Global Equity Valuations

In earlier posts, I called a general bear market. The valuation picture is good for most non-US markets. I think this bear market will be concentrated in the USA.

You can always tell when a bull market gets stale.

Every man and his dog will repeat the exact same narrative.

It is like listening to a broken record, or a flock of parrots.

For anybody who has been in the financial market for more than one cycle it would be a completely uncontroversial statement to state that:

Markets habitually manufacture stories to part fools from their money.

Do not get me wrong, these stories will make money for folks in the medium term.

However, when the trend bends it is no longer your friend.

The story will break at some point, after many false starts, and then collapse.

Can any nation stay exceptional forever?

There have been exceptionally successful nations and empires.

Ancient Rome was a very successful empire. However, it really began to go downhill when Emperor Valens neglected to pay the Visigoth mercenaries for their services.

The Visigoth were a tad miffed about their betrayal and Sacked Rome in 410AD. It had all come to a head under Emperor Theodosius, in internecine warfare.

Theodosius won the battle, and although Alaric was given the title comes for his bravery, tensions between the Goths and Romans grew as it seemed the Roman generals had sought to weaken the Goths by making them bear the brunt of the fighting. - Origins of the (First) Sack of Rome in 410AD

If you run around the planet, thinking you are the Bee’s Knees, and then you forget to pay off the folks who helped you maintain your Empire, then that Empire is toast.

Happened to Rome, can happen again.

Travel the world and there are plenty of monuments to vanished civilizations.

I met a traveller from an antique land

Who said: Two vast and trunkless legs of stone

Stand in the desart. Near them, on the sand,

Half sunk, a shattered visage lies, whose frown,

And wrinkled lip, and sneer of cold command,

Tell that its sculptor well those passions read

Which yet survive, stamped on these lifeless things,

The hand that mocked them and the heart that fed:

And on the pedestal these words appear:

"My name is Ozymandias, King of Kings:

Look on my works, ye Mighty, and despair!"

No thing beside remains. Round the decay

Of that colossal wreck, boundless and bare

The lone and level sands stretch far away.

— Percy Shelley, "Ozymandias", 1819 edition

It is foolish to imagine that the Sun will never set on any Empire.

Did folks believe American Exceptionalism?

Here is a photo of Geoffrey Hinton receiving his 2024 Nobel Prize for physics for his seminal contributions to the development of Artificial Intelligence.

Geoffrey Hinton is British Canadian. His team at the University of Toronto in Canada was largely responsible for keeping AI alive in the 1990s to early 2000s AI Winter.

The other recipient of that prize was the American physicist, John Hopfield.

Once the major breakthrough of Deep Learning had happened in Canada, Alphabet did the sensible thing and bought Hinton’s company, just as they had previously bought UK entrepreneur Demis Hassabis’ firm Deep Mind.

That effort won a joint Nobel Prize for Chemistry.

It is great that there are businesses that fund R&D like Alphabet, Meta, Amazon, Apple, NVIDIA and Microsoft. However, the innovation is of global origin.

What these firms have in common is that they are rich.

This helps enormously in funding and equipping R&D teams.

This man was not rich when he had his big breakthrough.

The young Albert Einstein was a poor student, on his own admission, but he liked to think and did that a lot. He took a job in the Swiss Patent Office to think more.

Chinese entrepreneur Liang Wenfeng was already rich when he founded DeepSeek, because he had innovated his way there through nonlinear finance models.

Rich is good, if you are rich, but smart is better if you are not rich. yet.

That has been the story of the human race since we first spoke.

What went wrong with American Exceptionalism?

Time. Short answer. Correct answer.

The mighty Californian Redwood is a tall tree, but they all fall, one day.

There is no shame in the demise of a once good market story.

There will be a new bull market along soon enough.

What do professional investors do?

Professional investors make money from their investments.

You can also make money by talking about investments, but that is not the same thing as actually making money from them. We all try. Sometimes we can walk and talk.

What to do now is unclear, because the world is rapidly changing in front of us.

However, there are some helpful rules of thumb to remember.

Time in the market beats timing the market.

Diversification can help when the future is unclear.

Price is not value.

Nobody is going to know now what the future “no lose” story may be.

Whatever that is will only appear with hindsight.

However, what we can do, using screening tools, is see where there is fundamental value in the market, and where there is clearly money flowing.

The tools of sentiment analysis help us finger where there is a good story for some. The metaphor of the Ant Colony is not a bad instruction for what to do, in markets, when the old narrative is no longer working. Go find food. Look where the ants go.

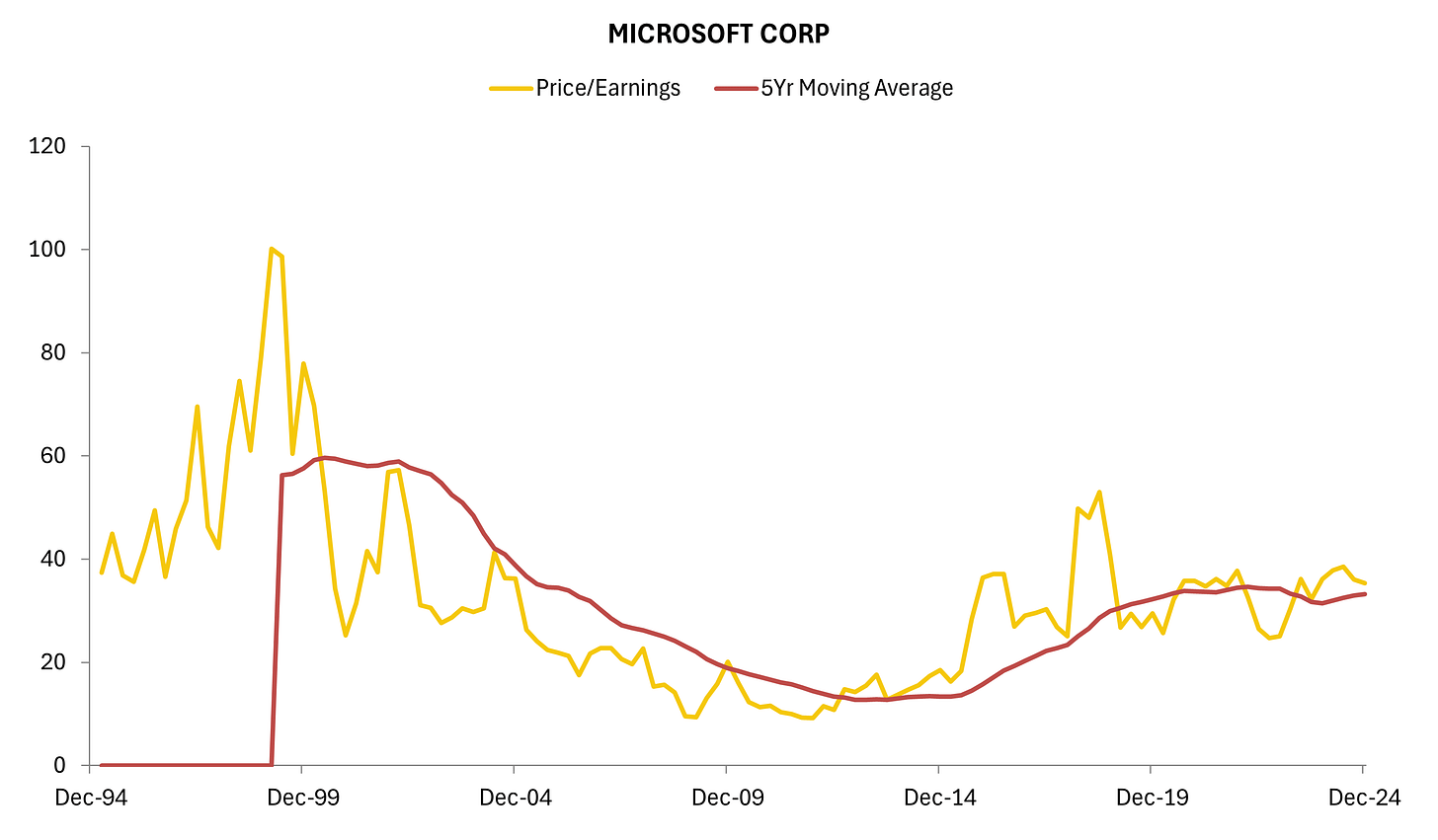

The US market has been such a good place to invest that it is now expensive. Under the narrative of “American Exceptionalism” this was because it deserved to be.

However, it did not start out that way. I bought Microsoft stock back around Jan-2014 when it was trading at a mid-teen Price-to-Earnings multiple. It was good value.

The bulk of professional investors that I know pay attention to value in the long run. They will ride trends so long as they seem warranted and then fan out in markets.

They are fanning out right now so let us look at some key metrics.

Global country valuation

There are real differences between nations so we should not assume that companies are valued the same way across the world. There are three basic categories.

Developed markets

Emerging markets

Frontier markets

I will show you which countries are in each group now.

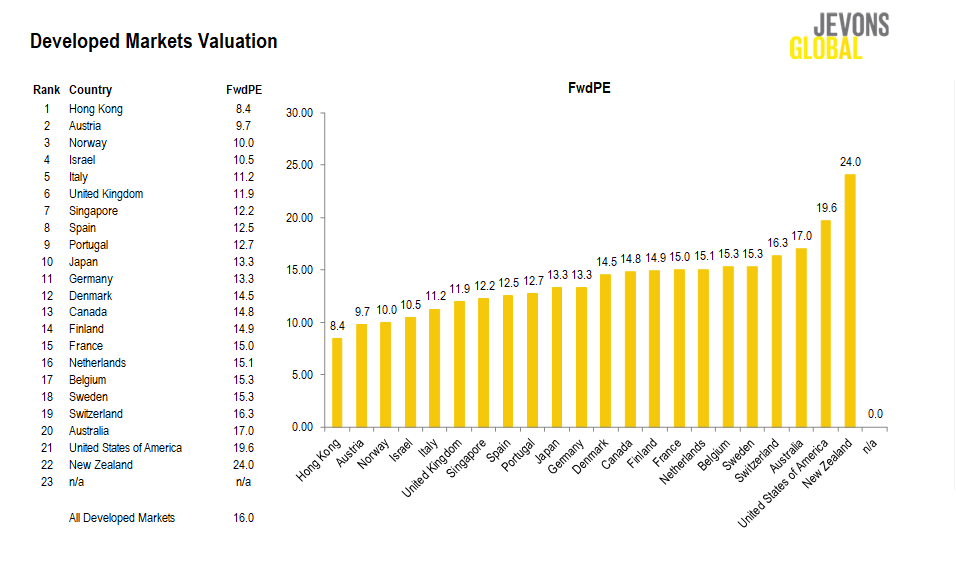

Developed market valuations

New Zealand wins the prize for the most expensive developed market, followed by the USA and Australia. Australia is pretty expensive outside of mining.

There is a concertina effect in the stock market where the multiple applied to a future year of earnings goes up and down within markets over time, and between them.

Currently, Hong Kong is very cheap, and so a good place to look for value.

Europe is variable, but has plenty of pockets of value.

You should note that Austria is traditionally quite cyclical, due to a cluster of industrial companies and a banking sector that does a lot of business in Eastern Europe.

Austria is the European Canary. When it does well, emerging markets do well.

Notice that most of Europe is below 15x forward. This is sensible, so we do not expect a general collapse in European stock markets. They have not shot the lights out.

The USA is expensive. We expect more damage there.

Emerging market valuations

India wins the prize for the most expensive emerging market.

Note that the average EM valuation is 11.6x forward versus DM at 16.0x forward.

This is normal since you expect the emerging markets to be riskier.

There is a story told about India to justify the high valuation. Mainland China is 10.4x forward, Hong Kong is 8.8x forward, and Taiwan is 13.5x forward. I would go there.

People will tell stories about the collapse of China and the day China invades Taiwan. Any of that could happen, but my reading of geopolitics is that it won’t happen.

Asia looks good, but I think India is overcooked.

Frontier market valuations

These are often higher because few go there except folks who have to.

This is a clientele effect. Few investors are seeking these out. Locals will.

Ideas for research

The present state of those valuations leads me to focus on these ideas.

European Region

Greater China (HK, CN, TW)

Singapore

Japan

You may read the list differently, but that is a start.

Global sector valuations

The world can also be cut by common sector within each group.

Developed market sectors

The American Exceptionalism + Artificial Intelligence theme has driven those sectors to high valuations. Technology Equipment is cyclical capital spend. Avoid.

The European and Asian banks look good, more on that in a stock note.

Emerging market sectors

The emerging market story is different. There has been a crowding into defensive areas like healthcare and pharmaceuticals. Banking and insurance looks good.

The timing to move into value generally is likely later this year. There are more shoes to drop on the US economic cycle, and emerging markets are usually soft when the US enters a recession. The risk of a global recession seems lower to us.

Normally, an emerging market recession is as shoe-in whenever there is a US recession. This time looks different to me. This is US-inflicted self-harm.

Frontier market sectors

This is a trade-by-appointment local clientele market. They are sensibly crowded into the more defensive sectors and avoiding financials and cyclical manufacturing.

This is not really a focus for me, but you can see the pattern.

Global sectors across markets

The global sector valuation across markets is a useful summary.

The embedded assumption is that Technology is defensive.

There has been massive capital expenditure in technology going into what looks to be a possible US recession. I do not think that technology is defensive.

Global industry group valuations

The industry group valuations are finer grained.

Banks look like a happy hunting ground, especially outside the USA, in places like Europe and Asia. Avoid Australian banks, unless they are long-term holdings.

Global industry valuations

Now we are getting really granular. I like banks per the above geographies.

Note that Gold Mining is at Rank 42, and a forward multiple of 12.86x.

As I wrote yesterday, ASX Gold Stocks are my best global idea.

Conclusion

This Cook’s Tour of the global markets has these geographical takeaways.

European Region

Greater China (HK, CN, TW)

Singapore

Japan

All of those look like interesting places to look for value.

Among sectors, that is more research intensive. You can see that there is a great split there, but that financials are showing clear value. In this risk zone for global markets, gold mining is my single best idea, especially ASX listed gold miners.

Happy investing!