Crisis Interrupted? Shipping Bullwhip!

It is very welcome news that China and the USA agreed to slash tariffs to a much less damaging level for 90 days. The result will be a surge in container rates.

In early April I called a bear market and shared some tips on Navigating Bear Markets.

The helpful Bear market preparation is, as follows:

Budget your needs over three months and meet those as your first concern

Now that you need not sell in a panic, plan what sells to match together

Do those trades, when you can, to raise cash tax effectively

Distract yourself from current panic by researching what to buy

Have a view to what kind of portfolio you want to own coming out

That was April 6th, and indeed we did see a 20% odd drawdown in US gauges, followed by a bounce of the lows when tariffs were paused, ex-China.

Now we have the China-US agreement in Geneva over the weekend to slash tariffs to a respective headline rate of 30% for US tariffs on most Chinese goods, down from a former 145%, while the Chinese tariffs on the US goods drop to 10%, from 125%.

This tariff reduction and return to sanity is unequivocally good news.

However, we would caution that this means the trade war is over. Likely we are still at the beginning in terms of maneuver for long-term advantage.

The bounce in US markets overnight says it all.

R-E-L-I-E-F

Bloomberg correspondent Shuli Ren wrote: Trump and Xi Tone Down a Senseless Trade War, expressing the common view that this 90-day truce is a good start.

However, there was also this headline: Xi defiance pays off as Trump meets most Chinese trade demands, from Bloomberg News, making clear that many analysts considered this to be a climb-down by the USA from “stupid” tariff levels.

It would be a mistake to hurl “I told you so” statements when the US side, under the more sober Treasury Secretary Scott Bessent, has made practical progress.

The road ahead still looks fraught

From the global investment perspective, no tariff hikes, and no trade war, would be a better outcome for global growth. The USA has made clear that it does have a firm agenda to reshore manufacturing, build self-reliance, and rebalance taxation.

Nation states are entitled to pursue their own best interests.

For the future, what Bessent telegraphs as the intention of US policy will now carry far more weight than most other members of the US Administration. He called the 145% tariff level “unsustainable”, received a Truth Social blessing from the President, to go for 80%, because that seemed “about right” and returned with 30%.

As critical as I may have been of Bessent’s view that China held a weak hand, a “pair of twos”, it would be churlish not to celebrate this outcome. This is very good news.

However, I have yet to change my view that this remains a bear market environment for US stocks. The rest of the world looks more positive, as I will elaborate.

This may seem a little strange, since it is an inversion of the viewpoint that has paid off so handsomely for the past fifteen years. However, the reasoning is twofold:

US stock valuations are still expensive compared to elsewhere

The Trump economic rebalancing looks set to be costly in time and patience

Recall that the first quarter of US GDP growth was mildly negative, and the driver of this turned out to be a surge in imports to front-run anticipated tariffs.

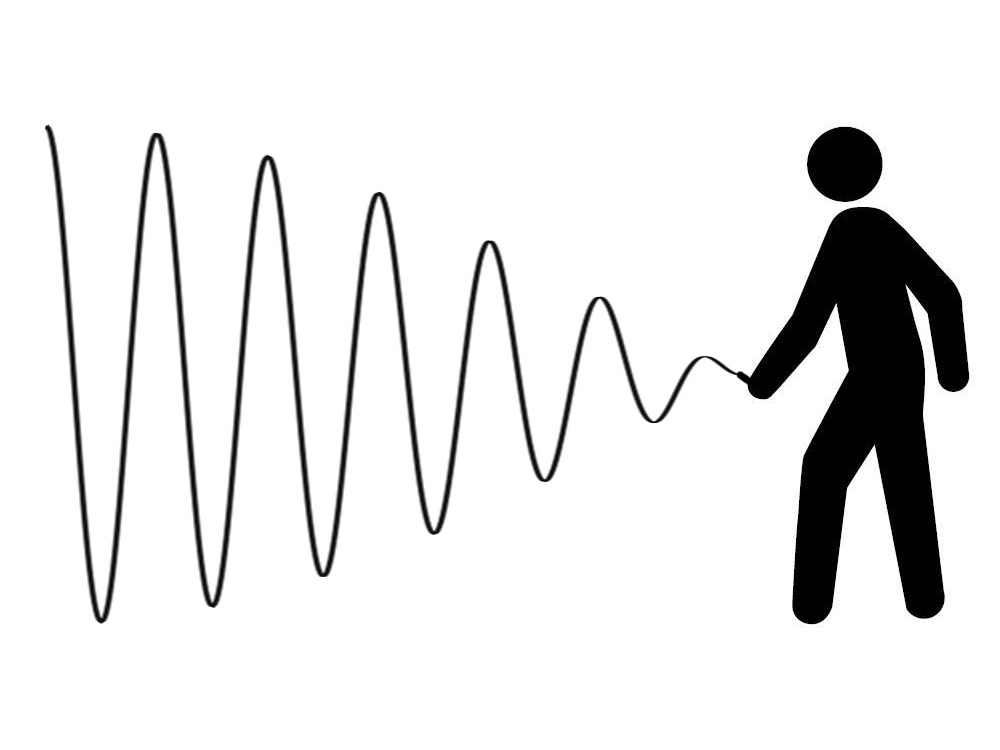

The logistics Bullwhip effect

In my piece, Beware the Ides of May, I suggested that the prospect of empty shelves in the US retail supply chain would make the mid-May time period critical.

This is because the container shipping industry indicators had shown a roughly 35% drop in ships leaving China bound for US ports, due to the tariff impost.

This point in time, namely mid-May, emerges once you take account of the sailing time from China to the West coast of the USA.

Previously, I shared this chart from Torsten Slok of Apollo Group.

This shows that there is about 40-day lag, give or take, between whatever Executive Order (EO) pen stroke President Donald J. Trump made, and the logistics result.

Raising tariffs causes shipping cargo volumes to go down.

This much is clear, but there is a natural corollary.

Lowering tariffs causes shipping cargo volumes to go up

In supply chain economics these swings are called the Bullwhip effect.

The problem is the cascading chain-of-forecasts made by agents along the supply chain. Small changes in final demand for goods can translate into large swings in the orders received by a manufacturer.

This is why manufacturing is a volatile business.

Shipping, as an intermediary with voyage constraints of available ships, space, fuel costs and the openness of shipping lanes is even more volatile than production.

Superficially, these rapid changes in tariff rates, rules and exceptions looks like some master plan to negotiate better outcomes. The truth is just more chaos.

The wild swings created by erratic policy making

It is clear, I think, that some ideologues in the White House do not really know very much about how long it takes ships to sail the ocean, new sources of supply to be found, new factories to be built, or adjustments made to corporate strategy.

This is why my bear market call on the USA has not changed.

What we have now is the chaos of a buying flood, as opposed to a buying drought.

Every man and his dog in the USA will be calling up China to get as much stuff on a ship to arrive before the present 90-day pause has ended.

Will tariffs be higher or lower in 90 days?

What we do know is that Donald Trump thought 80% was right, and Scott Bessent went for 30%. The Liberation Day number was 34%. Shipping now, looks good.

Surely this tariff relief is good for the US economy.

It is undoubtedly better for confidence, which is why the US market rallied so hard, but it may wind up being bad for the next US GDP print.

The prospect of a technical recession in the USA

This is a technicality of how the math works. The article How Do Imports Affect GDP? explains how Gross Domestic Product (GDP) is calculated, including the drag from imports. The market will likely look through any negative print from the surge.

The possibility remains that this technicality will see two successive negative prints for the US headline GDP, which amounts to a recession. That could be the story of Q2.

Once we receive those numbers in July, the first 90-day pause on ex-China tariffs will be over, and the end of the current 90-day pause on China tariffs will be near.

In between, there are likely surge conditions for import from all sources to the USA.

While a recession caused by an import surge can be looked through, to some extent, the problem lies with the uncertainty of how President Trump behaves afterwards.

If the media rhetoric says he “lost” to Xi in Round One, he may come out punching.

We just don’t know. Nobody knows.

These chronic conditions of uncertainty are bad for business.

US business, and their foreign subsidiaries and trading partners, are now on a 90-day clock of changing tax rates, rules and regulations, facing the natural lags and delays which stem from the laws of physics, geography, and production timetables.

It is hard for a CEO, who is bound to disclose material risks in their business outlook, to have any confidence that the future looks rosy beyond the next quarter.

Forecasting the US economy is now a crap shoot.

I am not brave enough to call sustained good times in this environment.

The more prudent call is to argue that the risk premium has gone up on US business which makes each future dollar of earnings worth less today.

This relief rally will likely go on until we test all-time highs in some stocks, but I am not encouraged to add to US exposures. On the contrary, I am reserving cash.

Which countries and regions am I buying?

In my piece on Navigating Bear Markets, I wrote:

Generally, it is a very bad idea to try and raise cash in a market rout.

This is a melt-up, not a rout. Rebalancing now is a good idea.

For reference, I did a survey of Global Equity Valuations, in which I singled out these regional ideas for investment, to apply cash from reduced US holdings.

European Region

Greater China (HK, CN, TW)

Singapore

Japan

All of those look like interesting places to look for value.

I also mentioned ASX Gold Stocks as my best idea.

Since valuations adjust slowly, none of that reasoning has changed. I still like the ideas that I mentioned and am deploying the cash I raised earlier to buy them.

How much of the USA to own?

This begs the question of what to do with US exposures.

How much of the USA to own is your decision.

I have stated that I insist that you own some.

The reason to be mindful of just how much is down to the outsize weight of US stocks in global indices. They amount to as much as 70% of the total. Even with the quality of US companies, I think that is too high. With the US economy being 27% of global GDP somewhere around 30% to 50% market share of equities seems fairer.

Indeed, it used to be around those levels ten or fifteen years ago.

The script I am following is to deploy cash to buy dips in non-US stocks and to reposition US holdings by trimming winners in rallies.

This is what I mentioned earlier on navigating bear markets. There are bull trends within every bear market, and they move counter to the bear trend.

For instance, Hong Kong listed stocks have a had a good few weeks but are softer on the US relief rally. The same is true of European stocks.

This see-saw rhythm is the thing to study closely.

As I stated in my piece Gap in traffic, you are looking for good times to move.

There are many stale bulls who remain wedded to US technology stocks. This naturally drives buying interest which surges due to the Fear of Missing Out (FOMO).

The money coming from non-US assets will partially flow to that.

This process takes weeks, which turn into months, and perhaps years.

The reason why I am bullish on non-US stocks is twofold:

Attractive valuations

Reshaping of global trade to avoid the USA entirely

The last point is critical to understand, and I will do a deeper dive on it later. Due to the sudden and extreme regime change in US policy volatility, it is now riskier to be heavily trade-exposed to the USA. Just ask Canada, and Mexico.

China is trade-exposed to the USA, but at a lower level than the headline numbers would have you believe. Only about 14% of Chinese exports go to the USA!

In this Livewire article, Why free trade matters, I shared this global trade-exposure ranking from the last available World Bank data.

The USA has a mighty economy, but it is dominated by service industries and the consumption activity of US consumers. Trade is 25% of GDP, in total.

This is very low by world standards.

On the 2023 numbers, the USA is just ahead of Ethiopia and behind Argentina!

For comparison, China which is supposedly devasting the world with its trade policy is a higher, but still lowish 37%. Australia is a middle ranking nation at 49%, while the former industry powerhouse of Germany is at 83%, and Japan is at 45%.

Pound for pound, Australia trades twice as much per $ of GDP as the USA!

This is why we have been a free trade advocate for decades.

Let us now focus on trading ideas in global container shipping.