Mineral Resources fails Confidence Test

Three weeks ago, I published a note on the iron ore sector, pointing out a looming test of confidence for Fortescue XASX: FMG and Mineral resources XASX: MIN.

Key test of confidence for FMG and MIN

In this quick update, we note that both companies failed to hold and recover cost basis, while the correction in BHP Group XASX: BHP and Rio Ltd XASX: RIO halted around the break-even level. Here, I quickly update those charts.

This is the British Virgin Islands (BVI) Holiday Edition covering iron ore.

There is more action in the gold sector which I will cover tomorrow.

The State of Sentiment in Iron and Steel

Across our universe of top twenty ASX listed iron and steel stocks, plus the Brazilian giant Vale XNYS: VALE, it is still a very mixed bag.

BHP Group XASX: BHP has corrected towards cost-basis but remains positive.

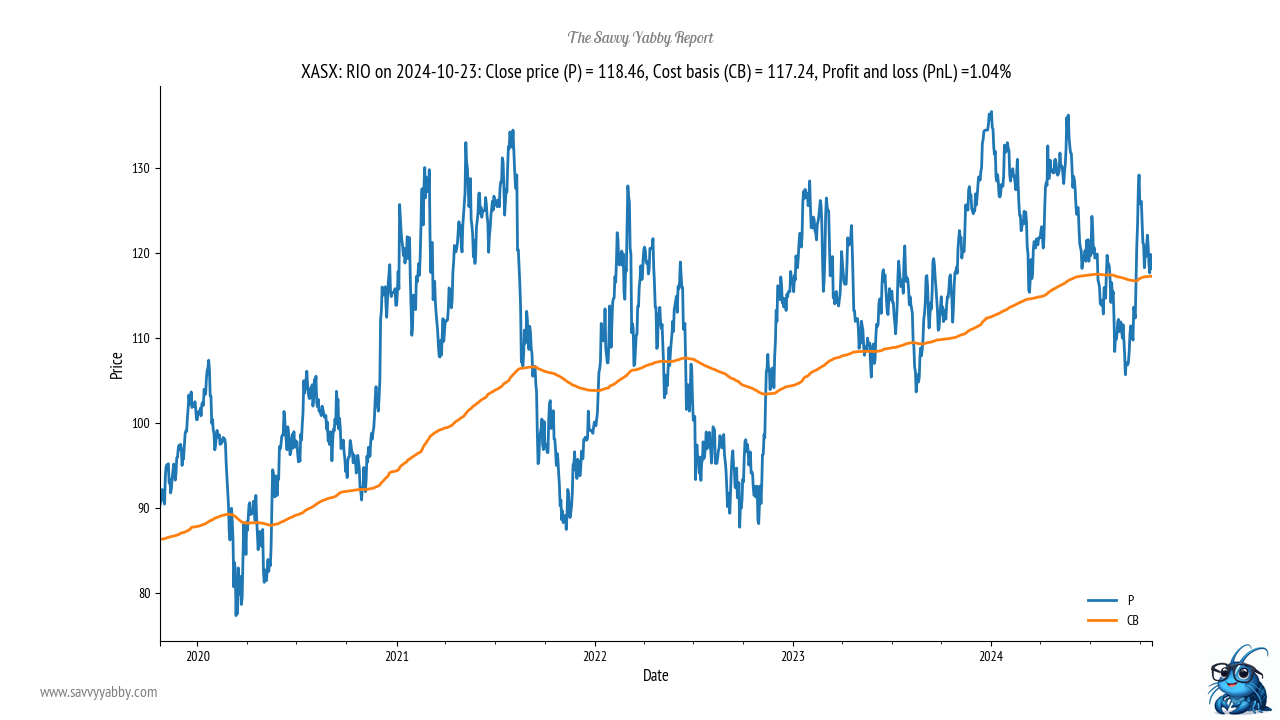

The same is true of the other major Rio Tinto XASX: RIO.

In both cases, it seems that markets are sanguine about the outlook.

Recall the C-1 cash cost chart we published earlier.

However, note that Fortescue XASX: FMG failed its confidence test from below.

The market seems more concerned with the green-steel and hydrogen ambitions of Fortescue, as posing a capital expenditure drag on the group.

The jury is out here, but investor confidence is weaker in this name.

Then we come to Mineral Resources XASX: MIN.

In my previous note, I wrote:

Mineral Resources has been the subject of negative speculation over the strength of its balance sheet. They made several early-stage lithium investments towards the peak of the market and are looking to raise cash from selling rail interests.

This is the stock I am most nervous about.

I think it could fail at these levels, with another leg down.

Of course, the reason for the failure of confidence only emerged later, founder and CEO Chris Ellison had a tidy tax evasion scheme running, buying equipment in an offshore British Virgin Islands (BVI) vehicle, and on selling that to the company.

This is not great corporate governance, to say the least.

The Savvy Yabby is but a humble blue crustacean, that does not get out much and spends most of its time at the bottom of a murky outback Billabong.

However, it stayed out of the Mineral Resources rally.

Note that there is zero direct connection between technical indicators and the current state of company fundamentals. The two are like night and day.

However, when sentiment is delicately poised, adverse fundamental news flow can affect stocks greatly. That is what just happened with Mineral Resources.

We would rate this stock a clear avoid until board room heads have rolled.

There is nothing that looks good about this insider behavior.

Founders are rightly celebrated for their success in corporate value creation, but not for some sneaky scheme to reduce their taxes at the expense of shareholders.

The steels look better

Bluescope Steel XASX: BSL is still fine but a little dull.

Bisalloy XASX: BIS retraced some of the prior move but is still positive on sentiment.

Recall that Bisalloy has little to no broker coverage, and so there is nobody out there banging the drum to buy this stock. Patience should be rewarded on this one.

Sims XASX: SGM just tested and held cost basis from below.

This firm deals in the scrap steel market, which is cyclical, like the rest of steel, but has a somewhat different cycle. This ought to be positively favored in the move towards green steel, but the dynamics for steel in Australia are a little challenged.

On the positive side, Australian government infrastructure spend is high, but the rest of construction is a little weak. The Whyalla steelworks run by Sanjiv Gupta is under considerable pressure right now, due to issues with the blast furnace.

Overall, the global steel market is a little weak due to reduced domestic demand in China, and a slowdown in US factory construction as Biden Administration Inflation Reduction Act (IRA) stimulus measures start to saturate.

The product mix, and destination geography, matters a lot at this time.

This is why we like tempered steel maker Bisalloy.

This is not raw steel, but improved steel, that is treated in a specialty line with crude steel billet and electricity as the key inputs. Compare that with commodity steels for construction, like concrete reinforcement bar, or I-beam sections.

We think there is growth potential here, but patience is needed.

The niche iron ore plays need to settle

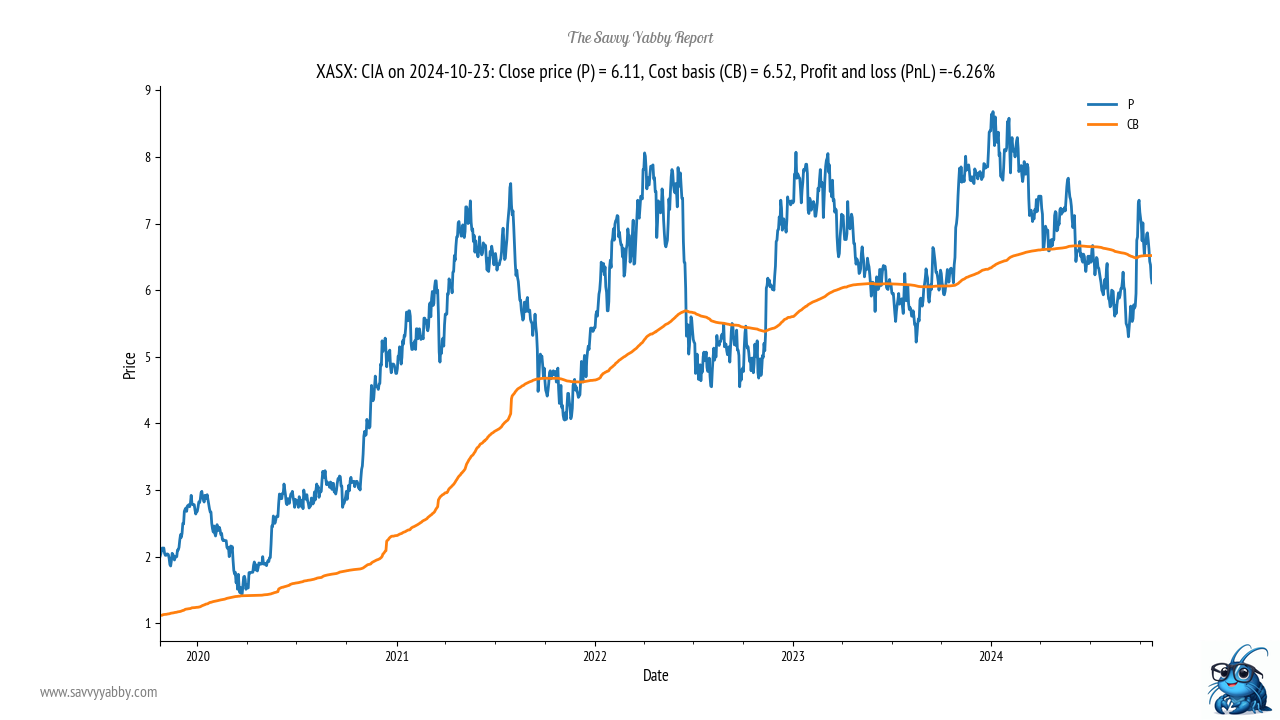

Champion XASX: CIA has flipped back into minor loss.

Notice that this stock has not typically had deep drawdowns in the last five years but is not showing much growth either. It has North American steel market exposure.

This is not a growth market by volume, so a lot depends on market share gains.

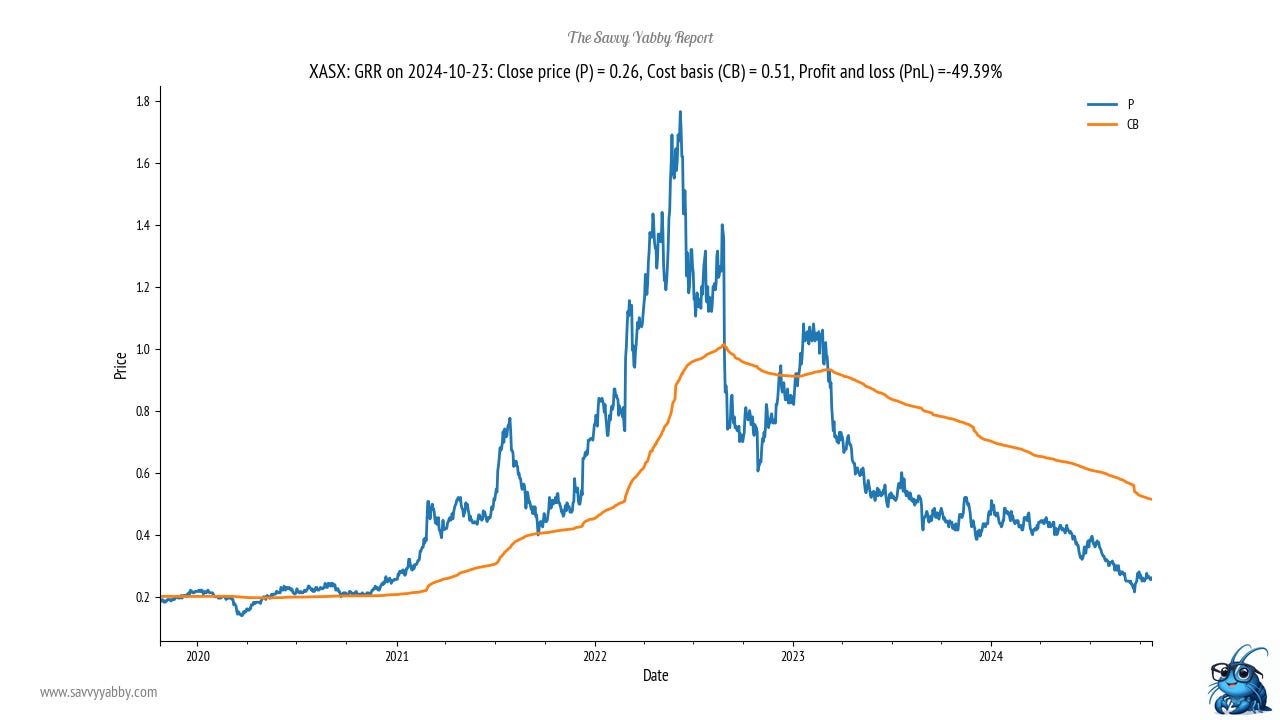

Grange Resources XASX: GRR has made good margin on their high-grade iron ore pellet business in Northern Tasmania. However, they need a mine life refresh.

The primary issue here is the mine-life refresh and patience for better prices.

Pelletized iron ore has a bright future for greener steel but needs better prices.

Mt Gibson XASX: MGX is in a similar position to Grange Resources.

Fenix Resources XASX: FEX has the advantage of an embedded logistics business.

The mine lives for all three of these companies are not as long as the Pilbara giants, but they each have advantages in different market conditions.

Our central view is that global steel is ex-growth, due largely to the plateau in China, and the smaller scale of growth market India. However, we think that the shift away from breakneck volume growth towards more specialty and green steel will help smaller companies with well-defined strategies.

Among these, we think Champion and Fenix are better placed.

Conclusion

This is really a housekeeping note to update readers on our prior call for a major test of confidence in Mineral Resources and Fortescue.

Clearly, Mineral Resources has failed that test for corporate governance reasons.

We remain constructive on selected iron ore miners, such as BHP Group and Rio Tinto, plus the minors Champion and Fenix. We also continue to like Bisalloy.

With iron ore hovering around the US$100/tonne mark this will not be a “shoot for the rafters” bull market. However, there are good yields on offer for the majors.

In coming notes, we pick up gold stocks and look at the battery minerals sector.

Happy investing!