Navigating Bear markets

Bear market conditions are far and away the most challenging markets for every investor, whether experienced, or not. Markets move fast. Here are tips to cope.

In What is the actual plan?, I outlined some basic tips for Bear markets.

The helpful Bear market preparation is, as follows:

Budget your needs over three months and meet those as your first concern

Now that you need not sell in a panic, plan what sells to match together

Do those trades, when you can, to raise cash tax effectively

Distract yourself from current panic by researching what to buy

Have a view to what kind of portfolio you want to own coming out

The very first step presupposes you have time to plan.

The coming Monday session of trade may leave no time to plan.

Generally, it is a very bad idea to try and raise cash in a market rout.

The people who will do that this coming Monday are generally facing margin calls from their broker, because they were leveraged going into this sell off.

When the Bull is on fire, the margin calls build up like a Tsunami.

There is no easy advice to provide in a market hit by margin calls.

There are two reasons I sell in such markets:

Because I have to meet a margin call

Because I have found an opportunity to swap horses in the fall

I have not done the first one since the Tech Wreck of 2000.

I told that story in Enter the Yabby… Our Origin Story.

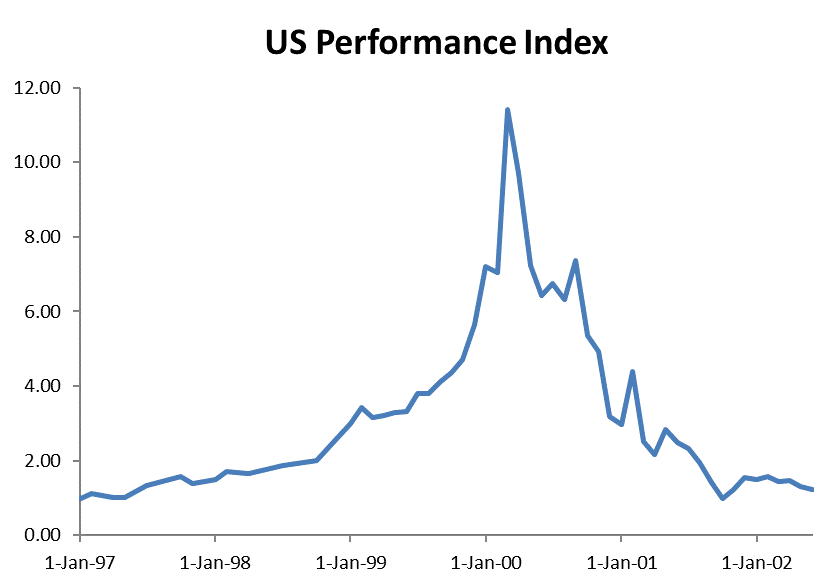

Here is the equity curve from that sobering experience.

I am sharing this because it is born of personal experience.

I actually did that, but I also survived that.

This experience taught me a lot about margin calls, and the reason why leverage must be used with great caution in an equity market. You need good antennae to survive.

I am not a proper cockroach. I would not survive a nuclear war.

I did survive the 2000 Technology Wreck, and it taught me a few things:

Margin calls matter more to the state of a market than you think

What matters to individual investors is their cost of entry on a stock

What matters to the rate or margin calls is the average cost of entry for a stock

The logic for this is very simple:

Margin calls happen when the stock is worth less than what you paid for it.

Actually, it is a bit worse than that because margin lenders usually only lend against a percentage of the value of a stock, say 50-70%. Worse, they can change the ratio.

When you have a widely owned market darling like NVIDIA XNAS: NVDA, the margin calls will pile up and forced selling will take over. This can, and likely will, drive the stock much lower than you think it should. I mean a fall of 50% or more.

You can see, from the chart above, that Nvidia stock is in a Bear market, as defined by the Savvy Yabby Indicator, which estimates the average investor profit and loss.

You can read more about it in the Tao of the Savvy Yabby.

The bottom line is that when price is above average cost of entry, you have what is called a “Bull market”. This is a market of positive general sentiment.

When the price is below average cost of entry, you have a “Bear market”. This is a market of negative general sentiment. Margin calls increase in this condition.

If you have a large group of widely held stocks, such as the Magnificent Seven, the condition where they are all underwater is very hazardous.

This could well lead to a torrent of margin calls.

It could well be better to buy on such a day than to sell on such a day.

However, this presupposes that you have the cash to buy.

It also presupposes that others will be done selling today, not tomorrow.

This is the why the market conditions that President Trump has delivered to all of us, when US Employment remains strong, inflation and interest are modest, becomes so very dangerous to capital markets. Nobody really foresaw such a crazy tariff policy; nobody has prepared as well as they should have. The rest, as they say, is history.

Switching horses, selling, or sitting pat

Rarely is it a good idea to do anything in market conditions like this.

Sitting pat, turning off the TV, and going for a long walk is a good idea.

Selling is what you do only when you have to.

Margin call management is extremely challenging, as the movie made out.

The best tip I can offer is to provision for the immediate calls early by clearing out weaker positions. This is counter-intuitive, but any position that is marked as zero credit for your margin loan is best converted to cash to retire debt.

This is very counterintuitive for many traders.

They wind up selling good positions, because they are down less, only to see those bounce wildly once the wave of selling breaks.

What you will find in the fast markets, that are coming on Monday, is that the weaker names will not bounce. It is the strong names that will survive a Bear market.

Furthermore, you will find that the trading patterns shift perceptibly once the selling wave strikes. First of all, everything is down, and you think it will stay that way. The market just sells indiscriminately. Then it begins to sort out late in the session.

You will see stronger names bounce late as cash comes in to buy.

Even if you are not trading, and have no intention to, you should watch these intraday patterns closely as they contain useful signals of what strong hands will buy.

This last observation brings me to the Bear market strategy of switching horses.

This is a little tricky to explain, but I will use a live example.

Presently, I own Apple XNAS: AAPL and also Alphabet XNAS: GOOG.

I bought Alphabet much later in the bull market than Apple, which I bought years ago.

Looking forward, in my plan of what I want to own going out of this Bear market, the plan says I should own more Alphabet and less Apple. That is my plan, you need not agree with that plan, as I am sharing it to make a point.

Here is the Apple chart, which is headed down.

Here is the Alphabet chart, which is headed down.

They are both going down, you can see that, so what gives Einstein?

If you had a crystal ball, which I do not, you would know exactly when to sell out of Apple, so you could hold cash, so you could later buy Alphabet, for cheap, right?

The problem with that plan is twofold:

All stocks tend to move together in Bear markets

Timing when to come out of cash is really hard

Having cash now is good if you want to change your asset allocation.

You can use cash to buy gold or bonds.

However, cash is precious, and costly to raise on savage down days.

The solution I use in this situation is a changing horses chart. Good chart services enable you to divide one stock price here Apple, for another, here Alphabet.

This type of chart is a bit counterintuitive at first. In effect, you are plotting the number of shares of Alphabet that each share of Apple can buy.

Let us do an example with the Friday 4-Apr-25 closing prices:

Apple closed at $188.38 per share

Alphabet closed at $147.74 per share

Pick up the calculator and confirm:

Each Apple share buys $188.38/$147.74 = 1.275 Alphabet shares.

Unless you are Rain Man, this is hard to do in your head when the sky is falling.

This is why most hedge-fund traders have ratio charts running on all live switches.

There is no need to be cute about this, but an intra-day or multi-day ratio chart can help you time your switches from one stock to another stock.

Notice that the pattern reflects the joint price action of both stocks.

The ideal time to switch need not coincide with highs on what you sell and lows on what you buy. You are using one stock to purchase another. This is what matters.

Looking at ratio charts is a good idea but be patient.

It takes some time to really master this trading strategy.

The main thing to remember is that stock is purchasing power for other stocks and that some stocks are easy sells in margin calls because the stock does not count towards your margin balance unless you sell it to retire a portion of the loan.

The last point holds a trap for novice players in Bear markets. You can easily wind up with a portfolio of broken and damaged small caps because you sold liquid majors to cover margin calls. The cock-eyed logic said “the small fry are down so much” so you could not possibly sell them. You sold the good stocks instead.

This is how Wall Street institutions go broke, and there have been many of them.

Now we turn to the Magnificent Seven and one doozy of an Official Bear Market.