Tax Loss Selling Opportunities

Lithium and Rare Earth stocks are being sold heavily

This week we launch the Savvy Yabby screening service.

This is designed to help investors locate stocks which may be at extremes of positive or negative sentiment. The analysis is based on the unrealized profit and loss signal described in our previous post Enter the Yabby…

Investor sentiment is driven by many factors, but a key one for those who actually own a stock is whether they have made or lost money.

Unrealized Profit and Loss and Tax Liabilities

This unrealized profit or loss can be calculated by dividing the current price by the price paid for the stock, after adjustment for any intervening corporate actions.

Coming up to the end of the tax year, on 30th June, your tax advisor may well go through your portfolio and recommend changes to reduce capital gains tax.

Perhaps you had a big winner earlier in the year and made a realized capital gain.

Now is a good time to look for losers in your portfolio and consider whether you should crystallize a loss in order to offset gains. Of course, this depends on your personal circumstance. Factors include how long you owned the stock, future prospects, and your overall tax liability and other available offsets.

Estimates of Unrealized Tax Losses

This unrealized profit or loss can be estimated in several ways. One simple idea is to look at where the current share price sits in relation to the 52-week high or low. You would expect stocks that are well below their one year high to have losses.

A better version of this idea is to average the price over each trading day through the last year to come up with an average price at which people may have bought.

Clearly, it would be a good idea to consider how much volume was traded over the past few years, and to give more weight to the more recent trading days.

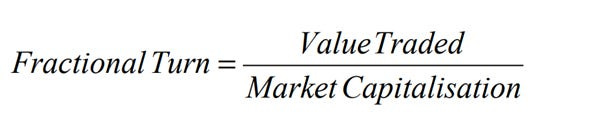

The indicator we use to estimate the average entry cost of investors is a variation on this basic idea. We think of all the shares outstanding, and what fraction of these are turned over each day. This is gotten from a simple formula.

If a company had a market capitalization of $1B and traded $10M of value on that day, then the proportion of shares turned over is 1/100th of the total, or 1%.

This would mean 99% of the shares did not change hands, and only 1% have a new cost basis, which we can take as the average price traded on that day.

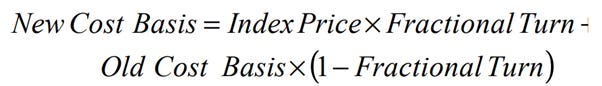

The result is a progressive update formula starting from the first day of trade.

The average cost basis moves by a small amount each day, in the direction of the prices that were traded over that day.

The update rule takes the old distribution of possible entry cost into a new one. This rule applies to the average entry cost also, so we can run our estimate forward.

For the example where 1% of the total company shares were traded, and the other 99% were not, we take 99% of the old distribution and add in 1% of the new one.

The easy way to understand this is to imagine a company float. Ahead of the first day of trade, every investor owns their shares at the same price, the float price. After the first day of trade some shares have changed hands, but not all.

Graphing the Average Entry Price

Let us take a simple example to see this in action.

This is a cost-basis chart for Woodside Energy ASX: WDS. The blue line is the closing price, and the orange line is the estimated cost basis.

Presently, the stock has an estimated unrealized loss of -12.72%, and so will likely be sold down going into the tax-year end on 30th June.

For a different view, we can divide the price by the cost-basis.

You can see that the 2020 bear market was particularly harsh for investors. They were sitting on unrealized losses of more than 40% at the trough.

Later the stock recovered, although it took some time.

Sentiment was likely positive from early 2022, when oil prices spiked at the start of the Russia-Ukraine war. However, it turned negative again in late 2023, and has slid since.

There are several ways that I use this information:

Consider which stocks are likely to be weak at tax-year end.

Screen for deep value turnarounds among deeply negative sentiment stocks.

Look for pull-back opportunities for sharply positive sentiment stocks.

You may find more ways than this to use such information.

For contrarian investors, the main value of the profit and loss indicator is to label current investor sentiment. The extremes are of great interest.

The crowd is generally correct, except at a turning point, or an inflection.

Note that the average investor break-even line is neutral for sentiment.

The share may bounce off it to confirm prior sentiment or pass through it. These are markers of general bear markets or bull markets for stocks as a whole.

Current Examples of Sentiment

Let us now look at sentiment for major stocks in Banks, Materials and Real Estate.

This tax-loss selling season has been dull for the banks. They are mostly in rude health, with only Bank of Queensland ASX: BOQ, in minor loss.

The story is similar for the major Materials stocks. Note that the better sentiment areas are offshore building materials with James Hardie ASX: JHX, and gold with Northern Star ASX: NST. The major negative is Mineral Resources ASX: MIN.

Later we will look at the lithium companies, which were hit hard this year.

The Real Estate Investment Trusts (REIT) show just how wide the dispersion can be for sectors under great pressure. Only Goodman Group ASX: GMG, is significantly positive, while Unibail-Rodamco-Westfield ASX: URW is deeply negative.

REIT investors have few places to go to see stocks in profit.

This sort of dynamic cuts both ways. Firstly, the positive sentiment likely sustains GMG in positive momentum, so long as the earnings outlook is positive. Secondly, the clear negative sentiment in the others will likely drag on stocks.

When a bear market goes on for long enough you can get deep value opportunities that await a major catalyst to turn the company fortunes around.

Clearly, Unibail-Rodamco-Westfield is worth watching for this reason.

In the short run, URW is down more than 10% in June.

There is likely a trading buy in the stock post 30th June as tax-loss selling abates.

Our paid newsletter service includes a screen of unrealized profit and loss over 1879 of the ordinary shares listed on the ASX, excluding Exchange Traded Funds (ETF).

The above file contains a sample analysis for the twenty largest companies.

The paid subscriber version includes all 1879 stocks in our screening system and some commentary on the stand-out sectors for tax-loss selling this season.