The Global Investment Themescape

Thematic investing is an often-ill-defined area of the market that is generally associated with "hot fund" launches. I use the idea to guide research.

For this Easter Break, I am taking stock of a few current investment themes.

Some of these are Bear Themes where I am alert for when value arrives.

Others are Bull Themes where I am looking for better entries.

I believe in balancing a portfolio among emerging opportunities, mature trends and waning opportunities. In my view, it is not a good idea to crowd into value, or to buy only strong momentum. Ideally, there is a mix of both, and the alertness to recycle capital from profit-taking in the waning trends, and position building in new ones.

The USA continues to dominate global equity market capitalization. Recall the IOO ETF I discussed in my article Unboxing our KISS portfolio: IOZ+IOO.

the USA was around 70% of global capitalization back then. Now it is 78% due to the relative movement of large-cap stocks. Although the Magnificent Seven is down, the fund manager community has been clinging to US large caps for safety.

These overcrowded trades are very dangerous, in my opinion. You can see an awful lot of global wealth wiped out in the rush for the exits, once it starts in earnest.

In my last post, The gift of a Bear Rally, I called a general bear market in stocks.

This does not mean, sell everything and run for the hills.

What it means, specifically to my method of calling markets, is that the general condition of unrealized investor profit and loss has turned to loss.

This means that investors are likely to be counting more losses in their portfolio than gains, which gradually and subtly alters the investment climate.

In a bear market, Fear of Missing Out (FOMO), turns to Fear of Losing Out (FOLO), and the trading behavior of markets changes. The up moves are very sharp, due to shorts being closed out, and the duration of rallies is shorter, usually 3-5 days.

If you want to get really technical, which I will do one day, the skewness of returns changes and becomes sharply negative. This just means that there are larger down moves in the distribution, increased volatility, and successive down days.

The cardinal sin of every investor, including me, is to snatch at quick profits, and to let losers run. The mistaken belief is that it is better to sell the stocks that held up, than to rid portfolios of the serial losers. This is what happens on really bad days.

That is why you will typically see a late session bounce from stronger stocks, while the weaker stocks are down even more into the close. The game actually changes.

Throughout the bear market there is a temptation to snare the bottom, and to make a heroic trade that confers bragging rights for all time. That is fun, if you manage it!

However, I have spent too long at trading screens to enjoy that much.

It is an emotional roller coaster.

The better long-term bet, in my view, is to take prudent profits where possible, clean up any evident losers during bear rallies, and to research coming opportunity.

Themes, namely sectors that cut across single stocks and countries, are my way to do that research. You identify which may be leaders coming out of the bear market, and which will be leaders in defining the way down, and how deep the drawdown will be.

In this spirit, I offer a non-exhaustive list of those I am looking at now.

(Gold stocks are not on this list and will be covered in depth later).

The Magnificent Seven (Leading the Bear)

The Magnificent Seven of US technology companies need no introduction. They have been a source of fantastic profits, over many years, for many investors.

This includes me.

Presently, I own just one Microsoft XNAS: MSFT.

I exited every other position, and took large capital gains, in the rallies since January.

This is how the group looks now (closing prices 17-Apr-25).

The interpretation of such market conditions is fraught. It is important to understand that a market can turn down before the fundamentals really deteriorate.

There is the old adage to keep in mind:

Price is not value.

Just because the market is in a state of unrealized loss does not mean that the bear market, as defined by that condition, will be deep or long.

However, I did not wait to find out on this occasion.

The coming earnings reports really matter, and markets will trade either way in the lead up to them, possibly more once the reports are in.

The reason why I raised cash from this basket is twofold:

They are priced for continued success

Profit margins look set to peak and deteriorate

The second point is the one to watch because this a forward-looking estimate.

It warrants a detailed appraisal, but these are fast markets.

I sold first to do the research later.

That may sound cute, but experience has taught me that when executives who lead large and profitable companies are making huge capital expenditures on AI, in the hope that the business model turns up to justify it, it is right to stop and think.

If I miss the first 30% of the next 100% move upwards, I can live with that.

However, these are widely owned behemoths.

They have been minting money for years and are now spending it like drunken sailors all trying to be the first and best on the next Artificial Intelligence model.

There are seven billion humans on Planet Earth.

Intelligence is not a scarce commodity except in board rooms.

I think that the DeepSeek Panic, was just the first warning shot of the real revolution to come. This will be AI that fits in the power and energy envelope to do useful stuff. China has some moves in robotics. Watch that space for the next big upset.

For these reasons, I am standing back from the Magnificent Seven.

These are great companies, but I think much better value is coming.

Note that I am purposefully separating my attitude to US investment, from my appraisal of President Donald J. Trump. You know I do not like the man.

This is not the same as standing on the sidelines in a US Bear Market.

Whether I like the current US President or not has no bearing on my appraisal of market conditions, and the prospect for investment return.

The only thing I will say is that the rabid Anti-China rhetoric might well blind some global investors to the opportunity in China Technology and Science.

The China Eight (Leading the Bull)

In my Causeway Bay Eight stock market travelogue, I mapped out my own research focus for a continuation of the technology theme, while the Magnificent Seven work through the margin pain that I think is coming. The flip side is China technology.

I chose these eight stocks with three criteria in mind:

They are not (currently) under US sanctions.

They are Hong Kong listed and quoted in a pegged convertible currency.

They are technology focused and chosen to cover a diverse group of sectors.

I also made this key point.

You should own a piece of the US story, and a piece of the China story.

As a matter of fact, you should own any good story that you legally can.

To elaborate on this point, I hold political views just like any other investor. However, I do not invest on the basis of realizing this or that preferred political outcome. This is not the prevailing attitude in Western financial markets. This is how I like it.

If you follow what is most comfortable in a crowd expect poor returns.

This is my mantra, and I am sticking to it. It works for me.

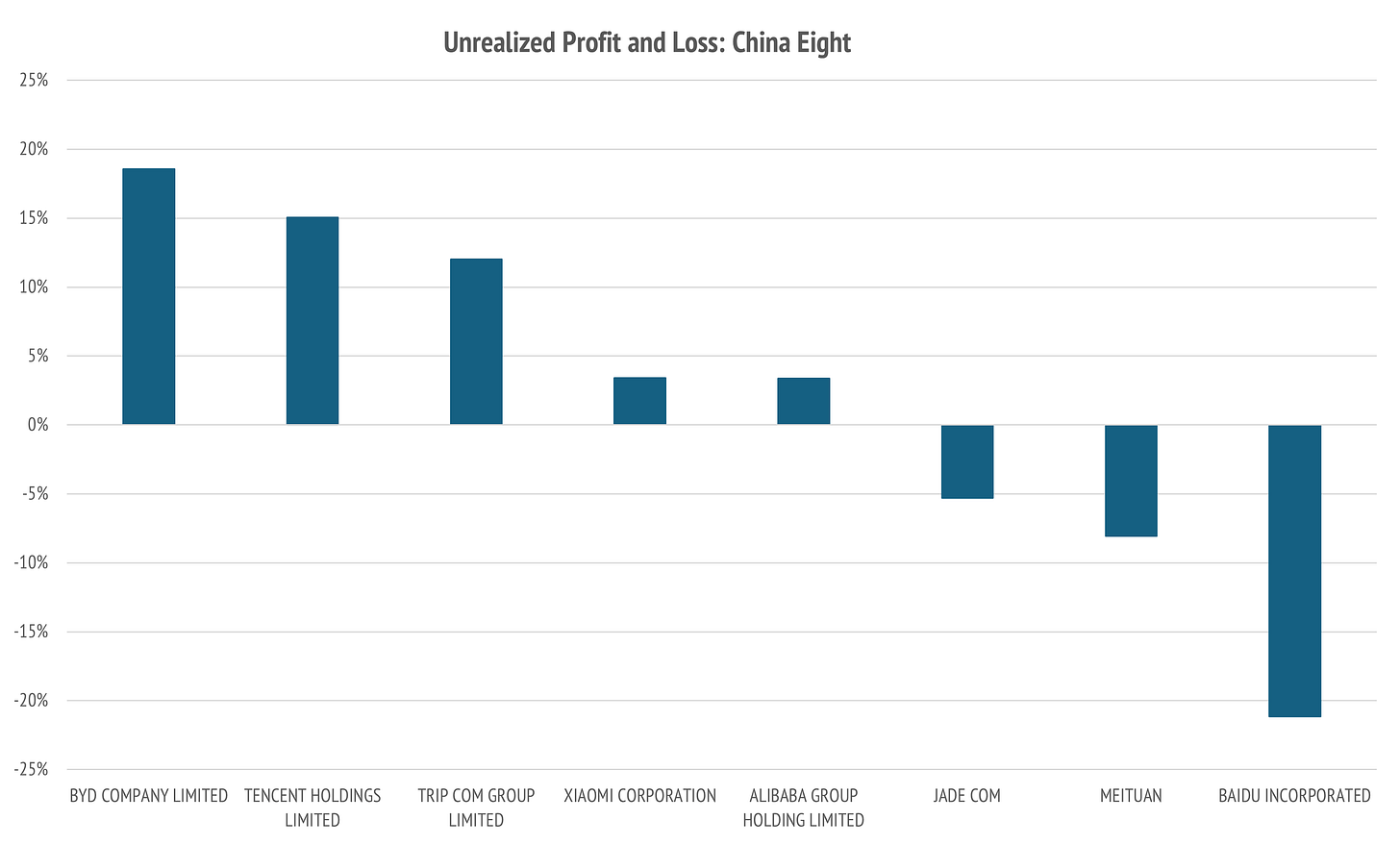

Here is the unrealized profit and loss picture for the China Eight.

There is an obvious question:

Why say this is an emerging Bull and the other is an emerging Bear?

That is an excellent question, which I will answer with two charts for the leaders.

Let us start with Microsoft which has had a fantastic bull market.

Let us now follow with BYD, the Chinese EV maker.

Are these considerations definitive?

No, they are not but recall that I use this process to seed research.

The obvious question to ask is what will sustain this bull market.

I will write more in coming posts, but I think it is best illustrated with Xiaomi.

The first car Xiaomi ever made was the best-selling SU7 EV. This is the factory.

I have no trouble accepting that the USA is an innovative nation that is brimful of good ideas, and wonderful entrepreneurs. Pay credit where it is due, I say!

What I cannot abide is the foolish notion that only Americans can innovate.

This is (frankly) a stupid delusion that will incinerate many global portfolios.

China can innovate, and some.

The pace of Chinese science and engineering innovation is accelerating rapidly.

I trained as physicist, and so I have no patience with the political strategy of denying the bleeding obvious to curry favor with voters who do not get out much.

China is making rapid strides in technology development.

Only a fool would ignore that.

Global Semiconductors (Cyclical value coming)

The global semiconductor trade has been a winner off a huge AI-driven chip cycle.

Notice that the best company in this space, Taiwan Semiconductor, is the only one of them that is not already in a bear market (NVDA is in the Magnificent Seven).

Here is the TSM chart.

I took some profits around the $175 mark and will likely sit this one out. The place to buy this will emerge from estimates of value once earnings momentum peaks.

I am not worried about Taiwan Semiconductor for the long term.

NVIDIA is a great company also, but I am not there right now.

Great companies can still be profitable in bear markets. What changes the calculus to see them sold down is the forward outlook for the sector they serve.

Generative AI continues to be a hot thematic, but the latest US controls on exports of the H20 chip to China saw the company take a $5.5B charge. It is not “Last Drinks” on Artificial Intelligence, but I am waiting for “Happy Hour” to buy.

NVIDIA looks like a train wreck in progress.

The problem is not “success” but rather too much of it.

The geopolitics has turned very nasty for this company. They may well be forced by their own government to cede the entire China market. It is the biggest market.

Huawei is the big winner from the Trumpian reset.

Conclusion

These are the main themes I am looking at, and this is a long read.

However, it is a holiday weekend so I will be back with another installment.

European Defense

European Luxury

European Financials

This is the main non-US market where I am looking for opportunity outside China.

The final thematic which is almost too obvious to mention is:

Australian Gold Stocks

I will discuss Critical Minerals also, as I think this will recover.

Happy Easter and good luck with your investing!

Hello, where does PDD Holdings stand in the chart of PnL? Is it big enough to even stand with the rest?