The Global Metals Economy

There is a clear commodity bull market in play, and it has broadened since our early calls on gold, to include the entire precious metals complex, along with copper.

Looking ahead to the coming year, it is clear that we have a major commodity bull market in play, and that the price action is becoming more frenetic.

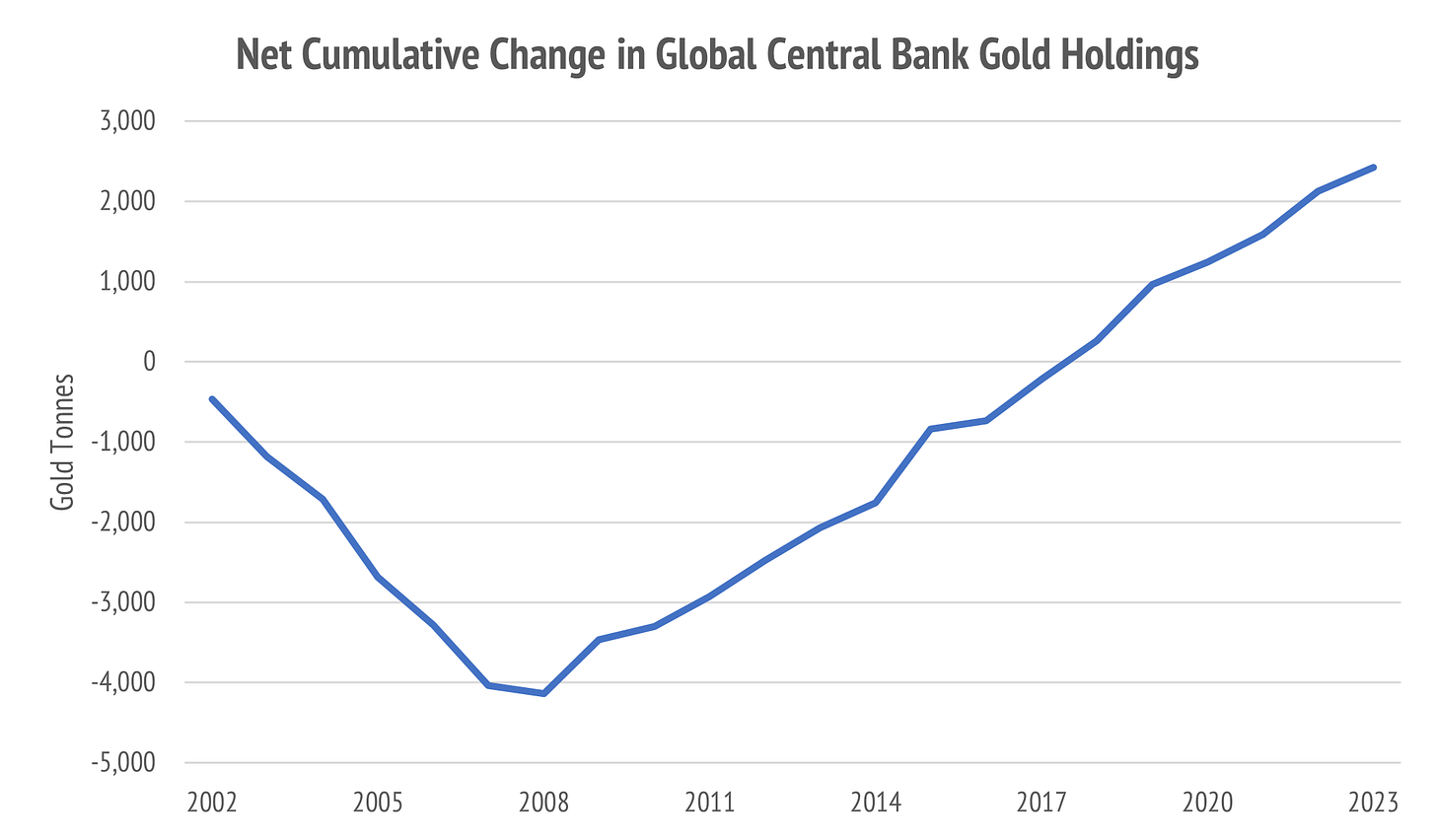

One reason for this has been touched on before, namely central bank buying.

In June, we posted on The Precious Metals Bull Market and mentioned the strategic background to the trend of dedollarization and the strategic competition between the United States of America and China. No matter your take on geopolitics, this is starting to have a real effect on the global metals market.

Artificial Intelligence may have hogged the headlines, and we do think that the trend if both important and persistent, see our note Practical Superintelligence. However, the extreme focus on strategic competition versus cooperation, means that the global markets are likely to face increasingly turbulent conditions.

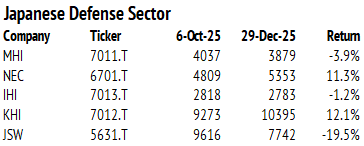

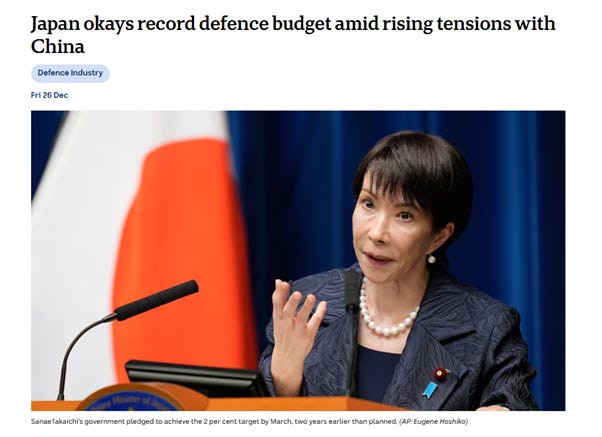

In October, we wrote Special Situation: Japanese Defense Stocks, calling attention to the hawkish tone of the new Japanese Prime Minister, Sanae Takaichi, and how that would likely see Japanese defense spending rise, and a deterioration of relations.

Since that time, the Japanese defense stocks we mentioned have barely moved.

This is in spite of a year-long bull market for all of them.

The expected news arrived on the day after Christmas:

The ABC reported: Japan okays record defence budget amid rising tensions with China, and flagged a “"record defence budget plan exceeding 9 trillion yen ($85.9 billion) for the coming year”. That is a 9.4% increase over last year.

Thus far the market is sanguine, but we think that is a mistake.

You can always say: “buy the rumour and sell the news.”

However, this rumour is not likely to be a passing phase, as you can well judge by the torrent of invective emanating from China. The historic 1972 normalisation of diplomatic relations between Japan and China is under strain.

I do not think that this global trend towards remilitarisation will end anytime soon.

You will find me vehemently opposed to any form of military adventurism.

I am very wary about where the global political classes seem to be intent on leading us and so I do allocate some of my portfolio to what I call conflict hedges.

That is why I allocate some portion of my holdings to the Western defense complex.

I must say, I am not elated by that prospect, and the best hedge would be to also buy those stocks which hedge disaster of the other kind. However, I am old enough and wise enough to notice that citizens of one nation do not get to choose a side.

When the politicians are in full chaos mode, they will choose your side for you.

For those who can read, the war planning is public.

Let us hope that it does not come to that as the result would be disastrous.

The Positive Hedge of Metals.

You will often hear me take issue with the notion that wars are good for metals.

This is because many years of commodity market study showed me peace was better.

Nonetheless, there is a popular perception that war is great for metals markets.

The folks who believe that are likely financiers like me.

The simple truth is that military demand for metals is quite small.

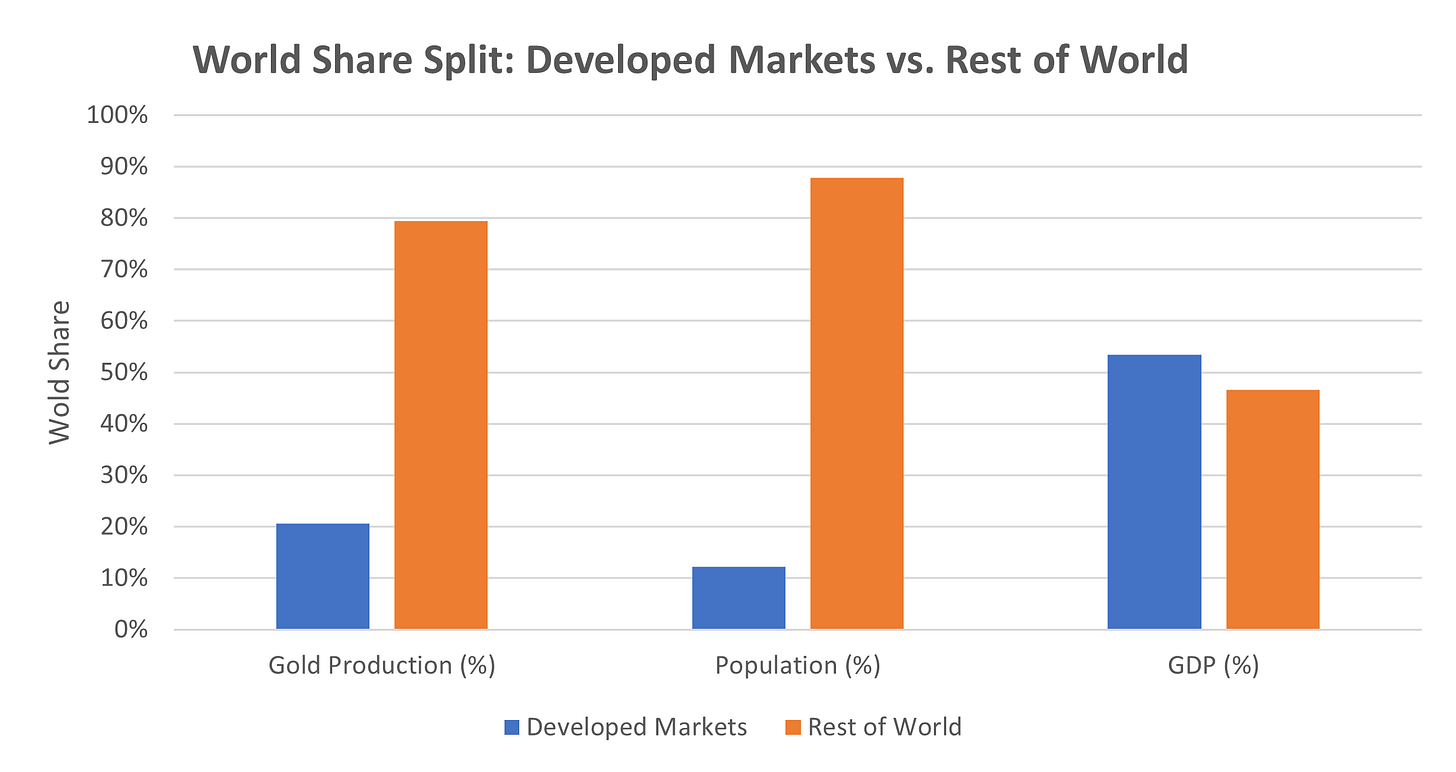

The real driver of metals demand today is the rise and rise of the Global South.

I wrote about this at length in Geopolitics and investment opportunity.

This is not a popular thing to discuss in the Western financial press.

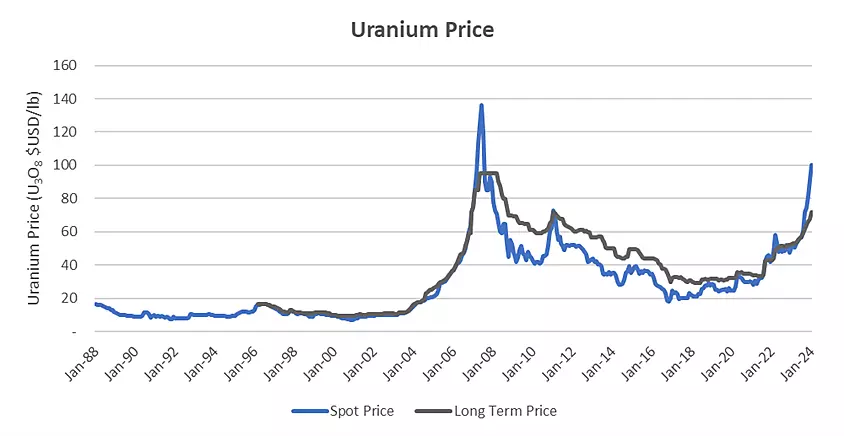

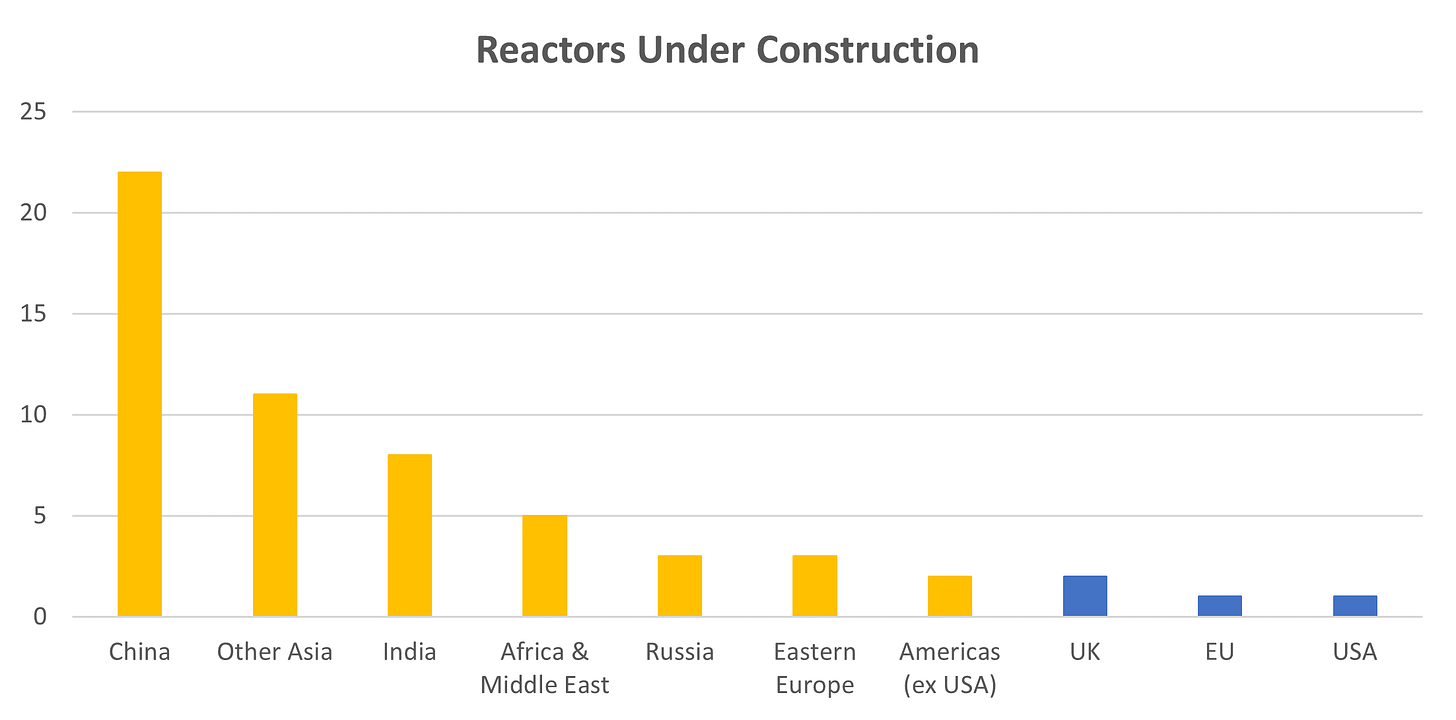

For instance, take the enthusiasm of investors for rising Uranium prices.

However, take a gander at where the new nuclear reactors are actually being built.

Do you notice that little squeamish feeling?

Here we have a press salivating over a uranium boom and entirely failing to notice who is actually driving the boom. I have this serious question to pose:

How do you expect to succeed with investment if you do not know the demand? Is this not more than a little clueless? What is going on?

I think you know my answer to that question.

This is dumb group think behaviour that benefits informed investors.

We can laugh at it, but the right thing to do is to mercilessly exploit it.

Global Minerals Product

This “ignore the demand side” behavior is a constant feature of our excessively financialised society. I have been a professional investor for thirty years.

Clueless investors ignoring the demand side is your opportunity.

This weird persistent ignorance is unlikely to go away any time soon.

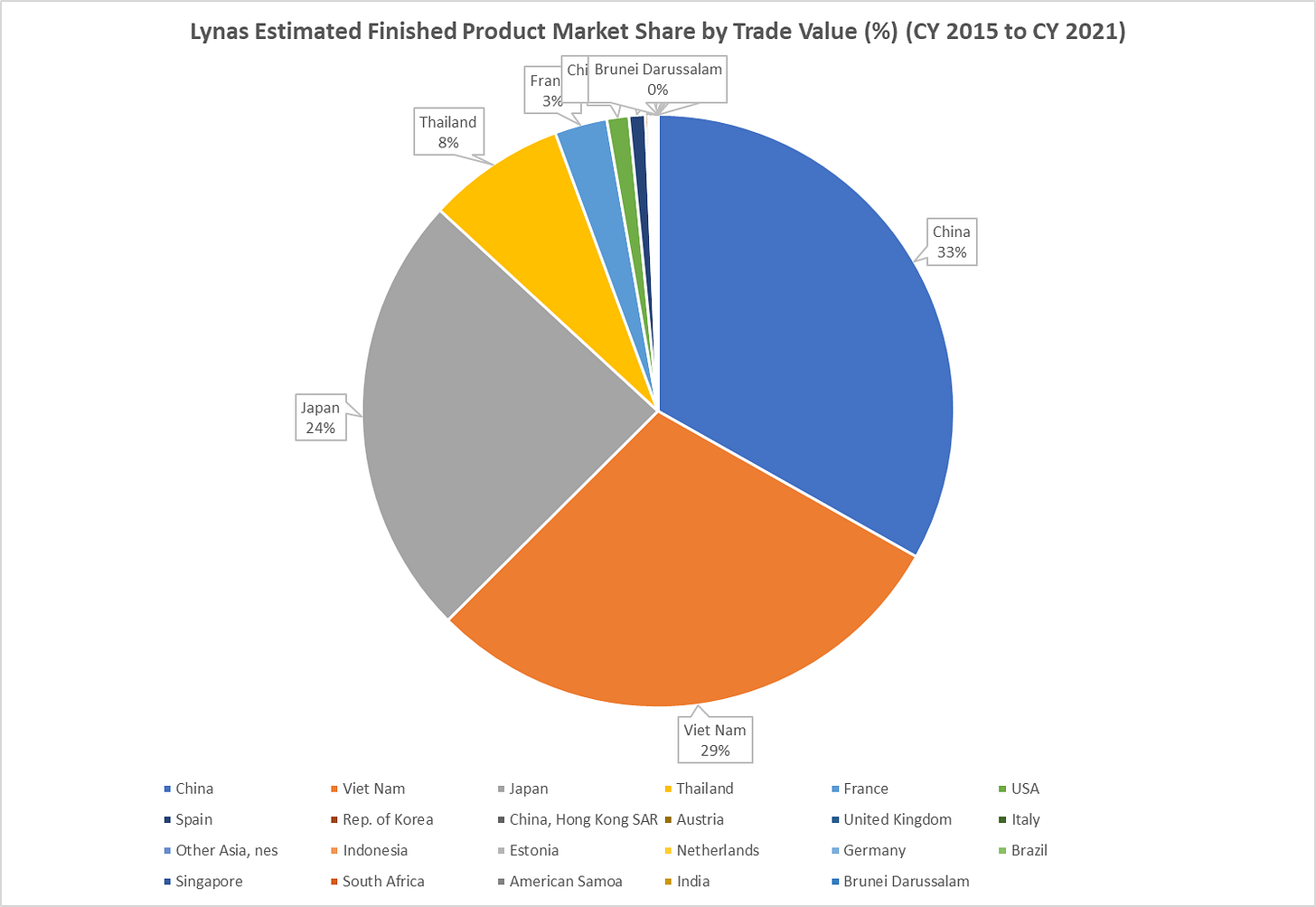

I demonstrated this publicly with my piece: Where do the separated rare earths produced by Lynas actually go?. In that research, I showed that the percentage of annual sales made by Lynas to a shipped destination in the USA was 1.5%.

The vast majority of trade, by value goes to China, Japan and Vietnam.

The reason for this strange disconnect can be found in this classic book.

There are folks, some who work in finance, who claim that our financial markets are efficient. You will find no quarrel from me with that assertion for this reason:

The purpose of Wall Street is to clip a ticket on trade in financial assets.

The money is made by those who properly understand this fact.

If I ran a managed fund, I would (and used to) clip a ticket on managing the money, diligently, or otherwise. You can certainly do this honestly with good intention.

However, the fact remains that you are paid to move the assets around.

This is just the facts of life in a financial market.

If there is a capital raising, to fund an emerging Australian rare earth production facility you can bet somebody will arrive to tell you the demand is high.

That is true, up to a point, demand for rare earths is high, in China.

That may not fit the sales pitch, so just don’t mention that.

This is how Wall Street actually works.

I write about this because I am a creature of the street.

I know how it works, so I know how to protect myself from it.

What I will share today is a method I developed more than ten years ago to insulate myself from Wall Street Fakebelieve stories to sell scrip in the metals market.

I am not against being sold shares in metals producers.

It is just that I make up my own mind about which metals interest me when.

Right now, I am interested in precious metals, copper and copper byproducts and a set of metals that do not make headlines in the aerospace metals market.

The purpose of this note is to (re)introduce the Gross Mineral Product (GMP).

This is simple, but tedious, to calculate.

It estimates the global demand side economy for metals.

You can think of it as the global revenue pool for new metals production.

Effectively, it is an estimate of the contestable revenue available.

You can think of it as the metals analogue of Gross Domestic Product.

There is no end to the public discussion of GDP.

It is in the financial press every day of the week.

If you follow markets closely you may be surprised to find that there is zero discussion of what I am about to show you. In spite of the relevance, and the conceptual clarity, this topic is simply not discussed in financial circles.

You may ask why?

Please do.

How not to solve a real problem?

One possible reason why people do not look at this is the delay. Metals prices are available every minute of any trading day. Surely, that is all you need?

In response, I point out that it takes years to open new factories and smelters, and even longer to develop new mines and production sources. The story that is told in the prices of today was many years in the making. What we are looking for is the message of the tides. Is it the ebb tide, or the flood tide. What is the trend?

This is particularly important now, at a time of intense strategic competition.

The local financial press is full of discussion of Critical Minerals in relation to the United States and their mission to reshore manufacturing. The USA is the largest economy on Earth, and so it seems intuitive to swallow this unquestioned.

However, the USA is predominantly a services economy.

It is manufacturing, especially the fabrication of components, that is the metals intensive part of the economy. The USA has a large manufacturing economy by absolute measures, but this is significantly smaller than that of China.

Furthermore, for quite sound reasons the US manufacturers have focused on their value-added share, which increases as you get closer to finished product.

When you account for these factors, as is essential to any investment case, you soon find that China is far and away the largest metals market for end use.

While the USA may amount to 28% of global GDP, it is usually 5-10% of the metals GMP of the global market, while China can be as much as 60% of that GMP.

The political classes like to use language that implies that China has cornered the global market in metals supply, and we are dependent on them.

This is only half true.

China has cornered the global market it in metals demand.

China buys metals and ores, produces refined metals, fabricates those into metal inputs for manufacturing, makes ships, cars, appliances, electrical machinery, you name it, from those metals, and exports finished value-added products to us.

You cannot short-circuit this system by building more mines.

This will not work, and not because people like me say that. It will not work, period, because it is not the actual problem. You are “solving” for the wrong problem.

Politicians have developed 100% proven methods for policy failure.

This is one of those methods, which is why you must watch out for it.

The Critical Minerals Economy (2024)

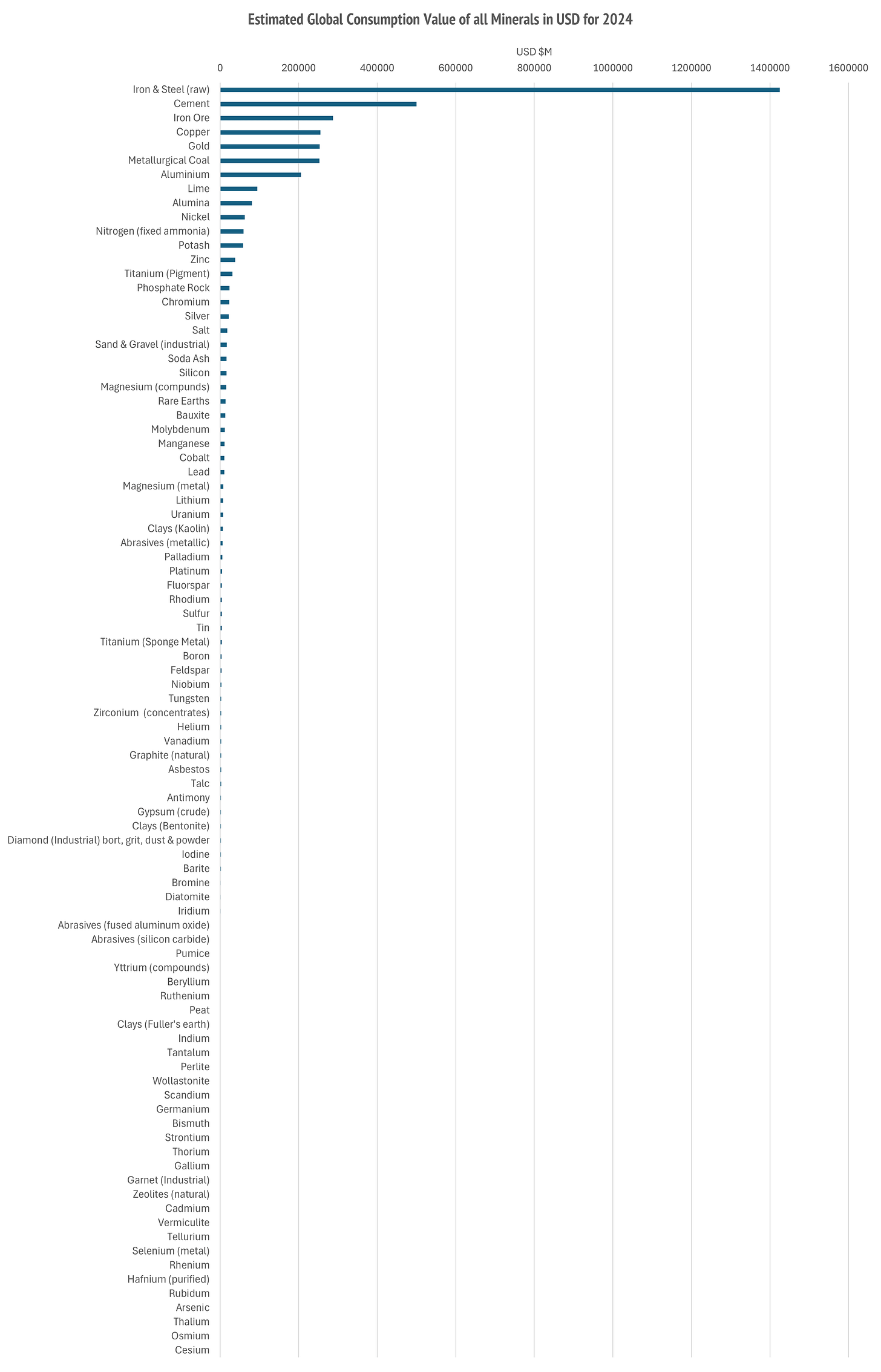

To illustrate these points, let us dimension the Global Critical Minerals Economy.

The figure below is from the US Geological Survey list of Critical Minerals for 2025.

This list of “vital” minerals just keeps expanding and now includes metallurgical coal.

For students of the Periodic Table, in chemistry, the USA is rapidly running out of minerals to call critical. Oxygen is not a mineral, or it would be on that list.

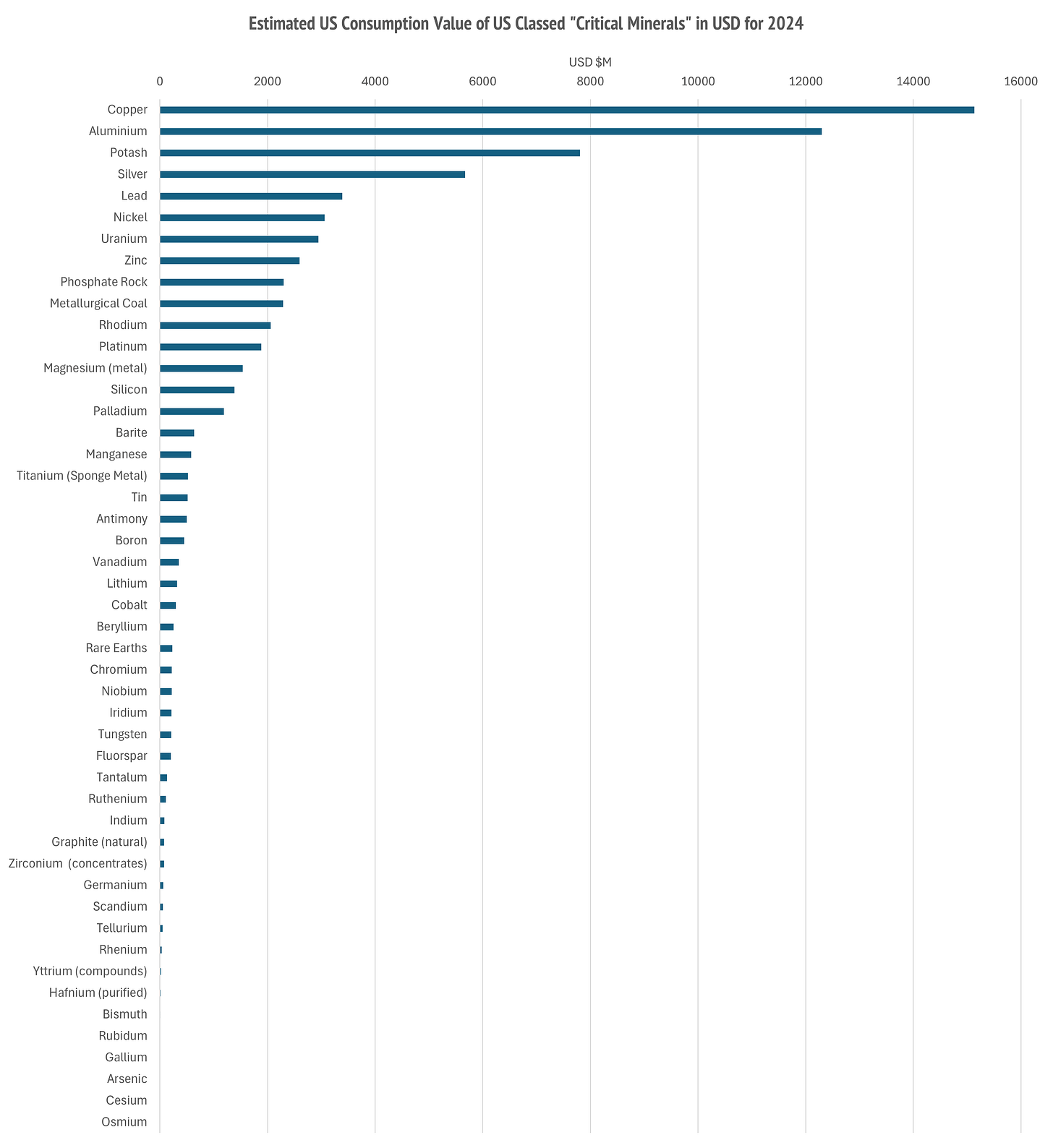

The important thing for all investors to understand is which critical minerals stand a chance of moving the dial for your investment opportunity. Which ones matter?

Copper is far and away the most valuable critical minerals market in the USA.

This is why I like it.

Americans want more critical minerals.

Okay with me, here is a copper project.

Similarly, with Silver in a raging bull market.

Okay with me, here is a silver project.

That is how I think, because I am an investor.

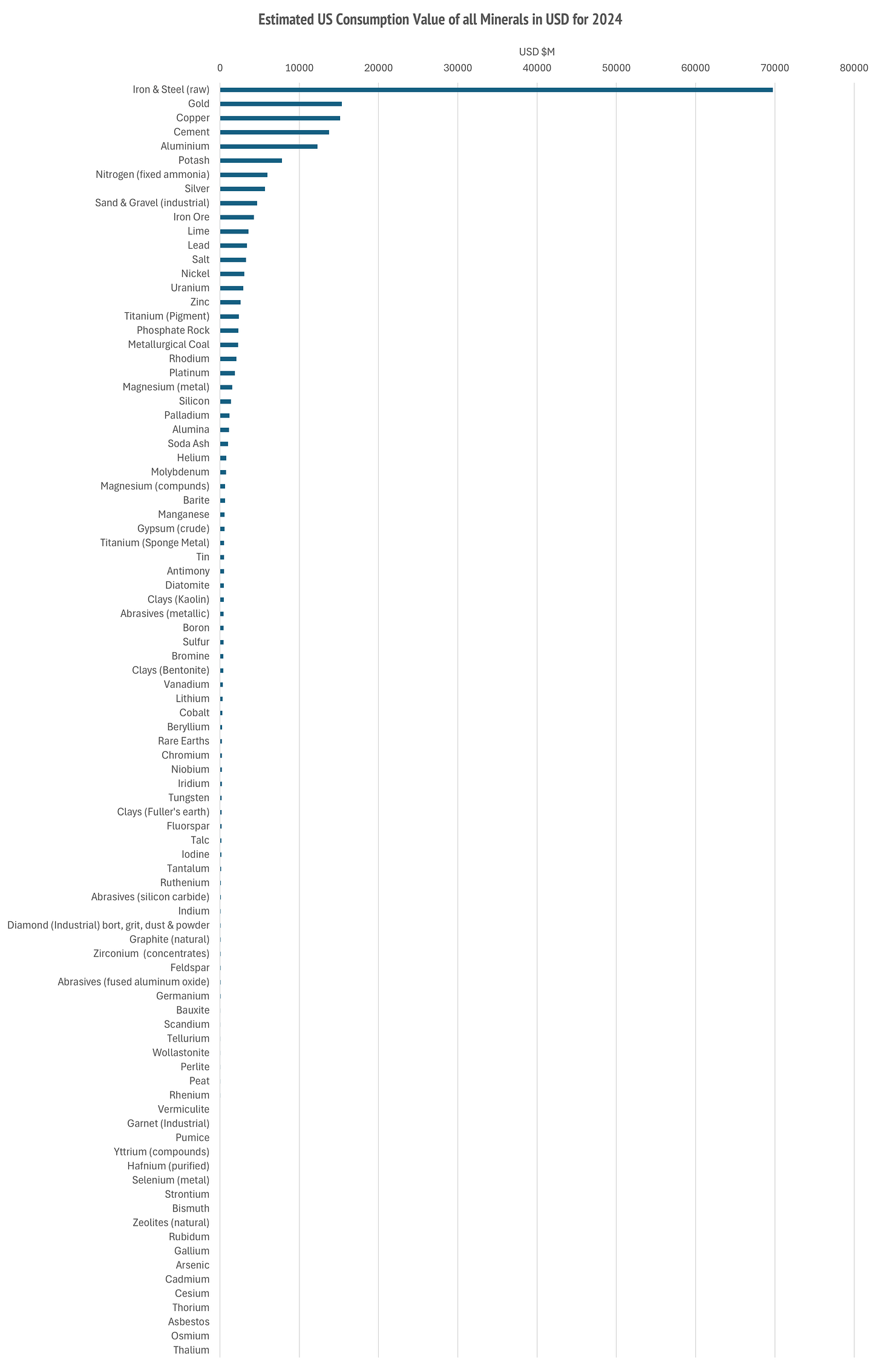

What about all mineral consumption in the USA?

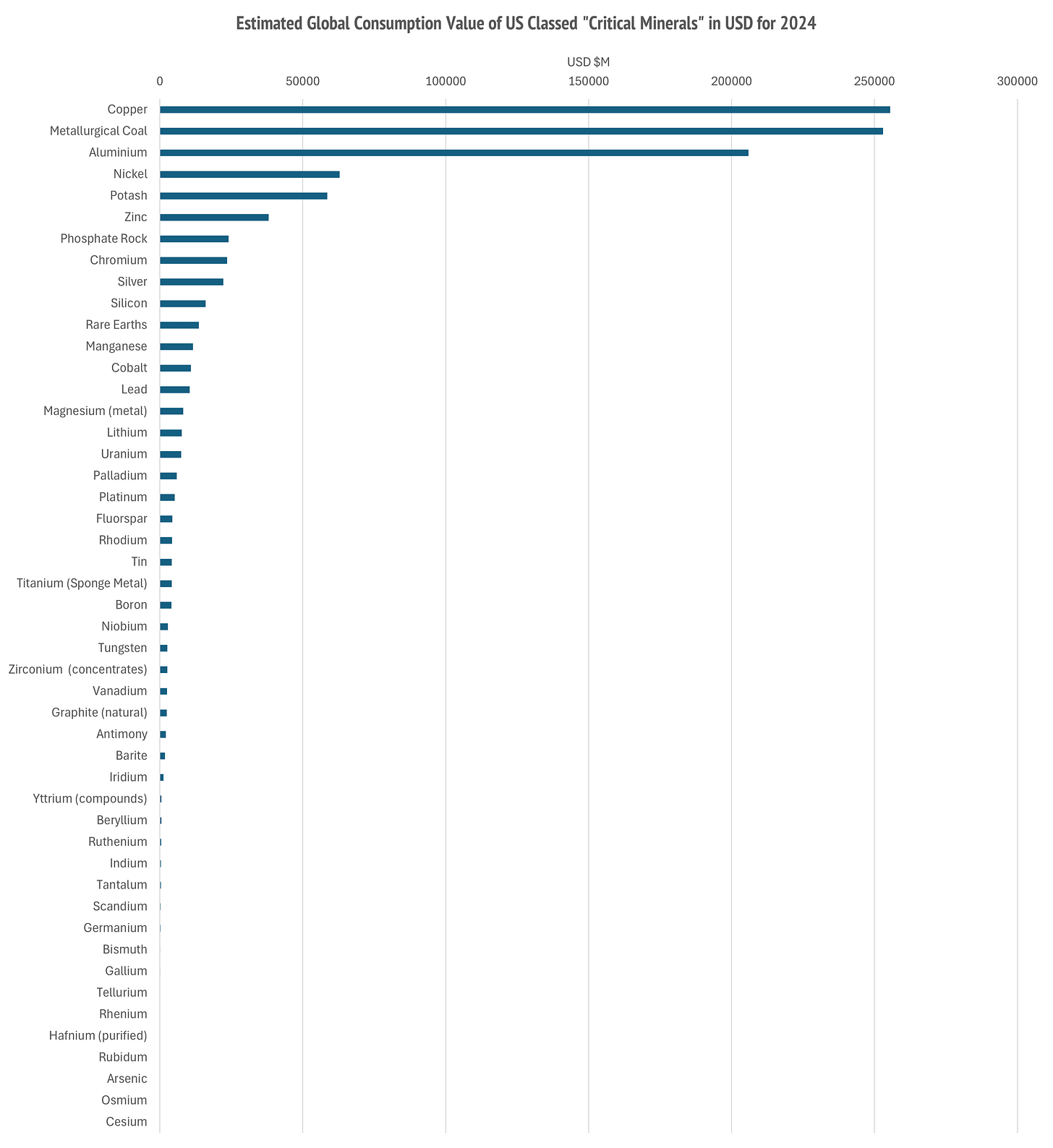

How does the global critical minerals demand picture look?

How does the global all minerals demand picture look?

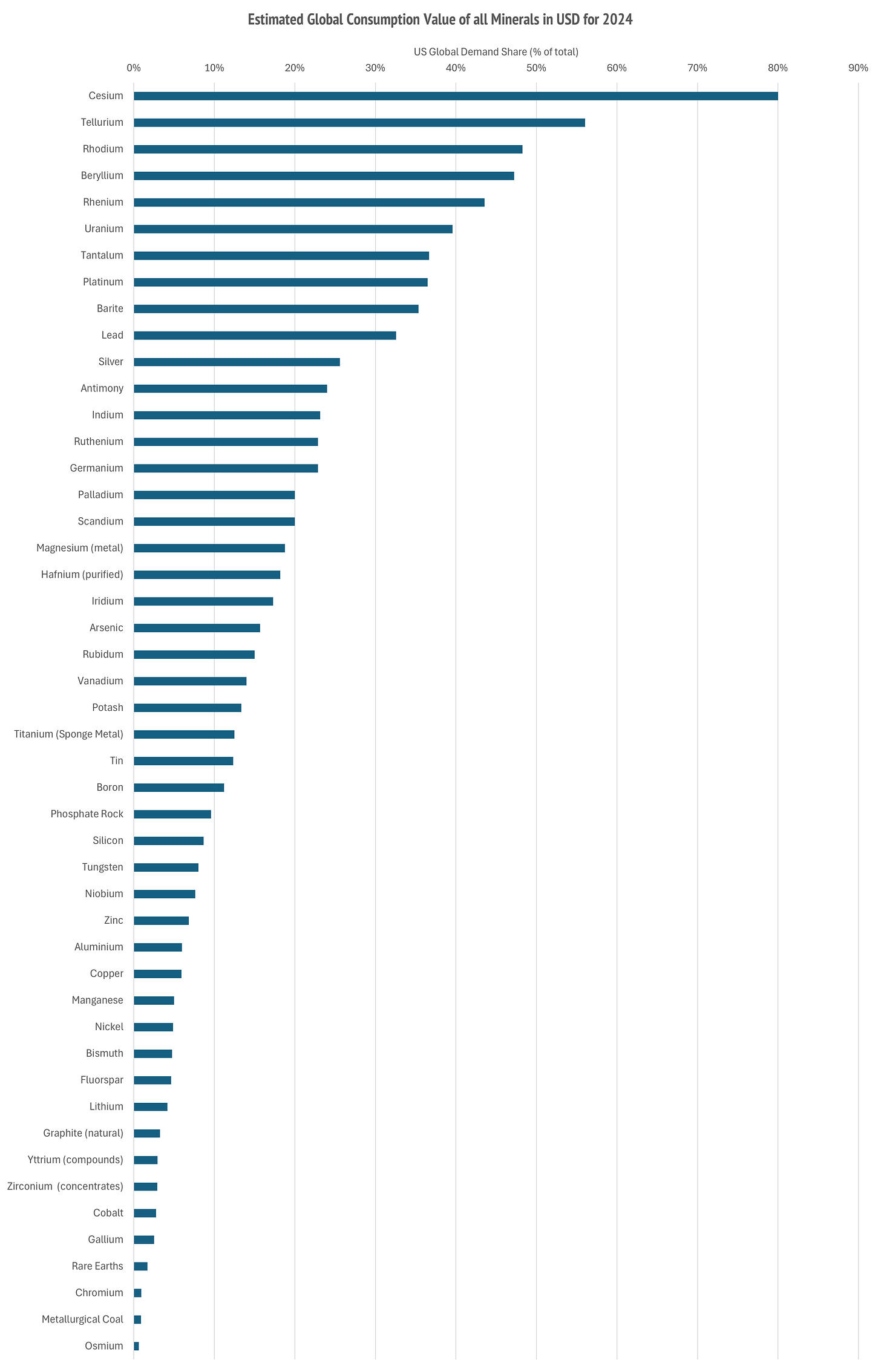

What does the US global market share of demand look like for critical minerals?

Do you notice something very important about this chart?

US demand for rare earths barely rates a mention in the global context.

On the other hand, Platinum Group Metals, Rhenium, Beryllium, Uranium, Silver, and Antimony are all metals where the US has a significant share of global demand.

Do you see how the message of the data can differ from that of Wall Street?

Conclusion

I have just completed the survey work for which I shared a small slice here.

Comparing the above with the market action, here are my top metals for 2026

Gold

Copper

Silver

Platinum

Palladium

Uranium

Here are my top minor metals for 2026:

Beryllium

Rhenium

Antimony

Titanium

How to play these depends on the metal.

I will include picks in my coming New Year List.

Happy investing!

! Most funds managers focus on commodity price, I focus on the commodity economy.!,

Gmp,

The sentiment indicator,

and more. It's a shame I don't understand math and physics