Introducing the 'Causeway Bay Eight' of Hong Kong Listed C-Tech Names

The world does not turn on American technology alone. Nor will it spin off its axis if China should develop cost-effective useful technology. It is time to invest there.

In our last stack, I called a notable “Gap in Traffic” amid the great portfolio migration.

Hong Kong came out of the blocks strong this year, along with gold, silver, European financials, European defense stocks, and a barrage of confusing Trump invective.

The Donald has decided to “Make the World Pay”, so that America can be great again right at the time when the decade long US Bull Market is looking pretty stale.

Upwards of 70% of global equity wealth is tied up in the US stock market.

There is a lot of wealth to lose if the non-US world starts doing okay.

Those with long memories have seen this movie at least twice before.

It happened in 1975, with the collapse of the no-lose “Nifty Fifty” trade in the USA. Later it happened again. During the 1990s technology boom, the “Four Horsemen”, namely Microsoft, Intel, Cisco and Dell, were considered no-lose investments.

This is a big call, but it looks like we are setup for the encore.

In this introduction, I make the case that time is up for the “Magnificent Seven”, that US centric, and highly concentrated, portfolio of Apple, Microsoft. Google, Amazon, Meta, Nvidia, and Tesla. You don’t need to sell out, but we think it is time to use the profits made in such holdings to diversify into other opportunities globally.

I will be given a list of such in the coming weeks, but my single best idea, is to sell into strength with the Magnificent Seven, and buy the “Causeway Bay Eight”.

That is the name I am giving to eight large Chinese origin technology names, which meet three essential criteria to recommend to a general audience:

They are not (currently) under US sanctions.

They are Hong Kong listed and quoted in a pegged convertible currency.

They are technology focused and chosen to cover a diverse group of sectors.

In the course of developing the list below I will mention other Chinese stocks for which I think the prospects are good, but which fall down on these criteria.

Hong Kong has been demonized in Western press for too long in my opinion.

As someone who is over sixty years old, has travelled widely, including into totalitarian regimes like East Germany in 1986, I think the current US soft power trope, describing this world as an existential contest between autocracy and democracy, is overcooked.

There is a genuine US-China contest going on, but it is largely commercial.

The prize is market share and profit.

I am an investor, and so I have no shame in suggesting that you should own both.

You should own a piece of the US story, and a piece of the China story.

As a matter of fact, you should own any good story that you legally can.

Of course, there is always a moral filter, but that is personal.

I do not own any tobacco stocks, because I was once a chain smoker. I gave up thirty years ago, and that was hard work. If I did not quit, I would likely be dead by now.

Feel free to apply your moral screen to my choices because they are your morals and my choices. There is no other way in the land of morals.

However, as a professional investor, I will apply whatever screens I think make sense from a practical, financial, and legal perspective. This is the fiduciary way.

We will flag US sanctioned stocks.

US sanctions have real consequences for US citizens and US resident aliens.

You should respect them. You should obey them if you are at legal risk not to do so.

Otherwise, the neighborhood of Causeway Bay is delightful.

Go there. Shop. Eat Chilli Crab at Hee Kee Fried Crab Expert Ltd. Drink milk if needed.

Enjoy.

Hong Kong is an amazing entrepot and a global cultural treasure.

Photo by Steven Wei on Unsplash.

Calling time on the big US move

The dominant active investment theme of today is US Exceptionalism.

Acting as if you believed in the narrative of some innate US Superiority has been a very profitable course of action. Speaking personally, I have made very handsome investment returns by acting as if the reason I bought was this story.

For instance, the Viking and I established our Self-Managed Superannuation Fund (SMSF) back in July 2011, once I left my former employer, where I was compelled to have all of my superannuation in an expensive and poorly performing corporate superannuation fund. We never looked back from that decision.

Not every holding worked, but the biggest winner was Microsoft XNAS: MSFT.

On 7-Jul-2011 we bought Microsoft at a split-adjusted $26.67 USD. The stock closed at $378.80 USD on the 28-Mar-2025. This is a 14.2x gain, excluding dividends.

I am not saying this to gloat.

For instance, we also bought shares in Amazon XNAS: AMZN for a split-adjusted price of around $11 USD around the same time and soon sold them for a 15% profit. The closing price on Friday 28-mar-25 was $192.72 USD, or a 17.5x gain foregone.

For every success, there is a failure.

If your success rate is 60% on stock selection you will do very well in the long run.

The reason that I held Microsoft but sold Amazon was a perception of value.

I thought that Microsoft was the better value long-term hold.

However, last week we started the process of adjusting our own portfolio.

Microsoft had simply been too successful as an investment.

It had grown to 35% of our personal liquid wealth outside of superannuation and upwards of 8% in the SMSF. That is too much to have in one holding.

However, there is no reason to move if the outlook is positive.

When the Viking and I first added Microsoft, back in mid-2011, it was cheap.

This is one way to make high compounding returns. Locate profitable companies with a history of penetrating and securing positions in new markets. Buy the stock. Wait.

Microsoft will not exit our portfolio. It remains extremely profitable, and the valuation is not so extreme that it warrants selling entirely. However, these are times which may rapidly turn as President Donald J. Trump upends comfortable assumptions.

The USA is presently 70% of global market capitalization.

The USA is presently 29% of global GDP, when measured in USD.

The US trade to GDP ratio is ranked number 198 out of 200 at 12% trade vs. GDP.

This is very low by world standards.

While the Whitehouse is intent on reshoring manufacturing and jobs stateside, the exports China makes to the USA account for only 3% of Chinese GDP.

All trade between the USA and China could stop tomorrow and Chinese GDP growth would certainly halve overnight and likely go back twice that with the multiplier.

However, upwards of 80% of product on offer in Walmart is China origin.

The US cost of living would soar. and a recession would follow.

This is why we would sell our former best idea Walmart into strength.

The problem, right now, for global investors is that some holdings in the USA are absolutely indispensable. Let me be clear: the USA has many fine companies.

However, the global enthusiasm for “U.S. Exceptionalism” seems to have carried the overall market valuation past the warranted multiple for the strife that is coming.

Strife is incoming, to be sure, and that is the message of an ever-rising gold price.

In our piece on asset allocation, our go-to core allocation was the US S&P 500, the US Short Term Treasury bill, and gold. Now our core allocation has shifted.

We never put a percentage to these numbers at the time. The outlook was uncertain.

However, I will share the numbers I am following for the SMSF allocation.

US stocks 40%

Other assets 60%

Notice that this is not a super-bearish positioning for most Australian investors.

However, a simple S&P Global 100 XASX: IOO, is effectively 70% US stocks.

The real movement, apart from taking profits in long-term US winners to fund any portfolio reallocation, is the composition of the other 60%.

This now reads:

Australia 15%

Europe 15%

Japan 10%

China 10%

Other 10%

This portfolio allocation may not suit you.

The majority of Australian investors have much higher holdings in Australia.

I am not going to argue with that, and it makes a ton of sense to hold substantially more assets onshore if you are in retirement phase, and/or feel more comfortable.

The purpose of sharing these numbers is not to advocate that you copy my allocation. Emphatically, I would state that this is too aggressive for most Australian investors.

Please remember that I, and my partner, The Viking, have over thirty years’ experience investing offshore, from Australia, in global equities. Furthermore, she is a European, a citizen of Denmark, and has Australian citizenship also. Our household is hedged.

The reason for sharing this is to walk you through the logic of it.

Recall that we bought Mr. Softy way back in mid-2011 when American Exceptionalism was a forgotten catch phrase from former periods when the USA blew up.

Vietnam

The early 1980s double-dip recession

WMD in Iraq

The Global Financial Crisis

The USA is exceptional at getting itself into great trouble whenever hubris takes over.

Whenever a general belief in one-sided US Exceptionalism takes over, you know that some kind of trouble is coming down the turnpike. Once that trouble is firmly in the rear-vision mirror, the USA, great nation that it is, will pick up and move on.

You don’t want to be the last investor who bought Peak Exceptionalism.

This does not mean anybody should contemplate selling everything.

That is an over-reaction the other way, and extremes are bad, for long-term returns.

The better course of action is to look where it is possible to raise cash tax-effectively and to prepare the investment team, that is you, and yours, for bargain hunting.

In our case, the Viking Council of Self-Preservation observed some flakey positions that were in loss, which could handily offset some trim on the long-term winners.

It is much easier to exit loss-making positions when markets remain quiet.

Right now, global markets may seem volatile. They are not.

I used to manage global portfolios for a major Australian investment bank. During the Global Financial Crisis some of our holdings would move up and down 30% during a single daily trading session. You read that correctly. Both up and down. One day!

The newspapers are full of reporting and commentary about what Donald J. Trump will or will not do. However, by historical standards, markets remain quiet.

This may be the calm before the storm.

However, it could also be the calm before a relief rally.

The thing about global markets, is that you are never certain what will happen.

The prudent thing to do is to look at those positions which you are not willing to hold beyond the next year and sell whichever long-term losers best offset profit taking.

Legendary investor Warren Buffet is a great example of this principle at work.

During the year just past Buffet sold 70% of his long-term holdings in Apple.

Now he has a pile of cash to put to work on buying good value when it appears.

Notie that in the above asset allocation for our SMSF the “Other” category sits at 10%. This is composed of cash and gold. Roughly 5% in each as a target.

Again, this suits me, not you. Your needs and risk appetite will be different.

What we are illustrating is the principles at work.

Our long-term portfolio allocation is there as a destination.

You will choose your own destination.

We are not at our destination, and I am saying that to reassure readers.

When I wrote the piece Gap in Traffic, I was doing so because global markets are quiet enough today to keep a clear head on where you want to go.

Presently, we are 20% in cash, with no gold at all.

That is because of this chart here, which shows Microsoft stock versus gold.

You can see that when the chart is climbing, Microsoft was beating gold, when it falls the other thing is happening. This does not include income from dividends, which at a level of 2-3% is good for a double over 30 years. However, stock is purchasing power.

The big picture is that gold can outperform stocks for a long period.

The Viking and I own zero gold now, but in August 2007 we moved to 30% gold.

That is because we could see the Global Financial Crisis that was coming.

This is not a market that warrants such extreme positioning.

The global financial system is very sound, in my opinion.

The unsound element of today is political leadership.

I am not going to go partisan on this one. You have your own opinions. However, I think those over fifty years old can tell all is not sweetness and light in politics.

The Microsoft chart has a positive message. The mid-term technical analysis on that price-relative chart sure looks like what traders call distribution. This is a process of selling down stock into relatively quiet markets, on a large scale.

Buffet has been doing this for over a year with Apple.

He has also been buying the Sogo Shosha trading houses in Japan.

We have been doing the same thing since Aug-2017.

Our largest Japanese holding, Itochu XTKS: 8001 is up fourfold in that time.

This is why our new SMSF allocation looks like five ideas, of which we are uncertain which is the “right” one: Australia, Europe, Japan, China and Other.

Correct call. We are uncertain.

However, we are confident that the USA is now too much of global equity wealth.

That figure is coming down from 70% and we figure it will settle around 40%.

This seems fair to us as this number is about 1.5x US share of global GDP.

In my view, it is not necessary now to be certain of where else to put the money.

The Rest of the World is presently 30% of global equity wealth.

Investing is a relative game, if the US market share goes down, the Rest of the World has to go up. Pick the better parts of the Rest of the World, and you will do fine.

Do not assume that anybody knows the best place to invest.

Just invest where you feel comfortable, watch that, and adjust as events unfold.

When I look at that Microsoft chart, I think there is a bounce left in this market. Here is a second reason why I think there is plenty of time to adjust positions.

The Trump Liberation Day is slated for 2-Apr-2025. This is momentous, but everybody has known this is coming for some time. There will likely be selling in this session, and the next one, but I think that the Magnificent Seven are now set up for a bounce.

Americans are patriots. They will buy this dip.

I already said that I am planning to raise some cash from trimming Microsoft holdings into strength. This is because 29.6% of our household liquid net worth outside of the SMSF is tied up in that one stock. This is what letting winners run means.

However, I am not in any blind panic.

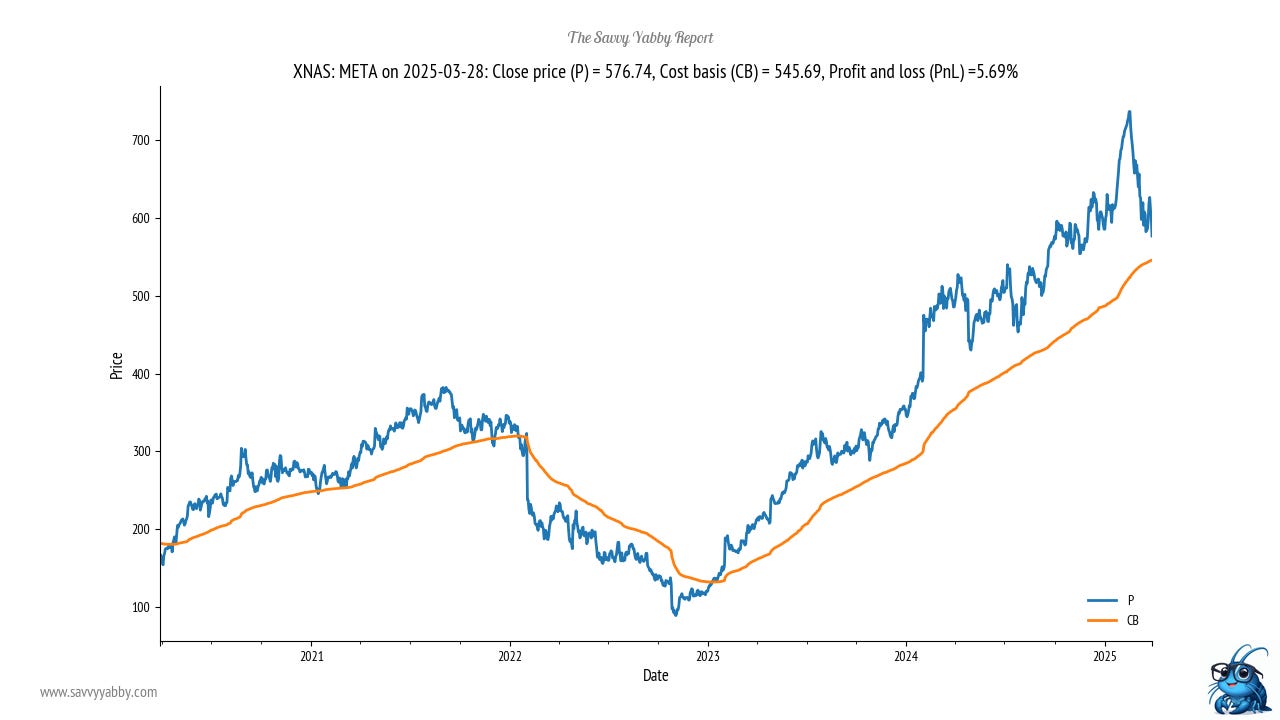

Some MSFT stock has been sold, and I aim to buy some Meta XNAS: META and more Alphabet XNAS: GOOG with the proceeds. This is down to my view on the importance of Open-Source business models to the future of AI, post DeepSeek.

Meta is approaching investor break-even from topside and is good value. Switching some Microsoft holdings into this makes sense. Alphabet is a similar story.

Apple XNAS: AAPL is allocated for sale to fund non-US positions.

Amazon XNAS: AMZN is looking fine for now, but we do not own any. Last year I came out with a best idea in Walmart XNYS: WMT. I would trim consumer stocks exposed to pricing volatility from tariffs, which includes Costco XNYS: COST.

Nvidia XNAS: NVDA is in a confirmed bear market.

Some readers may be skeptical, given how profitable the business has become.

Certainly, the revenue per employee has gone through the roof.

The sales per employee metric is something I look at a lot. Nvidia has expanded their sales by a huge amount without needing to similarly expand their asset base. This is a sign of huge operating leverage to the price-per-unit. That has been high.

However, DeepSeek changed the efficiency equation for Generative AI models. Cost to train and operate has fallen by as much as 95%. There are rumors that China may have excess capacity in newly constructed data center infrastructure.

Well, of course! They are foolish Chinese people who went gaga over nothing!

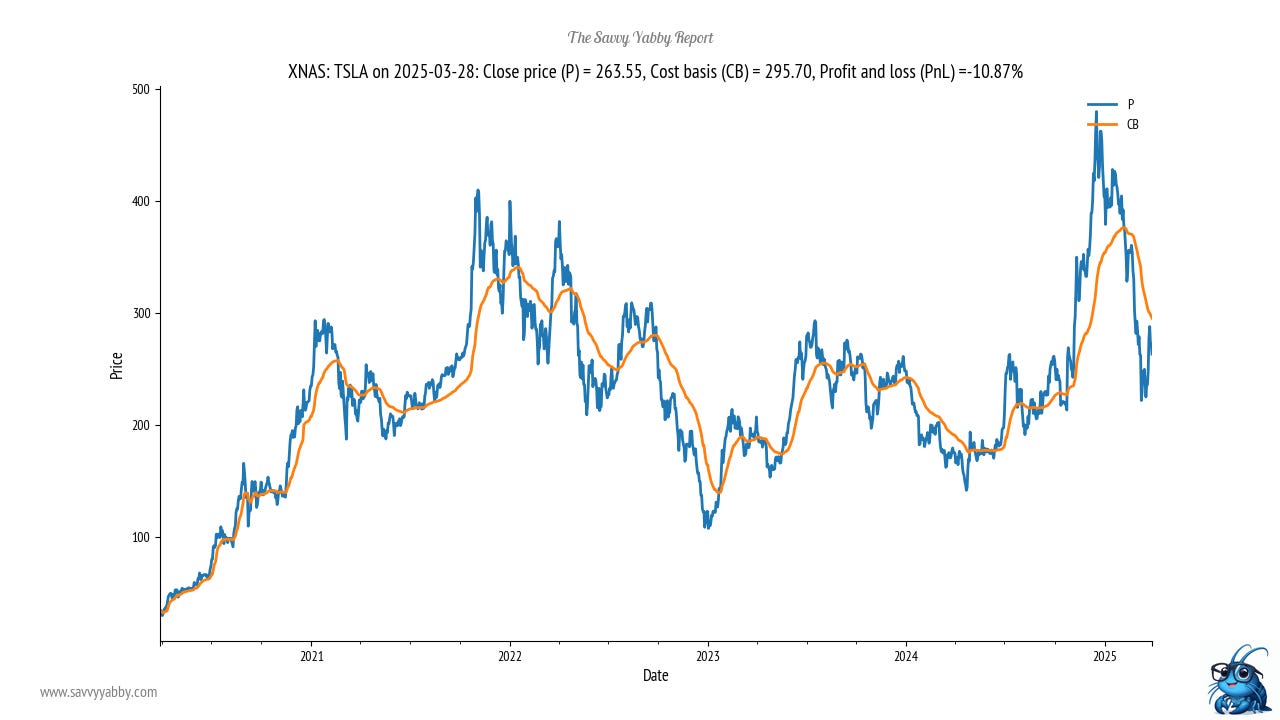

Finally, Tesla XNAS: TSLA seems to be in all kinds of trouble.

The Uber Musk Uber Alles narrative appears to be careening off the road.

I own the car, Tesla Model 3, built in Shanghai, but I do not own the stock.

I think I never will. It is too much daily excitement for this investor.

On to the Causeway Bay Eight!