Revision of "Best Idea": Exit Walmart

The world has changed a lot since I penned my Walmart best idea from a hospital bed. This note serves to warn of the new risks, which are obvious, and flag a good exit.

In Nov-24 I published a best idea focus piece on US retailer Walmart XNYS: WMT.

In the immediate aftermath of the Trump election win, I noted that market sentiment was positive across the board. Large cap stocks averaged over 40% unrealized profit.

Those long months ago most in the market expected that the Trump rhetoric on tariff measures would die down and be replaced by negotiated agreements among adults.

That has not happened.

Liberation Day is tomorrow, and I think we will see something of a bounce to the upside in the US market. As I wrote yesterday, technology looks oversold.

Microsoft looks set to rally off cost-basis support.

This is for sound reasons, since the fundamentals are fine. It is not expensive, like it was in the Tech Wreck of 2000. You will likely see a “least dirty shirt rally”.

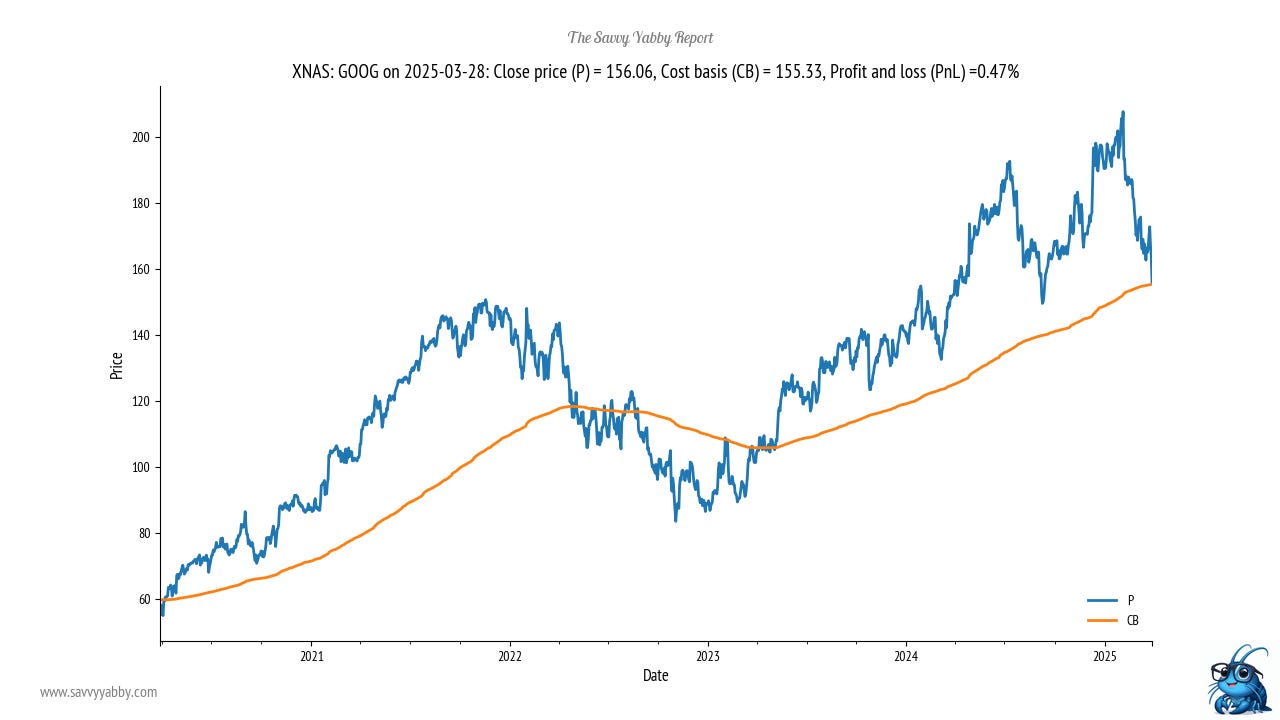

This applies to Alphabet XNAS: GOOG also.

The simple story of the Trump Era is that America was great already.

Leastways, it was a great place to invest in fantastic companies that made ever growing revenues and profits all over the planet.

The trouble now, as I see it, is that populism has taken the wheel and seems intent on telling bedtime stories of a worker renaissance through re-shored manufacturing.

This political schtick makes for great politics, but rotten economics.

The USA does have a yawning traded goods deficit with the rest of the world, but it also has a healthy traded services surplus. American service companies are highly efficient, largely through widespread digitalization of their service delivery.

This is the success story that drove the Magnificent Seven so strongly.

The underlying businesses remain excellent businesses, but we are rebalancing by taking profits selling long-term winners into strength and buying good value in neglected members of the Magnificent Seven, like Alphabet.

In my earlier piece comparing Walmart, Amazon and Costco, I fingered Walmart as my favoured name, largely because it has made serious progress on digitalization.

You can see this in the Return on Assets striking higher than Amazon.

I still like the idea on a pure fundamental business perspective.

However, I am now concerned that the entire group of US Retail stocks are facing a savage price adjustment through the Liberation Day tariff wall that approaches.

You make your own ultimate trading decisions, but I did state this as one of my best ideas back in November of 2024. The outlook on how serious President Trump is on reshaping global trade through tariffs has now made me very cautious.

The below chart looks a lot like distribution with a fair exit target of $90 USD.

Long-term the group of Amazon, Costco and Walmart are likely to remain excellent businesses, but this environment is just too risky for me to recommend them.

I am therefore removing Walmart from my best idea list.

Normally, I do not turn on a dime, but Donald Trump looks set to spin the globe off its axis. Until the North Pole and the South Pole settle down to some stability, and my geopolitical compass stops spinning, I think it prudent to sell into any rally.

Good luck and happy investing.