USA 20 Stock Model Portfolio

Leading into the new year, we are expanding services to include model portfolios. The free section reviews the portfolio performance. The paid section updates it with rebalancing.

Our Value Proposition

The Savvy Yabby Report is eighteen months old now.

When I launched this substack, the initial focus was on our sentiment tool, the cost basis indicator, and thematic research on global investment themes.

We had a few glitches in the first year of operation due to illness and a refocus of my business Jevons Global. Life has ups and downs, and I am okay now.

However, change brings opportunity, and my activity in financial markets has taken a necessary turn towards investment research and investment education. Next year brings up my third decade as a financial market professional.

I have gained a lot, from this career, and it is time to give a little back.

The activity I enjoy most is research and the connection I have with clients is based on presenting a digestible view of the financial world filtered by my own lens.

This will not always be accurate, in terms of the outcomes, but I do aim to be as honest as I can in assessing the opportunities and pitfalls in my field of vision.

What is lacking for me, is any serious opportunity for investor education.

It used to be that this happened within the investment firm, through an active process of instruction or mentoring by more experienced market participants.

I benefited from that greatly, across a host of specialties from quantitative investment, through trading, strategy, macro-economics, commodities and company research.

Unfortunately, the trajectory of the investment management industry has been more and more focused on marketing and distribution, and less on investment skills.

I will not say much about this, except to remark that I think there is a great deal of investment knowledge and expertise that is being lost to this form of progress.

Approaching thirty years in this business, I am more interested to imparting what I have learned of practical portfolio management, than crafting new sales pitches.

The interruption I had last year convinced me this would be a good time to change gears and build up this venue is a quality outlet for sharing lessons learned.

Some of this will be pith, you know me, but mostly I am a person who learned all that I know by doing. I am bookish, but the lessons only sink in when doing the thing.

Our value proposition going forward is pretty simple.

This is the place to come to see portfolio management in action.

The full box and dice from research, through portfolio construction, implementation through choice of security, service provider, and trading to performance.

This is the only way I know to learn and to keep oneself honest.

Without further ado, let us kick the process off with three model portfolios:

US 20 Stock Best Ideas Model Portfolio

International (non-USA) Stock Best Ideas Model Portfolio

Global (all markets) 25 Stock Best Ideas Model Portfolio

Those who are familiar with how the professional funds industry works will appreciate that this is no small offer, if it works. Normally, you pay a lot for such a service.

However, at my stage of life to not run such portfolios is boredom in deep space.

The more important thing, for me, is to share the thought processes that go into really running portfolios with all of the discipline that you find in an institutional setting.

We are offering the hindsight view of such portfolios for free to subscribers.

The important foresight view of what the new portfolio looks like, post rebalance, will be the recurring service to paid subscribers. Expect monthly performance reports for free to all, but these will follow the standard script of top three and bottom three.

You will see what I mean as we move forward.

Paying subscribers will receive institutional grade reporting and rebalances.

This is the best way I know to create the constant focus which feeds education.

Everything that I know about investment was learned this way.

The right way to learn investment is to do it.

The best way to remember each lesson is to use your own money.

This is how I started global investment, from Australia, back in 1996.

I liked it so much, I soon went professional.

If only one reader of this substack should do so I will be happy.

Introducing the USA 20 Stock Model Portfolio

Ahead of starting this substack, I established three model portfolios for the purpose of serving the institutional adviser market. These were all non-Australian portfolios.

For various reasons, it is hard for Australian advisers to implement those. You could go and develop well-performing global strategies but find no Australian buyer for them.

Now that the portfolios have been running for close to two years, I have decided to open them up to self-directed investors. Readers of this substack can readily open international broking accounts in Australia, implement them, and save money.

The majority of self-directed investors I know will not replicate some other strategy for their own purposes, but they are looking for investment ideas, and guidance on risk management, portfolio construction, performance, and tactical trading moves.

The model portfolio is a straw man portfolio I do not expect you will own, because you will have your own ideas about what stocks to choose.

However, the value of model portfolios is to cohere thinking about what trends are important to consider, which stock exposures make buy and hold sense, and how diversification can work to reduce portfolio risk.

In the international context, it makes sense to give careful attention to position size, country exposures, and currencies. Practical global investment requires realism on macroeconomic and geopolitical risks and uncertainties. Stuff happens.

For this reason, global equity investors welcome benchmark comparisons to address a key problem of global markets. Currency movements are ever present, and the local conditions of one country, or region, can change significantly.

The model portfolios I will share all follow important institutional principles.

They are sensibly benchmarked, they are diversified, and they are economical in the number of securities selected. The last part is very important to understand.

The USA has upwards of 2,500 stocks to choose from. In our model portfolio, we are only allowed to choose 20 stocks, and we will be benchmarked versus 500.

Those first starting out in the investment game may think those odds are pretty good. Consider that you have 2,500 stocks to select from, and you only need 20. This seems pretty easy. Just pick the 20 best stocks and you are done! If only :-)

Unexpected things happen all the time…

I well remember one stock I put money into called GT Solar. It made a hardened glass that was sought after in the early days or mobile phones. Apple signed a contract to buy glass from GT Solar provided it spent $1B building a new factory to make it.

GT Solar spent the money, built the factory, and then Apple tore up the contract!

Poof! Gone. Bankrupt. This is the kind of “to zero” moment that can happen.

Fortunately, while I thought GT Solar was a winner, I did not commit too much capital into one position. There are no “sure fire” winners in a stock market. Stuff happens.

In the case of GT Solar, I learned an important investment lesson.

The bankrupt have limited options to sue those who made them bankrupt!

Apple is a big company, with many lawyers.

Good luck!

War stories are a great way to learn, expect more of them :-)

Before we get into the current composition of our US 20 Stock Model, let us pursue this theme of robust portfolio management with another war story.

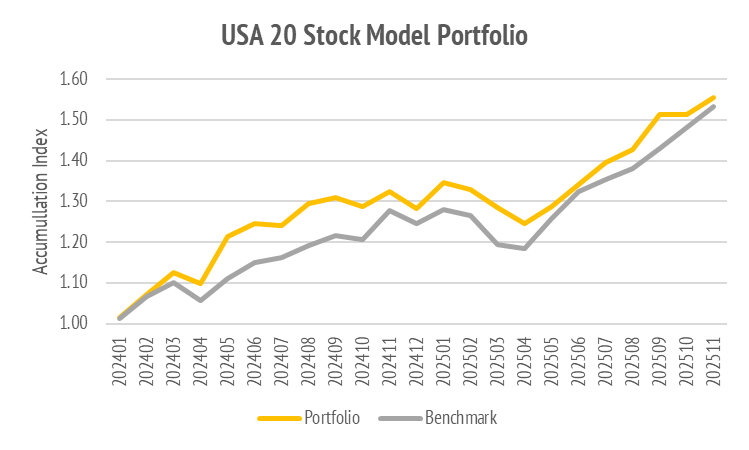

Here is the performance of the model portfolio since inception versus the S&P 500.

That is a pretty fair result, in the circumstances. The inception date was 18-Jan-2024 and the compound annual return was 25.84% versus a benchmark of 25.00%.

This comparison highlights why we benchmark the model portfolio performance.

The annualized rate of return 25.84% over nearly two years sounds sensational, until you realize that a passive investment could have yielded 25.00% over that time.

Whenever the investor embarks on a concentrated portfolio, where you own only a very few stocks among the total possible, there is a serious risk you underperform.

You can see from the above chart that the model portfolio did better earlier and then have some back, starting around Sep-2024. Coincidentally, that is when I got sick and went into hospital for seven weeks treatment for a rogue blood infection.

Stuff happens.

However, while the model portfolio gave back some performance, it has done okay since, in spite of the fact that no change was made since 4-Oct-2024. This is what I mean by robust portfolio management. Apple could turn up and bankrupt one of your positions. Some pesky bacterium could turn up and cause you to neglect portfolio management while you focus on more important things.

When we build portfolios, we cannot know the future, and we do hope for good outcomes, but it is important not to be too lopsided in the choice of stocks.

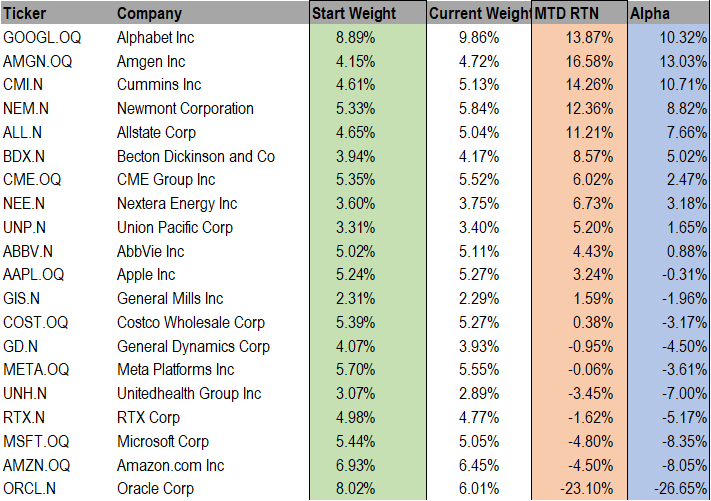

Positions at the Last Rebalance

Let us now take a look at the actual holdings of the US 20 Stock Model Portfolio as at the last rebalance, which took place 4-Oct-2024. As at the close of trade on this day, target weightings were reset for all holdings, and any stock switches made.

This is the last rebalance we made where some positions were exited, some new ones added, and the remaining weights reset to targets of 4, 5, and 6%. Note that NVIDIA was in the original portfolio, which started 18-Jan-2024, but exited 04-Oct-2024.

The stocks held, and their weights, before the rebalance are shown as “Pre Trade” and the new portfolio stocks held, with weights, are shown as “Post Trade”. The way that performance is calculated assumes that the trades were done at close.

This is how model portfolios operate.

There are some differences with real portfolios that reflect trading reality. Rebalances cannot be done this precisely because you do not know trading prices ahead of time. Additional complications arise in global markets due to settlement schedules. Sells generate cash for funding buys, but it may not arrive in time. Real trading differs.

Where the position change is less that 0.50%, we do not represent it is a BUY or SELL but simply a rounding back to whole number target weights. The larger changes are intentional changes to adjust overall portfolio weights. Some are large, like the new positions entered, and the olds ones exited. Others balance the risk exposure.

There is an art to how this is done, but to explain this feature of our models, we do it to keep the sector exposures in line to limit portfolio performance risk.

You will see how this works when we consider the updated version.

Positions prior to Rebalance

The key to any rebalance is to see how the portfolio overall has performed, and which stocks have been most responsible for relative gains and losses. In the previous table, all positions were 4, 5 or 6%. Of course, they all move around as shown below.

Note that Alphabet is the largest position at 9.86%. The Start Weight of Nov-2025 was lower at 8.89%. The MTD Rtn column shows the total return during the month.

The Alpha column is the difference between the total return and the benchmark, the S&P 500, which comprises 500 of the largest and most liquid stocks in the USA.

This is just the last full month of performance data, but you can see the point behind regular performance monitoring, the comparison with benchmarks and targets.

The question of what to rebalance is made more obvious by attribution analysis. This is a method used by portfolio managers to work out what decisions mattered most, in both a positive and a negative sense. It is not immediately obvious, but I will call out United Health Group for closer examination. It was added as a new position, at 6%, back in the Oct-2024 rebalance, but had shrunk to 2.89% as at Nov-2025.

Portfolio managers are like doctors; they bury their mistakes!

Clearly something went wrong there. This is the US managed healthcare giant whose CEO Brian Thompson was shot and killed by a disgruntled assailant on 4-Dec-2024.

Nobody can predict what can or will go wrong in portfolio management.

Tragedy can appear at any time, and this reminds us that nothing is truly safe.

Disciplined Rebalancing

You can imagine that weighing up what to do to fix an underperformance period can easily become a daunting task. The solution to this problem is the KISS principle.

Keep it simple and fix the need to fix problems first.

Do not worry overly much about what is not broken, except perhaps to trim winners that have run very hard to avoid lopsided exposures. This can easily happen. In my own portfolios Microsoft grew to be 30% of total holdings. That is too large.

There are always positions to trim, and some that may be cyclically weak which you still like and can top up. However, the real game is to exit serial underperformers.

On the other side, you need to have fresh ideas to replace the exits.

To kick this off, let us look at the year-to-date contribution analysis.

Large positive bars pointing to the right are good. Large negative bars pointing to the left are bad. Scanning down the bottom, you can see that United Health (XNYS: UNH), Becton Dickinson (XNYS: BDX), and General Mills (XNYS: GIS) were the big laggards.

Some or all of these may be candidates for sale.

Evidently, gold miner Newmont (XNYS: NEM), tech major Alphabet (XNAS: GOOG), and defense contractor RTX (XNYS: RTX), were the biggest positive contributors.

These positions can easily grow too large, and provide a rebalance towards the minor laggards, like Microsoft (XNAS: MSFT), Apple (XNAS: AAPL), or Meta (XNAS: META).

This is the sort of information we make use of when rebalancing.

On now to the new portfolio.