The Global Themescape: Sol

Confidence is the Elixir of Successful Business. Without it the economy does not amount to a hill of beans. These are tough times to remain confident.

The Artificial Intelligence Oracle of Google Gemini offers this pith on confidence.

In astrology, the Sun represents one's core self, ego, and life force, often associated with traits like confidence, creativity, and leadership. It governs the zodiac sign Leo and is exalted in Aries, indicating areas of strength and potential. The Sun's placement in a birth chart influences a person's overall attitude, spirit, and fundamental personality.

Whoa. Deep.

The Sun is not a planet.

Surprise!

You thought that I only did hokey planetary horoscopes.

Fooled you :-)

There are many ways to parse how confidence relates to the stock market, but we are Yabby kind, so we know that unrealized profit and loss is key to psychology.

There is also the small matter of fundamentals.

The precious metal gold is in the ascendant right now, due to a prevailing pessimism over the fortunes of the US dollar. I think the fears are overstated, the dollar will likely remain the dominant reserve asset for decades to come, but we need to look closely at who is buying gold, and why. We also need to look at gold miners.

This will also give me an opportunity to share my observations on bull markets, and the behavior of crowds in the early stages of such trends. This is really interesting.

You will note that I now write in an optimistic tone.

Jupiter is for pessimists. Sol is for optimists.

I may conceal a wicked tongue, but I am a cheery optimist in real life.

The mind of a nematode

When dealing with complex phenomena it is best to think like a worm.

The nematode worm has the best mapped brain of any living thing.

Caenorhabditis elegans has a whole 302 brain cells. However, it still gets around and is probably none too worried by the current market conditions.

Humans have about 100 billion more brain cells, so we can worry properly.

Nematodes do not need a big brain. They just need to find food, eat it, scatter when the phagocytes turn up, and look good when it is time to make more nematodes.

This is like being a celebrity, but the wardrobe costs a lot less money.

What is common between the nematode, and every other living thing with a brain, and central nervous system, is the existence of two hemispheres.

Living things literally have two brains, joined together, sort of.

The bicameral mind

I am not a neurologist, but I do pay one to figure out what is wrong with me.

(Apparently, I have brain scars after my stroke, but they are healed up now).

If you want to go to town, we humans have maybe three brains.

(Some presidents I could mention may differ in that functional brain count).

There is a huge literature on brains, and I have little useful to say, expect that the different regions are specialized, and the limbic system is the old bit that has a primary function to do with emotion, behavior, long-term memory, and smell.

I am not going to pretend to be a brain scientist but have long harbored a view on why two hemispheres seem to be a common feature of Planet Earth brains.

The gag about the nematode and Sam Altman, relates to a common feature of real brains which is not (presently) a feature of artificial brains, but likely will be.

The very short nematode tour of artificial intelligence would start with neurons.

In worm terms, a neuron is just a switch that can be on or off and is connected to other switches that will turn on or off when they get kicked by other neurons.

When a piece of food floats by the nematode neural network kicks into action as the different switches fire, the worm chases the food and eats the food.

Sensory Input > Pattern Recognition > Behavior Plan > Action Output

The above simple flow chart for a worm describes the basic idea.

Worm world is very simple, so there are few actions to take from the menu, and few things living in worm world about which it is worth taking action.

I described the action plan when food is spotted.

The action plan when another nematode worm is spotted is censored.

You do not need a big brain in worm world.

There is no worm called Marcel Proust parsing the niceties of erudite conversation.

The above is pretty similar to a flow chart for algorithmic trading.

Now write that out a hundred times.

What do you do when industrial production fell and the Fed lowered rates?

There is nothing certain in our world, but intelligent action involves doing those things that are more likely to be the right thing in similar situations.

The world changes all the time, and so feedback, looking at the difference between what happened, and what you thought would happen, is key to good outcomes. Correct any obvious mistakes. Manage risk. Move on.

Worms know how to do this in their very simple worm world.

Experienced investors work hard to get better at noticing what is going on, which of the prior states of the world it looks like, where it is different, and what is the likely best course of action. Then they diversify across the remaining uncertainty.

This world never looks the same twice, but it may rhyme with prior worlds.

History doesn’t repeat itself, but it does rhyme.

- Mark Twain

This is often supplemented by the natural corollary.

If you are consistently wrong in public, then change your name.

- Samuel Langhorne Clemens

Logic is overrated. The world is neither perfect nor boring.

This time is different, always, but it may rhyme.

Watch out for Gilded Age Presidents bearing tariffs.

Why two hemispheres?

You will notice that I have used analogy in the above.

There are two basic ways of “thinking” that I know about.

There are sentences like this:

That is a duck and there is another duck.

We all know when to apply this form of thinking.

Then there are sentences like this:

The white-headed duck is the male.

Wrong answer!

Actually, the paradise shelduck of New Zealand is unusual among bird species in that the female of the species is more eye-catching than the male.

Rules of thumb are good most of the time, until they are not.

The world is full of patterns, and they generally organize well into groups, to which we can apply rules, and labels, until new categories appear that break them.

Any neural system in Nature must be able to cope with variability.

There is a sensory system pouring information into the brain, and the brain has to be able to make sense of that to figure out what to do, why to do it, and when to do it.

The monotreme family, comprising the Platypus and Echidna in Australia, is a category crossing creature which breaks the rules normally applied to mammals and birds.

The two hemispheres deal in logic and analogic.

Logic describes “is” as reasoning and avows certainty.

Analogic describes “like a” reasoning and is more flexible.

If you reflect for a moment, you will realize that you do both all the time.

The two hemispheres of the brain are the left brain, and the right brain.

The left does logical reasoning, with a high degree of certainty attached.

The Magnificent Seven are good stocks so buy them.

The right does pattern recognition, with a high degree of flexibility attached.

The Magnificent Seven are all going down now so maybe not buy them.

The tussle between these two is called thinking.

Whenever these two brains of yours disagree with each other you may feel pretty emotional. This is because the left brain likes to be sure and can voice opinions, through the use of language. The right brain deals in pictures and analogies.

You may recognize some similarity to politics, but it is messed up.

This is because the left brain is wired to the right hand, and the left hand is wired to the right brain. There is a crossover network which makes it all confusing.

You need both of your brains, so make peace with which one is right now.

If listening to your right brain makes you less emotional, then that is probably the place you should go for helpful advice. Vice versa with the left brain.

Logical thinking and analogical thinking work hand in glove.

You can easily compete with Sam Altman, because he only has half a brain :-)

Informational advantage in markets

The brain is both an information system and a communication system.

We communicate with the world via our sensory system, and back again through actions like walking, talking, taking things up, and putting them down again.

Way back in the 1950s, Claude Shannon, the information theorist, developed a model and a theory for the communication process, in terms of symbol transmission.

Shannon realized that you could reliably communicate a signal, down a string that linked two cans, provided you added enough redundancy to offset the noise.

Noise, like the background sound of waves breaking, will scramble communication, but if you say the same thing often enough, in different ways, it gets through.

The secret to turning this into mathematics turned out to be probability theory.

Forget the formula, the key insight is that to work in the real world, which is full of noise, you have to consider the chance that what you think you see is noise.

There is a way to account for the chance that we are in a bull market, given that you see certain signals, and the chance that we are not. This depends separately on the chance that the signal appears, the chance that there is a bull market, and the two things in combination. Bayesian reasoning is the way to balance that.

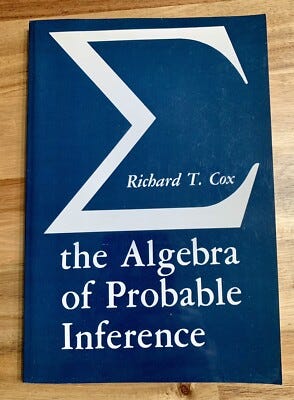

For those who like this sort of thing, there is a classic book.

The Algebra of Probable Inference, by R.T. Cox, published around 1961, the tidal wash of The Mathematical Theory of Communication, by Claude E. Shannon and Warren Weaver, published around 1949, are two peas in a pod. The circle was closed.

In contemporary society, it is easy to think that only billionaires change the world. They do, but none of what they do is possible without that which came first.

The first book describes how to reason correctly on uncertain information.

The second book describes how to communicate reliably in a world of noise.

The picture of the communication channel describes the setup that led to the mathematical model required to do both of these tasks together.

There is a third book, by Edward O. Thorp that describes how to put this together.

The point of the theory of probability, and reasoning systems, is to make informed decision-making possible when you do not know what to do.

You make an educated guess on what is most likely to be correct.

You do not really know, but you know how to guess better than most.

Quantitative finance is the art of educated guessing based on evidence.

Contrary to popular belief, it does not require the assumption of a static world. What it does require is the ability to classify and match patterns to current events.

When the world of finance changes, there are usually a set of patterns that emerge, which tell you things have changed, and that a new situation is before you.

Stocks go down more than they go up.

Central banks talk about lowering rates rather than raising them.

Well known funds managers tell you not to panic and not to redeem funds

These all go together and suggest that the bear market risk is rising.

This is not the same as saying how deep or how long the bear market will be.

For a deep bear market to arise, you likely need a recession.

This happens when consumers worry and stop buying, which makes producers worry about selling what they have already made, so they stop making any more.

Once producers start laying people off, consumers get more worried.

Around that doom loop we go until somebody on Wall Street notices that the world has changed and stops upgrading stocks that are already going down in price.

Later, much later, the newspaper will notice what has already happened.

The USA is not visibly in a recession right now, but it may be.

We just don’t know yet, but we should know by about the middle of May. There are always data releases flying around, but 15-May-25, will be a bumper day.

Notice that this happens in the evening of Thursday 15-May-25, which is after the market open in Australia on Friday 16-May-25.

That means Australia gets to trade this information before the USA.

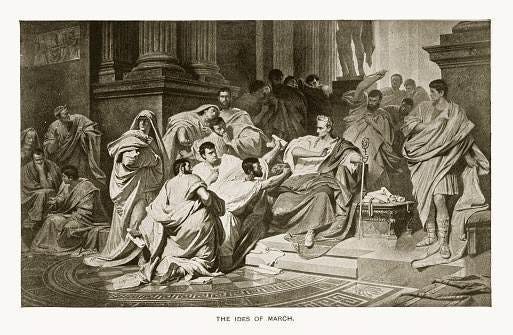

These data releases are so important that I am calling this the Ides of May.

It could be that the coming Ides of May is when President Donald J. Trump gets stabbed by Retail Sales, the Philly Fed Report, and Industrial Production.

We do not know right now but, applying communication theory, we know when the signal arrives, and, applying probable inference to the pattern of the data, we will know whether to buy or sell or the market after the fact.

Algorithmic trading engines do this in real time for short-run profits.

The fund managers who cannot hit “buy” or “sell” in under 10 microseconds will lay some bets in the days prior, likely around the Federal Reserve interest rate decision, which happens 8-May-25, and adjust course as they sit fit.

Algorithmic trading matters in the short term, but you cannot and do not take large positions when doing that. The so-called real money moves the whole market.

With all of this out of the way on to gold and the real money.

This is central banks.

What are central banks doing with gold?

The Trump agenda is focused on improving government finances, lowering taxes, and reshoring manufacturing. He aims to raise new revenues via tariffs and deploying the threat of tariffs to coerce foreign governments.

On the evidence to date, the Trump Administration appears convinced that this is a good idea, although the rest of the world is less sure about the merit of it.

China is under 145% tariffs for imports to the USA.

The USA is under reciprocal 125% tariffs for imports to China.

Practically, it does not matter who started this trade war.

Effectively each nation has put the other under an economic blockade.

This is a lot like war, except it looks civilized, until the economy buckles.

Central banks manage the national finances through acting as the banker to their own national government, setting domestic interest rates, and smoothing over imbalances that naturally arise from the buying and selling of national currency.

You cannot buy one currency without selling another.

Since all currencies, with the exception of gold and Bitcoin, are owned by some nation, you will likely need to talk to other central banks to smooth imbalances.

There is an old principle of International Law which allows that one nation may choose to use a currency that belongs to another as their own currency. This can happen, as often happens with Argentina going back and forth between USD and the peso.

It can also happen by joint decision, as happens with a currency union.

Alternatively, there may be de-facto equivalence through a currency peg.

The European Union (EU) is a currency union, and Switzerland has maintained a peg between EUR, the Euro, and CHF, the Swiss Franc, when it felt like it. Over in Hong Kong there is a peg between USD, the US dollar, and HKD, the Hong Kong dollar.

Stranger still, the Chinese Yuan, CNY, which is also known as the Renminbi, RMB, is convertible via a cross-border arrangement with Hong Kong, and HKD and USD.

You have probably heard of the Bretton Woods System, which involved adjustable exchange rates between the USD and other fiat currencies, but having an anchor through a fixed price of gold when measured in US dollars.

In response to US gold leaving the country, as foreigners sought to exchange their US dollars for gold, President Richard Nixon made Executive Order 11615, Providing for the Stabilization of Prices, Rents, Wages, and Salaries, on August 15, 1971.

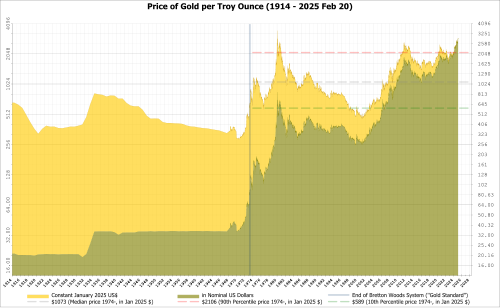

This period was associated with a huge gold bull market.

In nominal, pre-inflation, terms the gold price ran from US $35/Oz to a peak of over US $800/Oz. Today, as I write this on 26-Apr-25, it is fetching US $3300/Oz.

Evidently, something is going on right now, and it is not making gold go down.

Politicians in the USA claim that other nations have currency that is too weak, and that the right solution is to coerce them into making US Dollars cheaper.

Gold thinks otherwise and the US Dollar is getting cheaper all the time.

Indeed, all currencies are getting cheaper in terms of gold, and Bitcoin.

What should a central bank do about gold?

If you thought that it had no value, you would sell it.

This is what the Bank of England (BoE) did around September 1999.

They sold all of their gold around then and managed to do so at the low. The gold price was then about US $250 and has been rising ever since the BoE sold.

Whatever you do in the gold market do not copy the Bank of England.

For those who like repartee, here is an old exchange between friends:

Englishman: Did you see France lose in the Rugby World Cup vs. England?

Australian: Yup. The French do failed governments. They are on their fifth Republic.

Englishman: Beams and chortles. The French are such losers.

Australian: Yup. The English do failed banks. They are on the third Bank of England.

Englishman: Growls. Your shout.

Colonials. Cannot live with them. Cannot live without them.

Central Banks followed the Bank of England lead until the Global Financial Crisis (GFC).

For those who do not remember, the GFC involved a bunch of American banks which failed due to dodgy real estate bets, which caused English banks to fail more.

The problem is that US dollars became very scarce outside of the USA and the US Federal Reserve had to put in place special swap lines to other central banks.

This made it very clear how much the Rest of the World depending on the kindness of the US Federal Reserve to make dollars available when others needed them.

This was one signal that led foreign central banks to start buying gold again.

If you add up the year-to-year net buying you get the change from the starting point in the aggregate stock of gold held by central banks. It is going up.

The factor we need to consider now is this man.

Here is an essay question to answer to conclude our gold bull case.

In the present climate of geopolitical tension, and the trade war between the USA and China discuss the attractiveness of gold as a store of value to different central banks. Look at both sides of the story, and consider what might happen if the US Federal Reserve were to refuse dollar swap lines to foreign trading partners.

It is a trick question, to which you already know the answer.

Buy Gold

If you like excitement, buy Bitcoin, but we prefer gold.

Gold is the currency of no man and of every man.

As President Donald J. Trump has been known to say:

It is the kind of wisdom that appeals to this brain-scarred worm

I will do gold stock picks next week.

Then I have a couple of weeks off. They have to go pull the thing out that made my brain scars happen last year. Nothing terrible, but a necessary bodily simplification.

I go in. I go to sleep. I wake up. I am cured :-)

Take care and happy investing.