Why I like Australian Real Estate Developers

The latest print for US labour markets was well below expectations signaling a marked slowdown in new jobs growth. Interest rate cuts are coming for the US and our own Reserve Bank will likely follow.

The markets are an eternal roller coaster.

Good times lead to boom times lead to slack times lead to bad times.

What formerly did well can do badly and what did badly starts doing well.

In this stack, I will introduce my thinking on the emerging stagflation risk that we think will haunt financial markets for some time to come.

I am a child of the 1970s and so understand stagflationary climates well.

Since my parents were born in the 1930s, they thankfully missed WWII and were into homemaking right on the cusp of the stagflationary era. They bought their very first home on return from the USA, where we lived in the late 1960s, and purchased a sweet little weatherboard cottage in Balwyn for $12,000 AUD in 1971.

Four years later they sold it for $26,000 AUD and bought a nice Edwardian house in a splendid Camberwell cul-de-sac for $53,000 AUD. Another seven years later they sold that for $181,000 and downsized as me and my sister left home.

The sweet Balwyn cottage at 96 Rochester Road turned into this monstrosity.

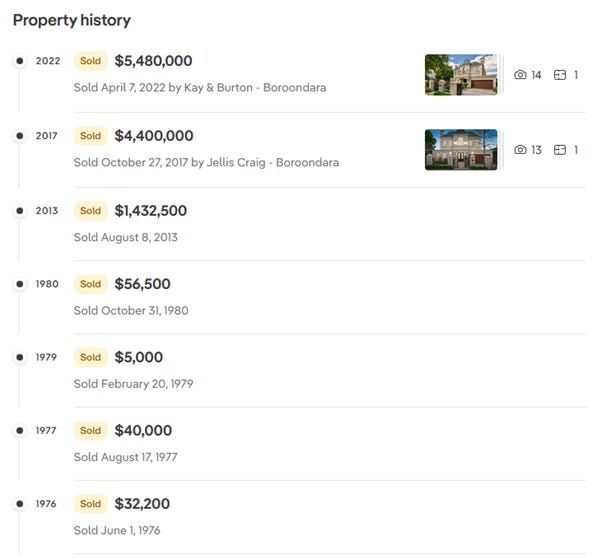

I took this photo from RealEstate.com where the sales history is listed as:

That 1976 sale looks to be the one after my parents sold. I suspect that the figure for 1979 is a misprint. It likely should be $50,000, not the $5,000 shown. The land value alone would likely have been hovering around $25,000 by then.

This lot description states:

96 Rochester Road, Balwyn, Vic 3103 has a land size of 706 m². It is a house with 6 bedrooms, 6 bathrooms, and 2 parking spaces.

That is a very good-sized block and the reason my parents chose it. They spotted that the modest cottage was ideally situated on a large block close to good schools.

Let us do the Compound Annual Growth Rate (CAGR) on the price. This is not going to be same as the investment return as that depends on holding costs, finance and interest rates plus any tax benefits that may or may not accrue to the owner.

Let us now look at where my parents moved to.

That house is still there, long after it was built in 1911, and we moved out in 1984.

The lot description sates:

9 Royal Cres, Camberwell, Vic 3124 has a land size of 667 m². It is a house with 4 bedrooms, 2 bathrooms, and 2 parking spaces.

The corresponding CAGR reads:

Why bother with this personal nostalgic exercise?

I am telling you something you already knew, housing goes up over time.

However, notice that the selling price for the Balwyn property experienced roughly the same growth rate in spite of a hugely upgraded house! The mansion you see is huge compared to what it replaced. I have no photo, but I can assure you.

The place I lived in, fifty years ago, had a big enough backyard that I could build a tree house so large the neighbors complained because it started to push their fence down!

The new place appears to have no front yard, and likely a paved area for cucumber sandwiches. It is not the house I grew up in, but who cares, the owner likes it.

The point of all this is that houses sit on land.

During inflationary periods, land values go up faster, along with everything else. The story of homemaking for my parents was a 1970s classic. Buy where you could first afford to, in the outer middle suburb of Balwyn. Then build equity paying down off the hideous mortgage, and trade up to a better location in the inner suburbs.

This was a very good strategy in the 1970s stagflation because debt is nominal and is deflated relative to your rising wages. In those days, investors were often positively geared because the inflation would pay off the debt. The one thing that you really needed to watch was the holding cost of investment properties.

There were several ugly episodes for real estate in the 1970s when interest rates rose and overextended investors and homeowners were forced to sell. The cardinal rule of those days was to ensure you would not ever be a forced seller.

The land bank under your feet would appreciate in value.

This is why a house from 1911 kept pace with a newer build from circa 1990.

This all seems irrelevant today, because everybody knows that real estate has been a great investment during the period of falling interest rates. However, that experience has probably masked the effect of rising debt burdens in present value terms.

The problem is that future dollars become more valuable with falling rates, and so the capacity to pay for a large mortgage rises. This leads to rapidly rising prices among established homes. The cycle is beneficial to those on the real estate ladder but becomes extremely challenging for those not on the real estate ladder.

We all know that to be true and especially today.

Gold versus land values

It can be hard to see the consequences of credit growth in relative price levels as they are often masked by other factors and the attention of investors on the short term.

In the past, I have done work for institutional investors whose specialty is farming, and the upgrading and development of farm operations to achieve better returns.

This is a niche that rewards very focused teams who know their sheep and chickens!

Farming is a challenging area because most money is made on the best farms.

You have to be very professional in your approach because many holdings will lose money most of the time. What keeps the marginal farm afloat is borrowing to plug cashflow holes against rising land values. The professional farmer approaches the problem differently and is acutely conscious of the need for the best land.

This chart should alert us to an important question.

Why have farmland and gold beaten residential real estate?

This is not a simple question and there is no proof statement to give.

However, we can turn this question around and ask why residential real estate beat the Consumer Price Index (CPI), of consumer goods and services, general.

We know land is in limited supply, as is gold.

Relative scarcity, given persistent demand, promotes price raises.

This has led real estate investors to focus on the mantra.

Position, position, position.

Great real estate appreciates more rapidly because the land on which the property is built has a great location. Over the years rising site values promote investment and improvements to upgrade the structure on that land.

However, the land itself goes up because of what everybody else does.

When you have a great location then everybody else will work for you to make the value of that site go up over time.

While you wait for that to happen, live in the house that is built on that land.

This feature of real estate economics falls within the realm of political economy.

Except for finance wonks like me, few will speak directly of the dynamics.

If you do, you could become famous like Henry George was!

However, you would also soon find out why your subject is called political economy. Any explanations that might be offered as to why land values rise is political.

The answer you give will likely depend on your pecuniary interest.

I am an investor, so my prime concern is what goes up when and relative to what.

Presently, gold is going up nicely compared to stock markets.

The above chart shows the performance of the S&P 500 of US stocks relative to gold when both are measured in USD. Note that when we do relative charts like this, we need worry what is happening in the currency.

I could convert both to AUD, and the result would be identical.

What I would like to persuade you to do is to think in relative terms.

This is what my (young) parents did fifty years ago to stretch every penny and seek support from relatives to buy an adequate house on a prime block of land.

They were wise enough to forgo nice to have features in the house, to make sure it was fit for purpose with a young family and go paint whatever needed painting.

It was the land that really went up a lot.

Notice that the same story is already playing out with gold versus stocks.

The S&P 500 is chock full of the best companies in the world.

See how unfair a credit expansion can become!

Gold sat there, did nothing, and beat 500 of the best companies on Earth.

This is what I want you to think about carefully at this time.

You know that I like gold and golds stocks:

Gold and the BRICS (26-Oct-2024)

Best Global Idea: ASX Gold Stocks (27-Apr-2025)

Rarely do I get timing nailed but these trends remain well-supported.

The largest slice of my private capital is in gold, gold stocks, and Microsoft.

The war risk and geopolitics has only amplified my conviction on these calls.

The Precious Metals Bull Market (17-Jun-2025)

However, I am not a bean hoarder and tinfoil hat shotgun toter by nature.

I am an optimist who remains cautious on the risk of error with my money.

There are times when I have held as much as 30% of my portfolio in gold, but this is not one of those times. I do think that the economic gears are grinding, and that the risk of policy errors in Western economies is particularly high right now.

However, I am not bearish on the ability of the younger generation coming through at this time to adapt to challenging circumstances. I watched my own parents navigate extremely challenging conditions, on employment, and inflation, and still come out ahead despite the modest means that come from being a teacher and a preacher.

Warren Buffet has often said that you should not bet against America.

I have mixed feelings about this attitude applied to a single country, in exclusion of the rest of humanity. I would adjust this adage to my own preferences.

Never bet against the power of the human spirit to overcome adversity.

However, I said I was naturally cautious, so I am careful to choose which spirit to back.

Narrowing the scope, which stocks would I back now?