Opportunity in the US Correction

Profit-taking takes technology leaders back to break-even.

The Savvy Yabby Indicator can be very helpful at times like this.

A market correction can set in at any time, although there is usually a catalyst. The global correction now underway kicked off last Friday with concerns over weak employment numbers in the United States.

Then Japan fell out of bed over an unwind of leveraged carry trades.

Suddenly, the whole market is falling and nervous investors dump stocks.

At times like this, I like to stand back for one to three days, until the dust has settled and then go through the markets looking for attractive opportunities.

I will do several posts over the next few days, covering key global markets., However, in this short opening post, I want to set the scene for what looks like a classic case of profit-taking in a market that had some crowded and leveraged trades.

How corrections unfold through profit-taking

As I explained in our previous article, the cost-basis indicator is an exponential moving average whose speed, or rate-of-change, depends on market turnover. It is designed to estimate the average price that investors paid for their stock.

The rationale for tracking this indicator relates to the effects of market movement on investor sentiment. This can deteriorate rapidly in a market correction.

I will illustrate that here with the example of XNAS: NVDA.

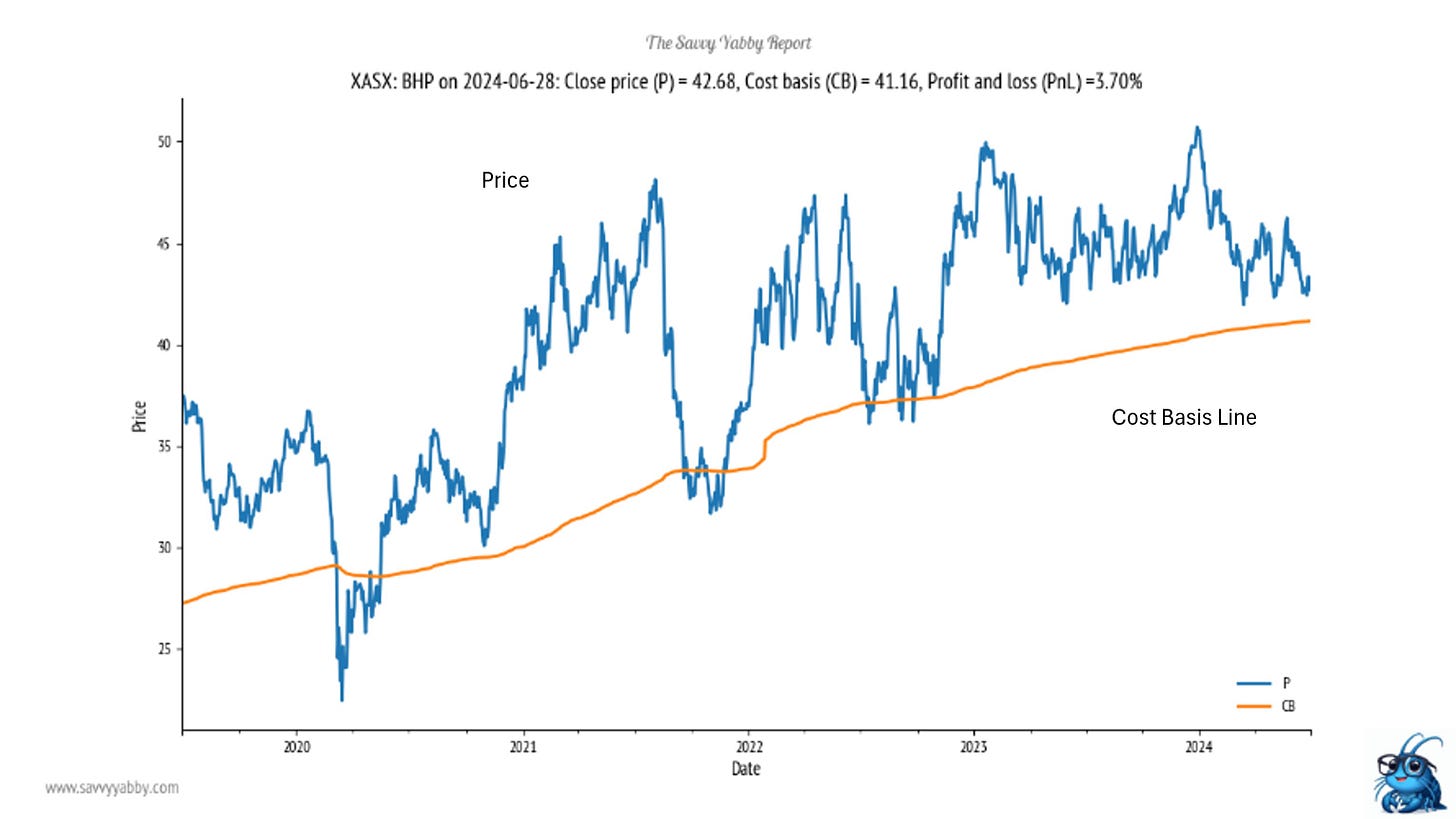

However, first let us review the basic form of the charts we use. In the example below, the blue line is the closing price for the stock, and the orange line is the cost basis.

Notice that the share price was mostly above the orange line, signifying that most investors were in unrealized profit and sentiment was likely positive.

This is made much clearer when we look at the profit-and-loss chart, which is formed by dividing the closing price by the cost-basis to get a percentage profit, or loss.

It is commonplace to use the term “profit-taking” to describe general selling during a market correction. The correction typically takes and index down 10 to 15%. When a correction goes much further than 20%, we usually call that a bear market.

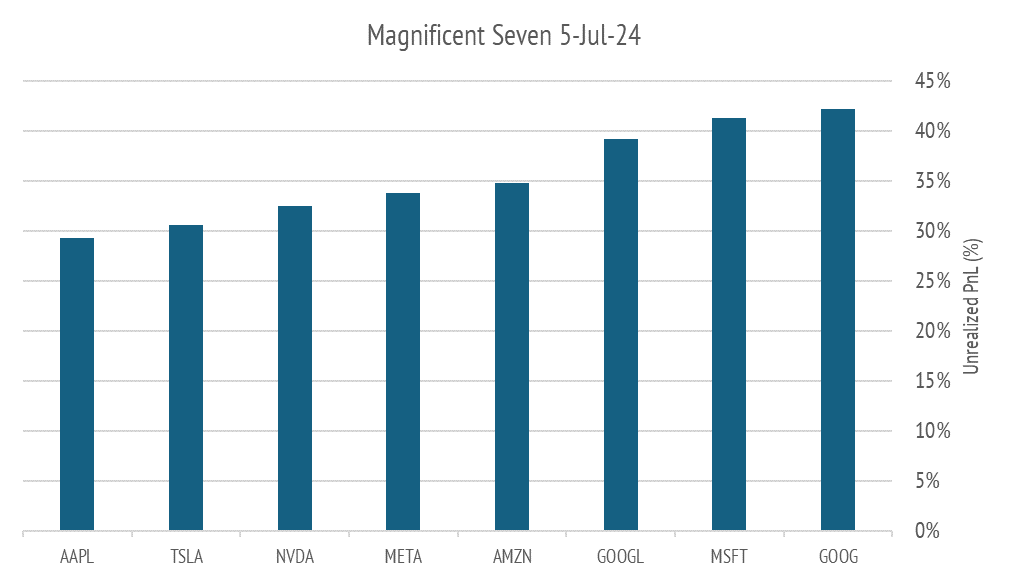

The profit and loss indicator above makes this process much clearer as I will illustrate with the Magnificent Seven. For comparison, see our post "Where is the value in US technology”, that I published about a month ago. One month ago, the unrealized profit and loss chart for the Mag-Seven was healthy.

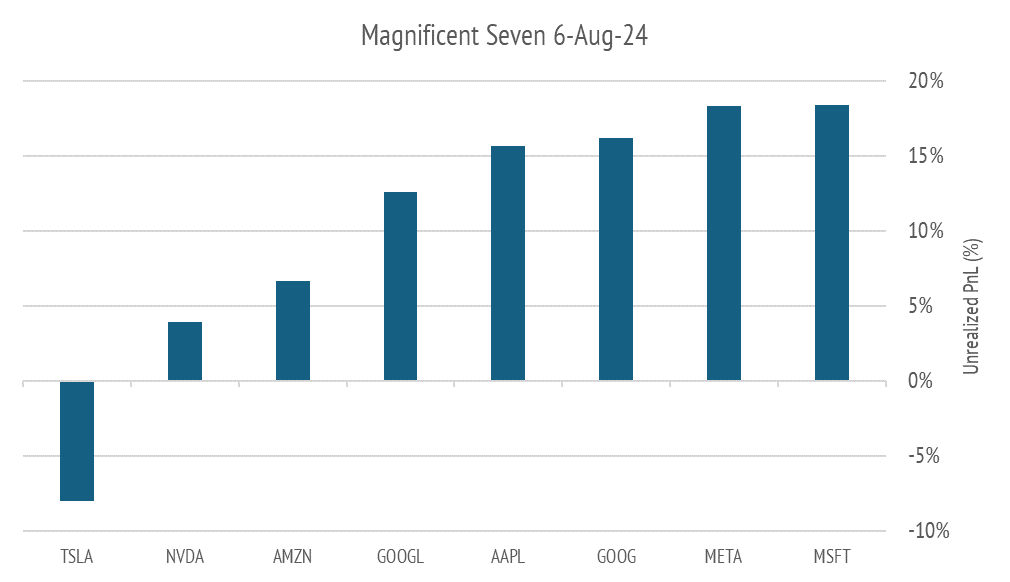

Then came the latest correction.

Notice how XNAS: TSLA and XNAS: NVDA have had their former unrealized profits wiped out entirely, or severely reduced. That is classic profit-taking.

Now let us look at some charts in detail.

You can see that Nvidia has had one profit-taking correction already, and now seems to be turning at around break-even. While the descent is scary, the point to consider buying is where that falling knife meets resistance at cost basis.

The profit and loss chart supports this tactical assessment.

For a sobering assessment of what can go wrong, look now at Tesla.

Tesla stock has now kicked into a bear market.

It is my personal preference to avoid trading stocks like Tesla. They are more opinion and news flow driven than other stocks, in my view.

What of the other Magnificent Seven stocks?

Microsoft XNAS: MSFT has had a relatively sedate correction. Notice that the cost basis is still a long way below the current price. There is no great stress here, and investors are likely looking for a turn at the first quarter lows.

You always need to consider tactical trading decisions in the light of valuation and current earnings momentum. Valuations are elevated, but Microsoft is an annuity revenue company which ought to survive any business slowdown.

It is not cheap, but the business is not broken.

Apple XNAS: AAPL did get extended off the first quarter low. There may be some more profit taking to come, to settle at the highs of the former range.

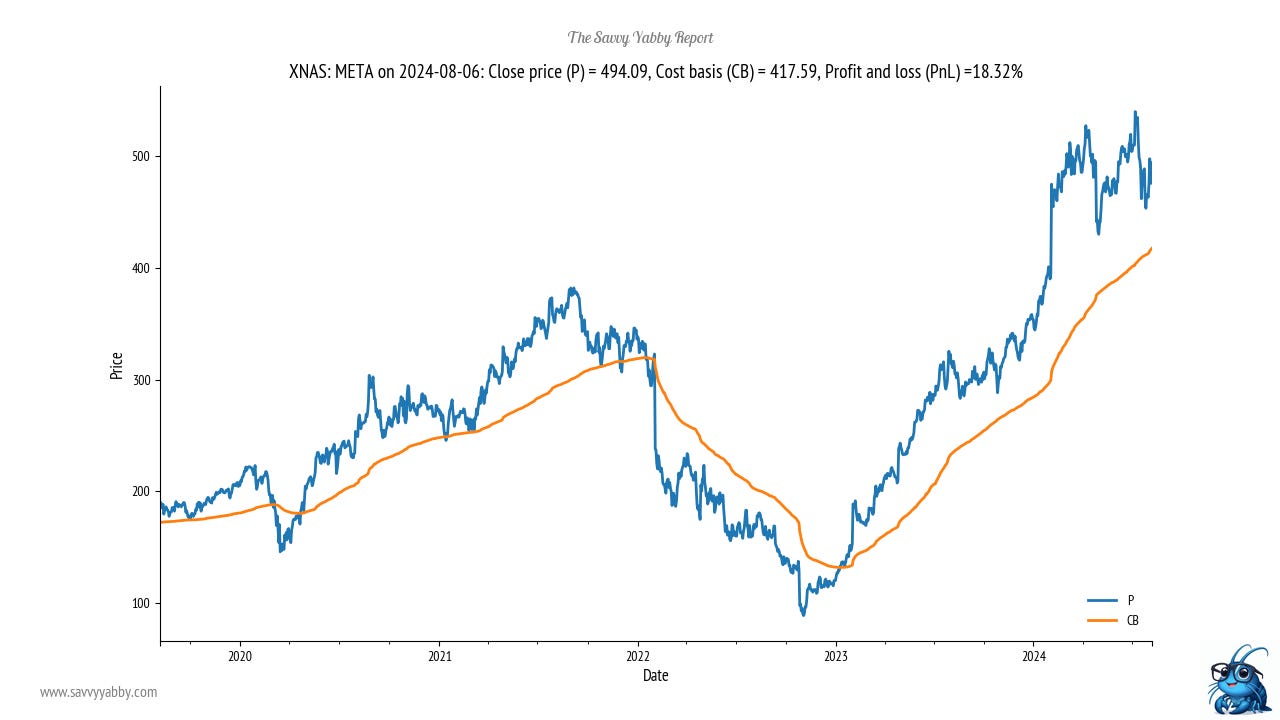

Meta XNAS: META has barely corrected. There is simply a hold. There is cost basis support some 18% below the current price, but no obvious bargain to be had.

Alphabet XNAS: GOOG has corrected some but looks ripe for further profit-taking.

I am cautious of adding to stocks in a position like Alphabet. There may be another leg down, which is only around 12% to cost-basis, so news flow is key.

Amazon XNAS: AMZN has clearly fallen out of bed with a major correction.

The profit and loss chart can be very helpful here.

Notice that I have not treated the fundamentals of these companies, but I hope that you can see how the trading sentiment is likely to differ among them.

Our prognosis

There is much concern that we may be on the verge of a U.S. Recession, but there are also clear signs of over-extended investors in some crowded trades.

The most crowded of all has been the A.I. trade with Nvidia.

As you can see, the cost basis is the near round number $100.27 USD.

This is a key level to watch as the correction sorts itself out. Nvidia has led this market up and is now set to tip the scales through leadership, either way.

Levered money has to get out in a swift correction to avoid margin calls. If you owe more debt than the stock is worth, that is a problem, and selling is necessary.

Right now, the position for Nvidia is delicately balanced.

Buying interest at this level can turn the stock, but also the market.

In such conditions, I like to look for recovery trades in stocks that followed the leader down, like Amazon, but which have less challenging growth expectations.

Look for Nvidia to turn at $100 but have a tight stop-loss below that level.

The trade I prefer is to look for Amazon to slide further to reach cost-basis at levels around $152 USD. Look for the tenor of the market to improve as buyers hunt for bargains and focus on those stocks that recover lost confidence on the bounce.

The next few days will be interesting.

I will publish more detailed notes on the wider global market tomorrow.

Market movement always gets attention that then demands an "explanation" in the news. We have been told that this correction was down to recession fears. Well, that can be a catalyst, but the bull move was very narrow in technology stocks, hence the profit taking. I think it will likely surge back but would look to position in other areas of the market, like healthcare and utilities. The Mag Seven have been over-owned and this is part of the process of correcting that.

The stock market is not the economy and the mag seven even less so.