The Precious Metals Bull Market

Some investment calls look easy, but you need patience to execute well on them.

This is turning into a war materials bull market.

There is much excited chatter about war, so much that you could be forgiven for thinking that the public actually want it. Some clearly do, perhaps more will.

Anybody who ever knew somebody who lived and suffered through a long war will likely think otherwise. Too much death and destruction make Jack and Jill corpses.

Enough pith. War is again on the agenda, and now between Israel and Iran.

Some might contend that they have always been at war.

The key question now is whether the USA visibly joins this conflict.

The headlines of war in the Middle East keep on coming.

This is a “just war” because Weapons of Mass Destruction (WMD) are involved.

We know that the United Nations is an unreliable source, but here goes anyway…

Seen this movie before.

On this occasion, so far, Australia has stayed out of this conflict.

We have intelligence services too, and they probably clocked this story in March 2025.

The USA pre-positioned B-2 stealth bombers at Diego Garcia in the Indian Ocean for any “eventuality” that may, or may not, involve the Houthi, or Iran, or Joe Blogs.

US Defense Secretary Pete Hegseth is on the record as saying that the Pentagon has plans for “any contingency”. Of course they do. They are in the business of war.

This time it looks like it will not involve either Greenland or Panama.

You can read some commentary from RAND experts to try and make sense of the reasons why this simmering Iran-Israel conflict just escalated into outright war.

This is the main takeaway for me:

Cohen The attack could remake the chessboard of the Middle East. If Israel is successful at neutralizing Iran's nuclear program and if that in turn destabilizes the Iranian regime, it could shift the balance of power in the region. But as the United States has learned, regime change in the Middle East is a particularly fraught business, so there is no guarantee of a positive outcome.

This is sobering coming from the former U.S. home of gung-ho regime changers.

If, and if, and if…

This time around the “official” line is that Iran must be stopped because the IAEA estimated that it had increased “near-bomb-grade” uranium to 267.5kg.

That is a significant increase, according to the cadence of such estimates.

However, this is not the same as a working nuclear weapon.

Israel has, by estimates from the Arms Control Association, around 90 nuclear warheads. This is more than North Korea at 50, and less than Pakistan at 170.

Of course, to those who started this war, the zero nuclear weapons that Iran has count for less than the possibility of it having some, someday, maybe.

The idea is that conventional military campaigns will deter Iran from possibly gaining a single nuclear weapon and remaining undeterred by the 90 Israel already has.

The idea of deterrence is to possess weapons and trained personnel in sufficient number to discourage an attack by an adversary.

Apparently, the possession of 90 nuclear warheads is insufficient to prevent a nuclear attack by Iran, a nation that has zero nuclear weapons, on all credible estimates.

Unlike Iraq, this is a war about the possibility of WMD, maybe, one day.

There is no need for the USA to tell lies in a UN presentation anymore.

Just go to war!

Preemptive Acts of War to prevent proliferation will certainly encourage it.

Any nation in the Middle East that does not already have nuclear weapons will be thinking hard about how to acquire them to deter any attack from Israel.

The circular logic of contemporary war-making is now complete.

This is a logic made possible by the time we live in.

That means you should buy precious metals.

Nobody is thinking very hard, which makes this world a very unsafe place.

Buy gold, silver, platinum and palladium.

The problem is an Empire in decline

Empires can take a long time to decline and cause a lot of trouble on the way out and into long-term decline. Ray Dalio did a good job covering the geopolitical dynamics.

You can read a more complete account in his book by the same name.

Dalio is a good enough analyst to step back from calling the outcome from a situation that is this complex, this fluid, and likely long lived. This is wise, in my opinion.

I am a good enough analyst to know that what counts is the principle at work.

The animating principle of present geopolitics is the visible collapse of trust. This can be trust of different kinds, interpersonal, institutional and international.

The official motto of the United States of America makes this point clear.

One nation, before God, may trust God, but that does not mean that other nations will trust their currency. With a White House that pivots daily, global trust is evaporating.

This is a principle so profound, and yet so simple, that few investors acknowledge it. When your nation loses all trust, the coin is dead.

There is a temptation to point to the lagging indicator of foreign reserve ratios, and the wide usage of the US dollar. This will supposedly negate the evident trend.

There is nothing that will restore trust in the USA but trustworthy behavior.

The evidence of failing trust in the USA is ubiquitous.

This is obvious, and I will not belabor the point.

If you cannot see it, be happy.

Gold and De-Dollarization

On this planet, those who actively look for conflict are guaranteed to find it.

Those who are trying to avoid the downside of this popular activity will hedge.

While the outbreak of a very dangerous war is the proximate cause of this note, the investment theme is one that I have written about before.

Let me reprise the reasoning.

I wrote first on Gold and the BRICS, back in October 2024.

This was well into the present bull trend which started in the beginning of 2024. The first piece I did on this appeared in TheMarketOnline back in January of 2024.

In that piece, which you can read here, I wrote about the wider thematic of a Global Power and Energy Transition. This contest exists between nations at the nexus of three axes of geopolitics: industrial power, financial power, and military power.

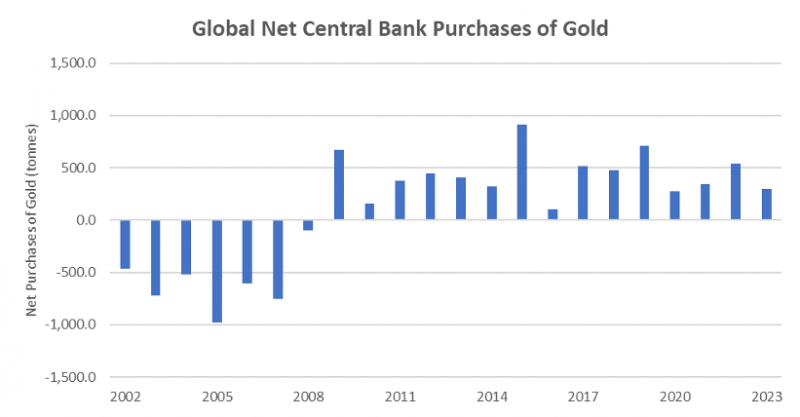

The telltale chart from that earlier piece was this record of central bank gold buying.

This is happening against the backdrop of US weaponization of the financial system to exert control and influence on foreign governments. The reaction first happened after the Global Financial Crisis (GFC) in 2008, when non-US central banks experienced a dollar shortage created by the US credit squeeze. This made them cautious.

Since then, the collection of nations known as the BRICs and the wider developing world of nations has continued to grow their share of the global economy.

While there is no question that the Developed Markets of this world remain the richest and most prosperous in the world, our share is shrinking.

This is not because we have less but because others have more than they had.

Not every rising tide will lift all boats at the same rate. It depends where your boat is sitting in relation to that tide. Where the water was once shallow it rises fastest.

(No, the ocean is not flat any more than the Earth is flat.)

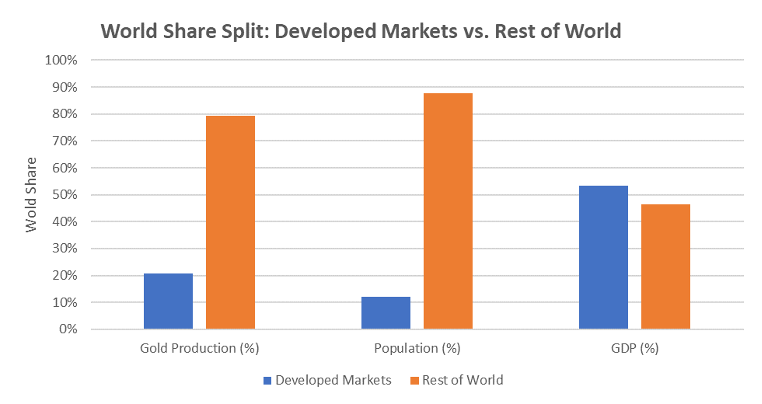

The Rest of the World has more people and produces more gold.

However, gold mining is a highly mechanized business, so rich world gold producers like Australia, the USA, and Canada produce more per capita than elsewhere.

The global GDP of gold production is dominated by emerging markets.

You might suggest that they do not matter, because they are not as rich, but these economies are growing faster, and they will ultimately dominate global GDP.

The US solution to this “problem” is to disrupt global trade and finance.

The chosen tool is US dominance of the global financial system.

Provided that the US dollar remains king, and you control it, you rule the world!

The logic of this exercise is now so clear that only a fool would doubt the intent.

If you lead an emerging markets central bank, the math is clear. Gold can be mined among your economic peers in greater quantity than those who would hobble you. The USA would like to make you hostage to the dollars that it prints.

This is simply the way things are.

Those in the USA who favor a “hard currency” that is in limited supply would like you to buy cryptocurrency while controlling the supply of chips used to manufacture it. This is a good strategy for them, but bad if you have limited access to chips.

The chart above showed that the non-Developed markets produce the most gold.

Specifically, China and the Russian Federation, nations that are under active financial sanctions, semiconductor sanctions, or both, produce the most gold.

Strategically, it makes sense to hoard gold as a substitute for US financial assets. This lesson was brought home to Russia when it had both confiscated.

Once international trust is gone, an old law of the jungle reasserts itself.

He who has the gold makes the rules!

Notably, the USA is in a great position if gold resumed its previous dominance.

Australia is the number three producer and bought for a few submarines!

Canada is the number four producer and easily annexed!

Do that and you are number two at 644 tpa gold production to 710 tpa with the combination of Russia and China. Invade Mexico and you are #1 at 784 tpa.

Some may call this cynicism.

Others who share this outlook may get a job in the US State Department!

In gold the worldly wise will trust

You do not need to be a conspiracy theorist to see why gold is bought.

The non-US world lacks faith and trust in US institutions and intentions.

That means the dollar is in a slow and gradual decline.

It remains valuable, and useful, and those who hold dollars, which is everybody, even Russians with lumpy mattresses, do not want it to die quickly.

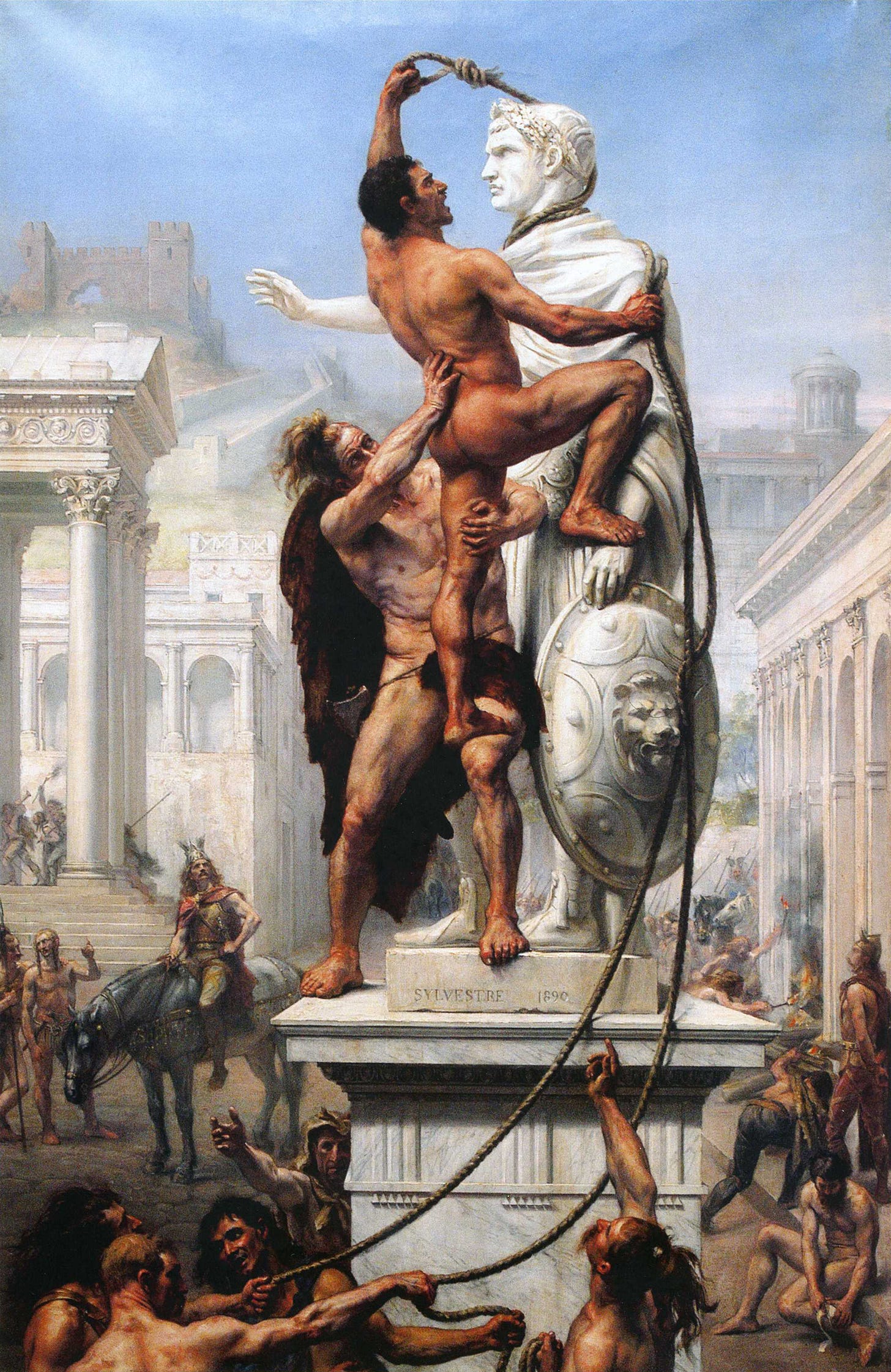

The Western Roman Empire is commonly considered to have ended in 476AD with the deposition of the last Western Roman Emperor, Romulus Augustulus, by the Germanic warlord Odoacer. However, a pivotal event was the Sack of Rome in 410AD.

Annoying the Visigoth barbarian army that once fought for Rome, accelerated it. They turned up one day and sacked the joint, carting off anything of value that was left.

Robust Empires fall slowly.

However, three things will accelerate your decline:

Cutting the coin through inflation which beggars the poor.

Betraying the trust of your allies so that they cease to support you.

Honoring your faith in the Empire through fruitless war that empties the Treasury.

The USA is now stepping up for the full trifecta of key conditions for imperial decline.

I do not need to put in another stock chart, discuss the dollar, or the bond market.

You know what to do to hedge imperial foolishness.

Buy precious metals starting with gold.

Australia is a great nation and the willing fool of no foreign power.

We have gold and more where that came from.

We make our own rules.