Commodity Outlook 2026

The continued geopolitical chaos combined with excess liquidity is likely to drive a group of metals higher in 2026. We like precious metals, copper, antimony and aerospace metals.

The winner of monster year for metals markets was Silver.

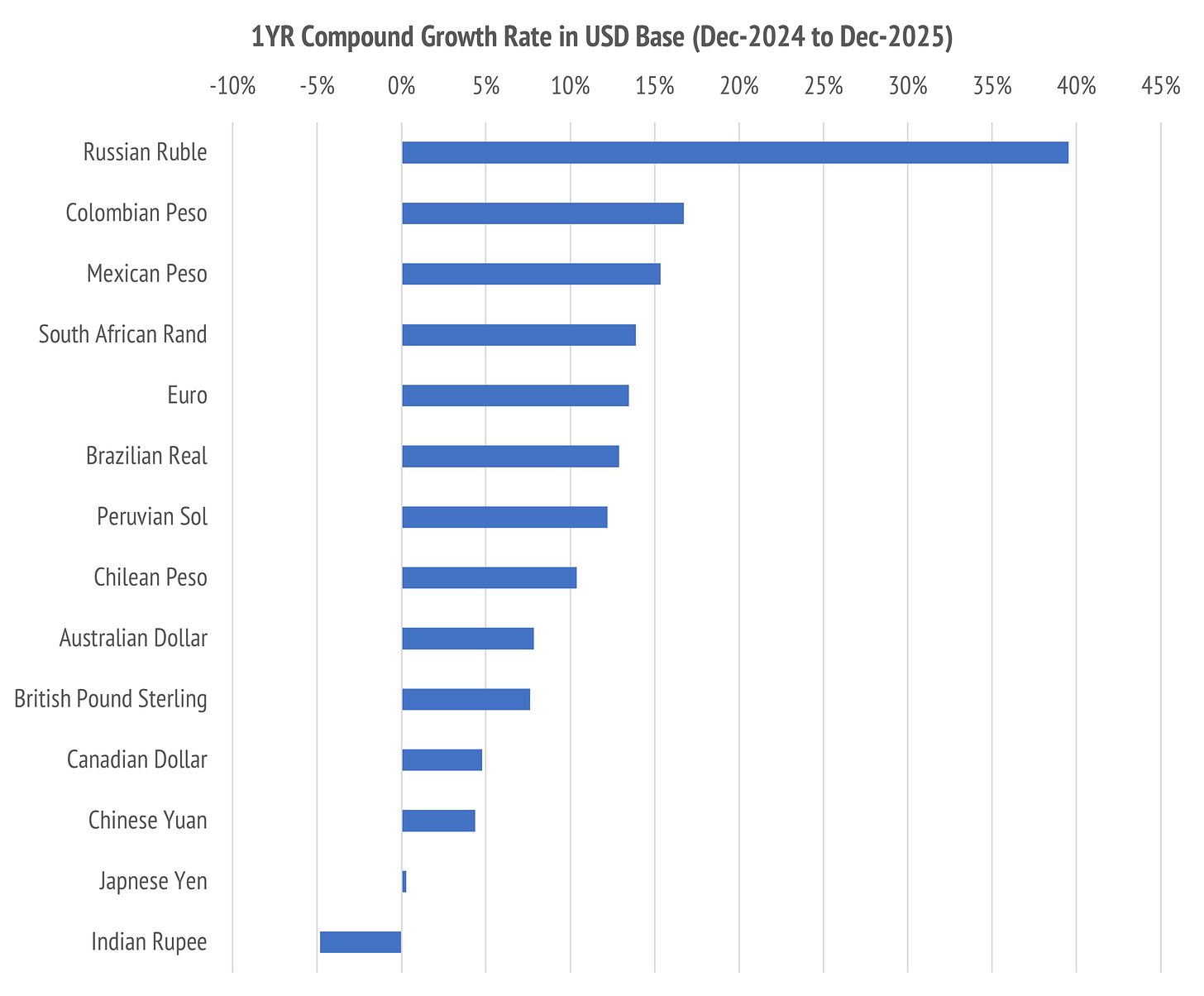

Let us kick off this survey and outlook with a glance at some currencies.

In my world, to screen out Wall Street noise and focus on what is real, I monitor what is happening in the currency market. First, there are the majors:

US Dollar USD

Euro EUR

Japanese Yen JPY

British Pound Sterling GPB

Following that, we have the developed market commodity currencies:

Australian Dollar AUD

Canadian Dollar CAD

Then we have the copper, gold and silver belt currencies:

Colombian Peso

Mexican Peso

Brazilian Real

Peruvian Sol

Chilean Peso

Next, we have the gold, platinum and palladium currencies:

Russian Ruble RUB

South African Rand ZAR

Finally, and to round it all out, we have the populous commodity consumers:

Chinese Yuan CNY

Indian Rupee INR

Notice how I group these currencies in relation to finance versus commodity trade.

It is true that London and New York are still major centers of trading and have a lot of analysts focused on commodities. I pay zero attention to any and all of them.

That is because it is only China and India that matter to the future of commodities.

China and India are the demand side of the commodities equation.

The USA is a big economy and is extremely noisy about it.

The USA does not matter for most commodities outside of oil and gas.

Following the action to annex Venezuela they are now bigger in oil.

How did our currencies do in 2025?

Notice that the copper belt nations did well. The two major iron ore producers also held their own, but Brazil did a lot better than Australia. There is plenty of copper lurking in Canada, but nobody builds any mines there nowadays.

Russia was top of the pops.

It is the second biggest gold producer after China, ahead of number three Australia.

The commodity consumer nations, the USA, China and India did less well.

The one exception to this rule was Europe due to fund inflows.

Notice how the above story is different from that told by Wall Street.

The reason is simple.

There is no investment banking fee to be made by telling this story.

Wall Street specializes in remunerative stories.

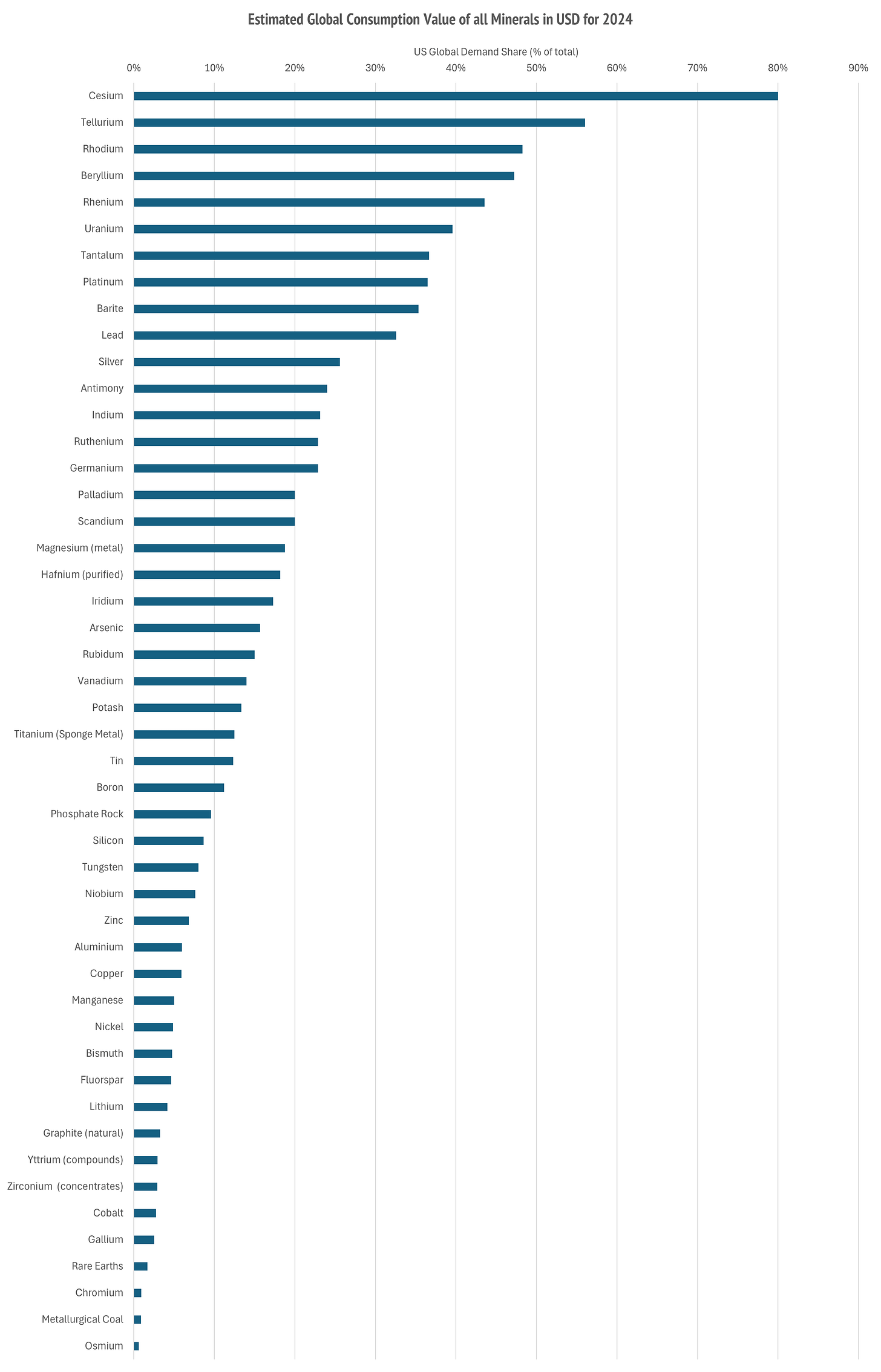

The US Metals Opportunity

As I explained in The Global Metals Economy, the USA is typically 5% to 10% of global demand proposition for most major metals. India will pass that soon, and China is a 50% of global demand proposition. Europe matters, at around 15% of demand, but the leadership seems intent on shrinking the place, so it will matter less in future.

This does not mean the USA does not matter at all.

It is huge if you are into a tiny market like Cesium. Tellurium matters for solar cells, but only if you are a US manufacturer of the obsolete TeCdS cells, like First Solar.

Rhodium is great, but your best place to find that is South Africa or Russia.

Beryllium is good and stock picking is easy.

I will explain later.

Rhenium takes effort, you need to go to Chile or Poland.

Uranium is a good one. Go to Canada.

Tantalum is found with pegmatites, look at Lithium prospects.

Platinum, like Rhodium and Palladium is a South African, Russian or Montana story.

Barite is often found in salt deposits, which the USA has many of.

Lead is great if you shoot a lot or drive an F-100 truck. It is an all-American metal. If you need a lot of it go find a smelter in Mexico. I will sell you one below.

Silver is our favorite Spine-of-the-Americas metal.

Only Wall Street is dumb enough not to know America is made of silver.

Antimony is the wild horse, which we have learned to like a lot.

Indium is what Intel needed when they used to make chips well.

Ruthenium is not a disease common in small children.

Germanium sounds super important, but China keeps the price low if you can get it.

Palladium is our value precious metal, which we like a lot.

Scandium is used to sell worthless mineral claims in a nothing global market.

Magnesium is a super important metal, but I do not want to own any.

Hafnium is cool if you are into nuclear reactors. I like it. I want a paperweight.

Iridium is best treated by a good colorectal surgeon. Check their insurance cover.

Arsenic is useful if you have rich relatives who won’t leave when asked to.

Rubidium is found in volcanoes. Pack an asbestos suit.

Vanadium is a decent market and a seriously useful metal. I can be serious now.

Potash is best applied to high-value cash crops. BHP Group likes it.

Titanium is the one truly useful strategic metal for defense applications.

Tin does not get much respect, but it should. Very important for electronics.

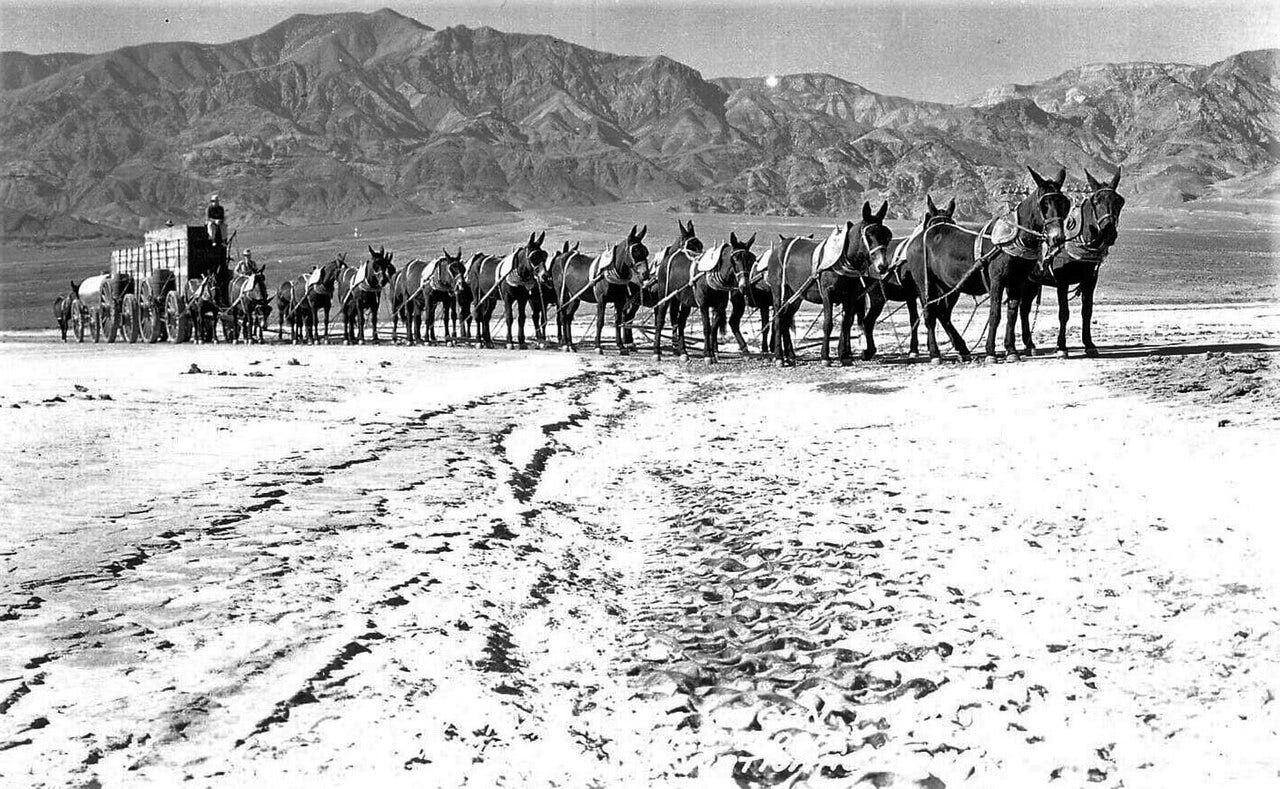

Boron is actually pretty useful and a fascinating piece of Death Valley history.

Phosphate Rock is what Morocco is made of.

Silicon is in common sand and increases hugely in value for pure forms.

Tungsten is mainly used for machine tools but is good for busting Panzer tanks.

Niobium is controlled by one mine in Brazil and great for high strength low alloy steel.

Zinc is great to sell to Australians at the beach or to put on your roof or water tank.

Aluminum is the source of much angst for foreign contestants in spelling bees.

Copper is a welcome addition to this list and the most important metal to the USA.

Manganese is used in steel making. It is in places folks have not heard of.

Nickel is tremendously important, but Indonesia cornered the market.

Bismuth is for green shooters who do not pepper ducks with lead. Unamerican.

Fluorspar matters as a flux, but nobody knows what that means anymore.

Lithium is my absolute top pick for increased US production opportunity.

Graphite used to be interesting until Chinese synthetic graphite got too good.

Yttrium is used in F-35s so knock yourself out. There is plenty of it.

Zirconium is what holds civilization together. It is used in toilet bowls.

Cobalt is a source of crises every forty years. We are due one now.

Gallium is a metal that takes effort to make from Red Mud. China worked at it.

Rare Earths are good for headlines in the USA. Otherwise, they disappear in the data.

Chromium is next to last which is a crime for fans of the 1959 Cadillac Eldorado Biarritz Convertible. Tell Lady Penelope that the Pink Roller is so passé.

Metallurgical Coal just got added to the 2025 Critical Minerals List. Um, why?

Osmium does not matter at all, but I went out of my way to put it in there.

You will gather from my (occasional) flippancy, that I mostly do not care about any of the metals that the USA regards as Critical Minerals, and especially not the USA.

This is not out of rudeness, but cold hard mathematics.

The majority of metals with major global markets, such as Rare Earths, are not really large global share markets for anybody selling to the USA. If you were in the USA hoping to import replace those metals good luck as domestic demand is small.

China won market share globally because that is where the demand is.

India is the new demand center and the place I would go to sell metals.

However, the USA is highly prospective for some metals.

It is great for copper, gold and silver.

It is brilliant for industrial salts like borax.

It has huge potential in lithium and that will grow.

It has some potential in palladium and proven deposits in beryllium.

It could do a lot more in mineral sands, which opens the door to rare earth monazite, zirconium concentrate, and titanium concentrate.

The USA has excellent academic geoscience, and a solid precious metals mining industry but it has obstructive planning processes, irascible politicians and folks opining about going to Ukraine to mine rare earths, where there are none.

We think it is important to have the USA on your research list but would happily put money into a Canadian uranium mine, or Mexican gold and silver project.

The world is a big place.

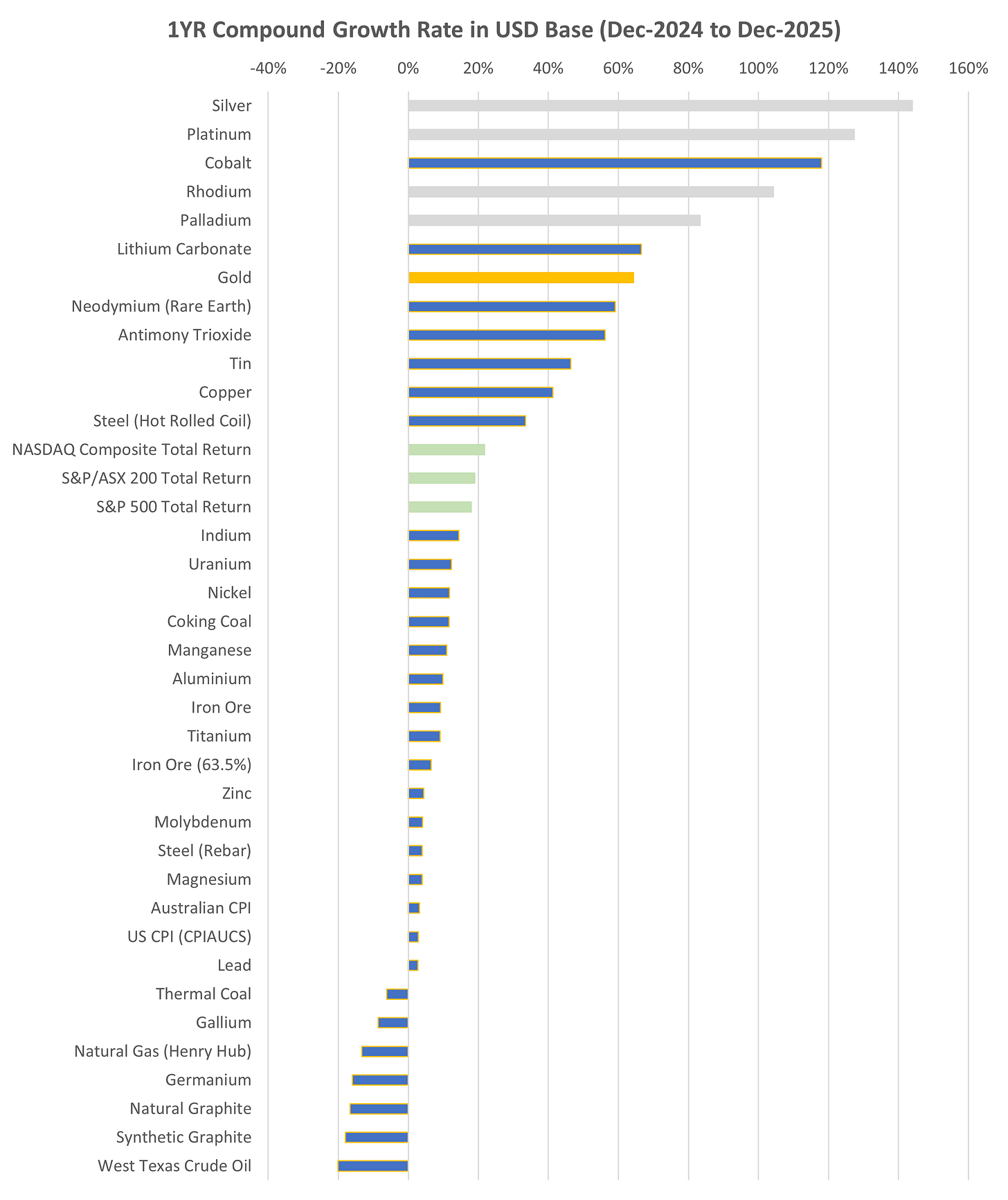

Commodity Price Action

Let us now look at metal prices in the year just passed.

Gold is colored gold, while the ones in grey are the other precious metals.

They are all running hard because liquidity is strong and the USA prints money fast.

Note that the Russian Ruble is doing great, and we think this has nothing to do with the war in progress. Russia is made of oil, gold, platinum and palladium.

Cobalt is on fire and so you may want to look again at miners with cobalt.

Lithium is back on track so that is a happy hunting ground.

Rare Earth prices are good, but the worry is whether your target company was dumb enough to not sell to China. If they only want to sell outside China, avoid them.

Antimony is the quiet achiever and there are good exposures among antimony rich gold mining prospects. There are also operations in the USA. One word of warning, way back in WWII, when the US lost supplies of imported antimony, the entire US military demand was soon served by one single mine operation in Idaho.

Uranium has been volatile, but we think the Canadian prospects are good.

Copper is the one must have investment aside from precious metals.

Strock picks are below.