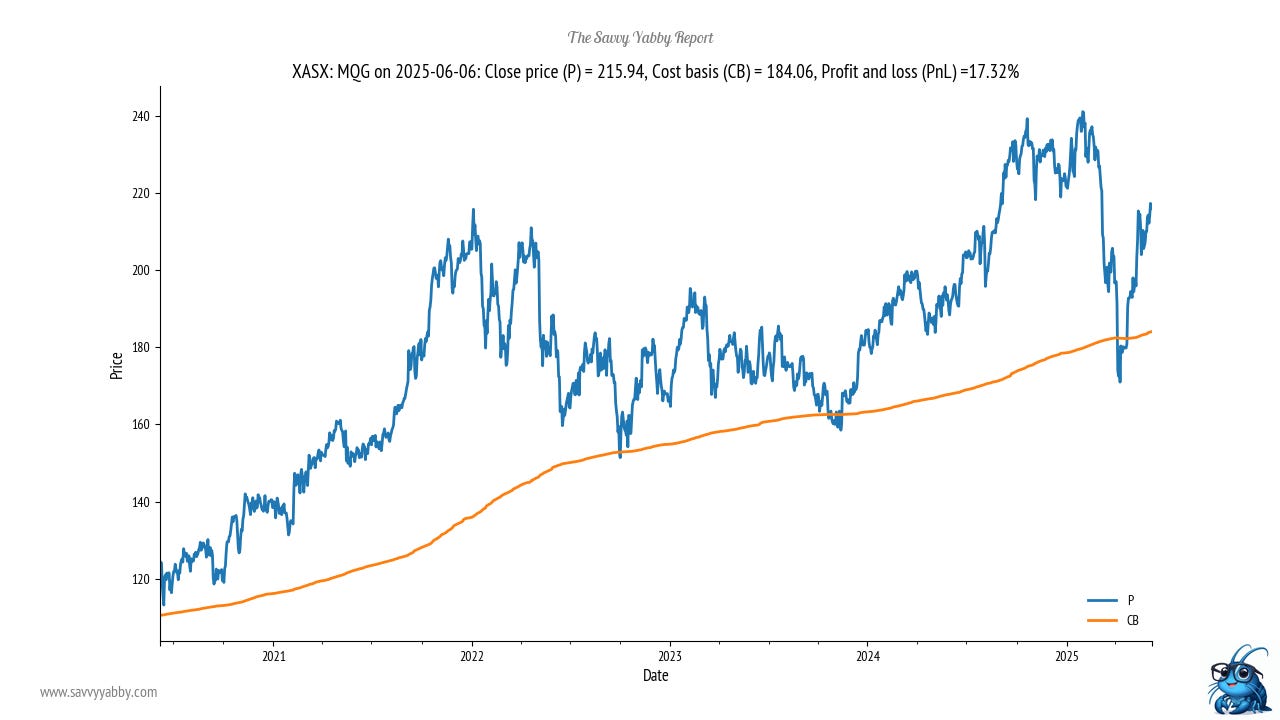

Macquarie Group XASX: MQG had a similar test of confidence.

ANZ Group XASX: ANZ is the cheapest of the big four Australian banks.

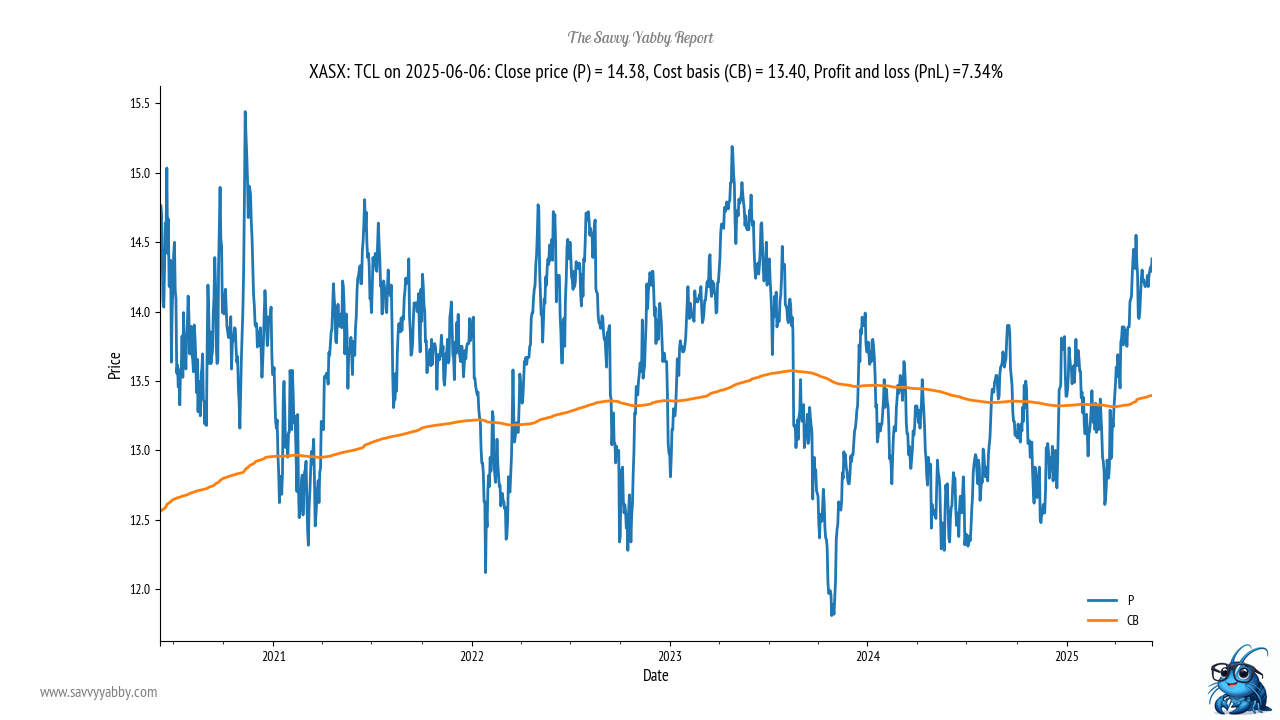

Transurban XASX: TCL is fairly dull in terms of recent history.

Of these, the standout new buy opportunity is Telstra.

I will do some more research on this, particularly in the context of global trends.

Of the others, Goodman Group and Macquarie Group look like adds.

If you own them, perhaps own some more.

Conclusion

In this note, we focused on large-cap stocks and the influence of unrealized gains and losses on likely investor behavior going into the End of Financial Year (EOFY).

Sentiment is generally pretty good in large stocks.

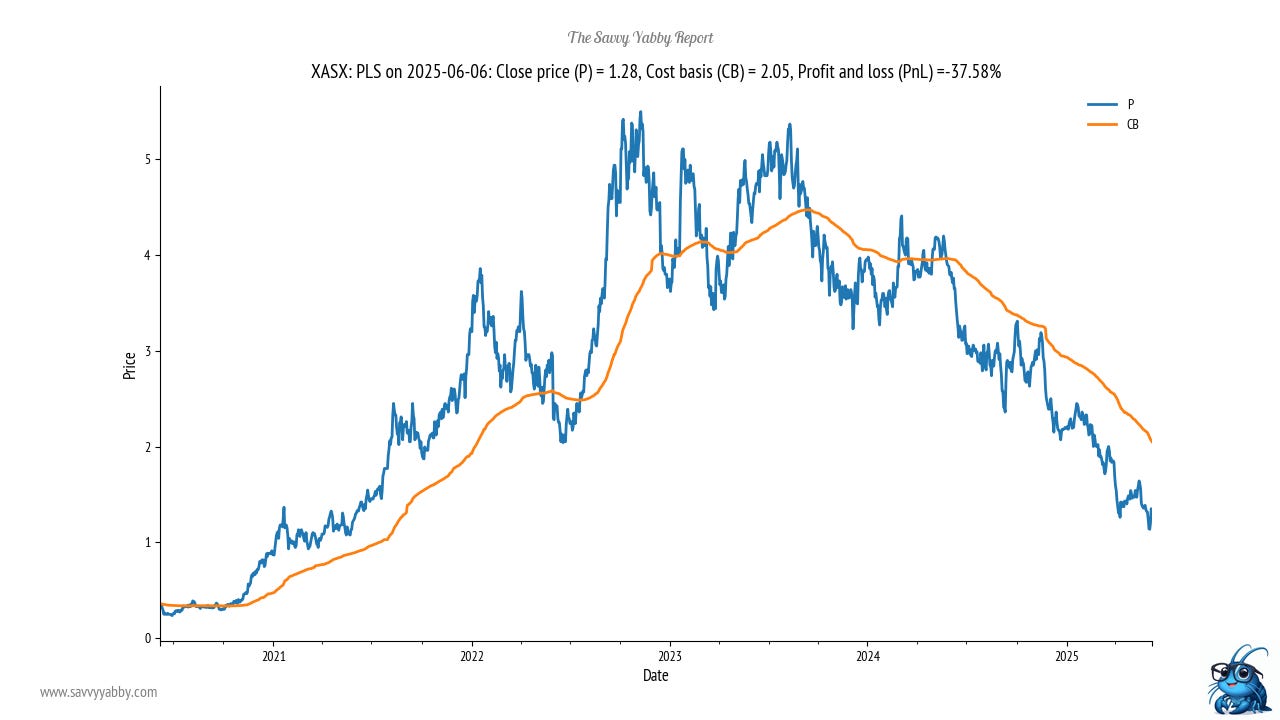

The real weakness is to be found in smaller companies, and those which have been the wrong side of commodity price trends. For instance, Pilbara Minerals XASX: PLS shows a deep bear market in progress. This is a more interesting place to look.

The takeaway for today is that the bargain cuts are likely to be among smaller stocks in the under-pressure sectors. The richest hunting ground is non-gold miners.

I will return to look at this tomorrow.